Seriously, this is 4 Tuesday's in row – is anyone seeing a pattern?

Seriously, this is 4 Tuesday's in row – is anyone seeing a pattern?

Of course this Tuesday we are 100 Dow points lower than we were last Tuesday and the BS pre-market pump job at 6am has already faded (7:30) although we're still working short bets on the Russell futures (/TF) and the Euro (EUR/USD) from 813 and $1.256 as I put up a note in early morning Member Chat as we spiked on – get this – the news that Draghi cancelled his appearance at Jackson Hole this weekend.

Why would it be good that Draghi is NOT going to the last Central Bankster conference of the year but the buzz is that he MUST be so close to a masterful solution to all of Europe's problems that he can't be bothered to gather with his brother bankers on the eve of his triumph. The announcement was timed to coincide (10 minutes before) bond auctions by Spain ($2Bn 3-month notes at 0.95%) and Italy ($3.75Bn of 2-year notes at 3.06%) and the Euro jumped 0.7% into the auction – lowering the effective rates and both auctions were a "success".

That pulled the EU markets off the floor (still down half a point at 8am) and got the US futures out of the red zone as we finally pushed the Dollar under that pesky 81.50 line, goosing the indexes and commodities. Unfortunately, it's just a sugar rush and we've already run out of steam but I'm sure someone will start another rumor around 9:15 to get us back to green into the open.

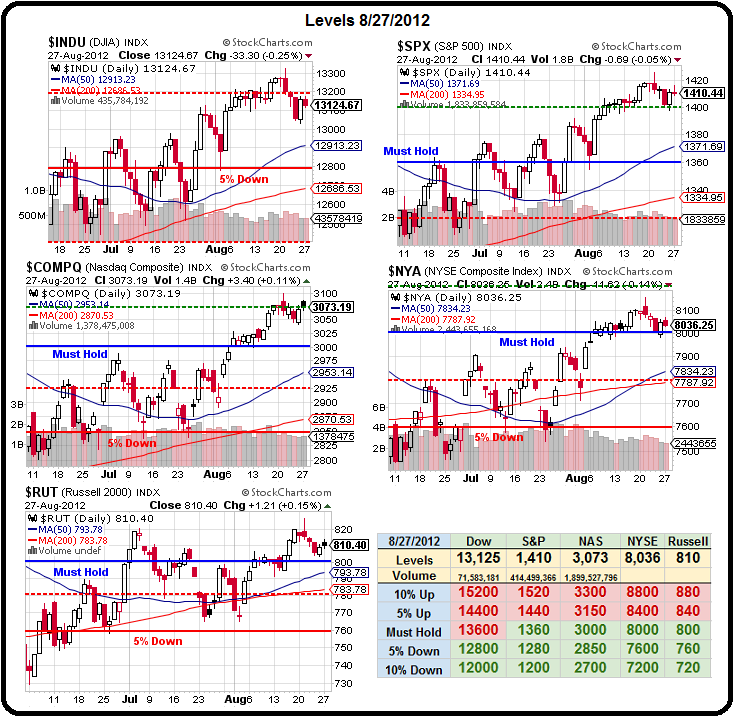

As I said last Tuesday, with the Dollar at 81.50 we're looking for adjusted levels of: Dow 13,464, S&P 1,428, Nasdaq 3,060, NYSE 8,160 and Russell 816 and we held the Nasdaq yesterday but that was all so no reason to capitulate on our bearish stance just yet. Last Tuesday we also discussed 3 more trades (there we 3 the Tuesday before) to make 300% if the market did break higher and our first batch had several 100% winners so let's see how our 3 new trades did in a downtrend:

- 2 FAS Oct $107/117 bull call spreads at $2.05, selling 1 BBY 2014 $15 puts for $3.75 for net .35 is now net $1.52 – up 334%

- AGQ Oct $38/45 bull call spread at $3.10, selling BTU 2014 $20 puts for $3.60 for net .50 credit, now $1.18 – up 236%

- 3 DIA Oct $135 calls at $4.05, selling 1 HPQ 2014 $20 put for $3.80 for net .25, now -$2.56 – down 924%

HPQ had a rough week, dropping 20% and that killed that trade, which was the most leveraged of the 3 but not a bad consolation on the first two considering the market moved against us. Of course, setting a stop somewhere before you have a 100% loss can save you a fortune in these situations as well! We never did made our levels and, as we discussed yesterday, our bearish positions had a fabulous week so the hedges certainly did their job.

