Courtesy of Lee Adler of the Wall Street Examiner

The composite liquidity indicator rose last week. The indicator is breaking out to new highs again after a pause. Four of its components remain in bullish intermediate trends. Two are neutral. There’s no sign in this data of any change in the outlook for the markets.

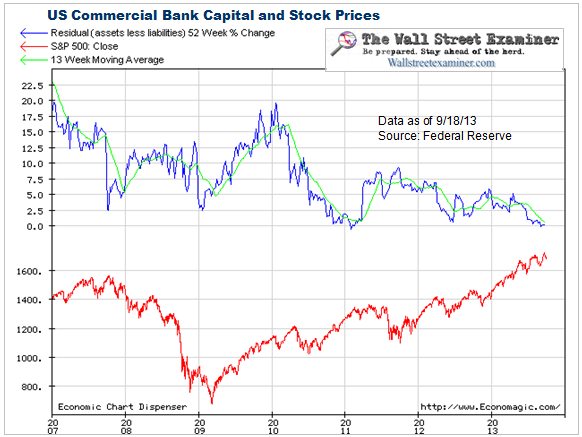

Bank capital has been shrinking again since the surge earlier this summer. The long term downtrend remains intact. In theory this should be bearish, but as the great business theoretician Yogi Berra observed, in theory there should be no difference between theory and practice, but in practice there is. In this case I think that part of the explanation is that massive deposit inflows have left US banks flush with cash. Some of that cash has been the basis for a 10% increase in financial lending. That category includes loans to finance securities purchases. In addition the banks’ own securities investment and trading accounts have risen dramatically in size.

Don’t blame this big increase in securities holdings on the Fed. This has come since the end of QE2. The Fed has shrunk its System Open Market Account (SOMA), the official name for its securities holdings, by $70 billion since then.

I think two things are happening. Big deposit inflows are forcing the banks to seek yield, so they’ve been buying a lot of MBS and other higher yielding paper, as well as lately increasing their Treasury purchases. These purchases push liquidity into the markets.

Secondly, the banks are holding $1.5 trillion in cash reserves at the Fed earning virtually nothing. These funds pressure the banks to either make loans or buy securities. If loan demand is weak, or of poor quality, the banks will opt to purchase “safe” securities. As a result, we’ve seen massive bubbles in fixed income securities. As the cycle progresses, this may spread into stocks. That’s usually the way it works. It’s what Bernanke has been hoping for. The problem is that the trickle down effect to the economy is minimal. When eventually the economy doesn’t grow fast enough, the financial bubbles driven by too much money and too easy credit (for certain economic sectors) collapse.

Get regular updates the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the US market, in the Fed Report in the Professional Edition, Money Liquidity, and Real Estate Package. Click this link to try WSE's Professional Edition risk free for 30 days!

Copyright © 2012 The Wall Street Examiner. All Rights Reserved. The above may be reposted with attribution and a prominent link to the Wall Street Examiner.