HPQ had a rough week, dropping 20% and that killed that trade, which was the most leveraged of the 3 but not a bad consolation on the first two considering the market moved against us. Of course, setting a stop somewhere before you have a 100% loss can save you a fortune in these situations as well! We never did made our levels and, as we discussed yesterday, our bearish positions had a fabulous week so the hedges certainly did their job.

Obviously, we take the money and run on the first two hedges and there's no need for 3 new hedges when the DIA spread can now be played with 2 DIA Oct $135 calls at $1.23 selling the HPQ $15 puts for $2.30 for net .16 and, if you don't mind owning HPQ for net $15.16 (12% off the current $17.21 price), then there's not much to worry about on this trade but, as I said last week – we are NOT bullish and these are just small hedges against our generally bearish bets.

Realistically, if we played all 3 spreads with even distributions, we laid out .10 in cash and the two winners made $2.70 while the loser dropped $2.56 so, even without stopping out the loser, we're no worse for the wear on the drop. A great example of why all your eggs should never go in one basket.

Speaking of broken egg baskets – check out this Bespoke chart of the Shanghai Composite – what a mess! Our stock indexes are currently back where China was in late 2007-early 2008 and a lot of the reason we're back there is the way we're so enthusiastic about potential expansion into China and the growing Chinese demand for our goods and services and swelling Chinese Middle Class and the endless Chinese demand for commodities and…. hey, what's that smell? Smells like BS to me…

Speaking of broken egg baskets – check out this Bespoke chart of the Shanghai Composite – what a mess! Our stock indexes are currently back where China was in late 2007-early 2008 and a lot of the reason we're back there is the way we're so enthusiastic about potential expansion into China and the growing Chinese demand for our goods and services and swelling Chinese Middle Class and the endless Chinese demand for commodities and…. hey, what's that smell? Smells like BS to me…

You can read 100 articles and the Punditocracy on the MSM can hit those talking points until they are blue in the face but this chart is A FACT! The Shanghai is down 66.6% from the top and anyone on TV using CHINA as a reason to be bullish should be given a few hundred volts through is chair! What if the US market looked like this and people tried to tell you how great things were? Would you say "well, that certainly not what I see here but, if you say so – it must be true"? Just because the MSM assumes you're an idiot, doesn't mean you have to invest like one.

Despite the "great" bond auction this morning, the rats are leaving the sinking ship of state in Spain at an ever-accelerating pace. The chart on the left shows the outflows from Spanish banks, where deposits fell 4.7% in July alone. A few more months like this and there won't be any banking system left to save!

Despite the "great" bond auction this morning, the rats are leaving the sinking ship of state in Spain at an ever-accelerating pace. The chart on the left shows the outflows from Spanish banks, where deposits fell 4.7% in July alone. A few more months like this and there won't be any banking system left to save!

Spain's once-wealthy Catalonia region has officially requested an emergency liquidity injection of $6.5B this morning from Madrid's sadly insufficient bailout fund. Don't worry Spain, Germany says CHINA will buy up all your debts (not a joke, sadly). Spain officially admitted they are in a recession today as Q2 GDP fell 1.3% after falling 0.6% year/year in Q1 and is projected to fall further in Q3.

At this point, even the Swiss are running out of money, and patience, as the SNBs policy of supporting the Euro at all costs. The SNB is currently holding 230 Billion Euros, which is 1/2 of their entire GDP, adding 34Bn in July alone. If not for Swiss support, the Euro would surely be at $1.20 or less – even against the weak Dollar. "The minimum price is not for eternity," said SNB's Jordan, "this is an extreme measure for an extreme situation." Any sudden removal of this support can have a sudden and devastating effect on the Euro.

Just ahead of the open we're getting our predicted pre-market re-pump and that's fine with us because – we don't care IF the game is rigged as long as we can figure out HOW the game is rigged and place our bets accordingly. The Russell bottomed out at 808 – up $500 per Futures contract and the Euro hit $1.24, which doesn't seem like a big move (.016) but it's $10 per .001 so up $160 per contract on that one and that is how we pay for our Egg McMuffins.

Now we get to sit back and watch the fun!