This is so exciting!

This is so exciting!

The Futures are up, Europe is up, the Dollar is down – despite the fact that the last Fed Statement, the last Fed Minutes and Bernanke's last speech all said, VERY CLEARLY, that there will NOT be any more QE UNLESS the economy worsens. We just had the new Beige Book on Wednesday and, thankfully, the economy is not worsening. Therefore – one may conclude – no easing today. To do so would make the Fed seem capricious and inconsistent and erode their future ability to steer the markets with rhetoric.

Of course, this doesn't matter to the robots who are jacking up the Futures after the foolish humans sold all day yesterday – and the day before, and the day before that, and the day before that. But not last Friday – although last Thursday was terrible too and last Wednesday wasn't so good and last Tuesday was awful – so how about that rally?

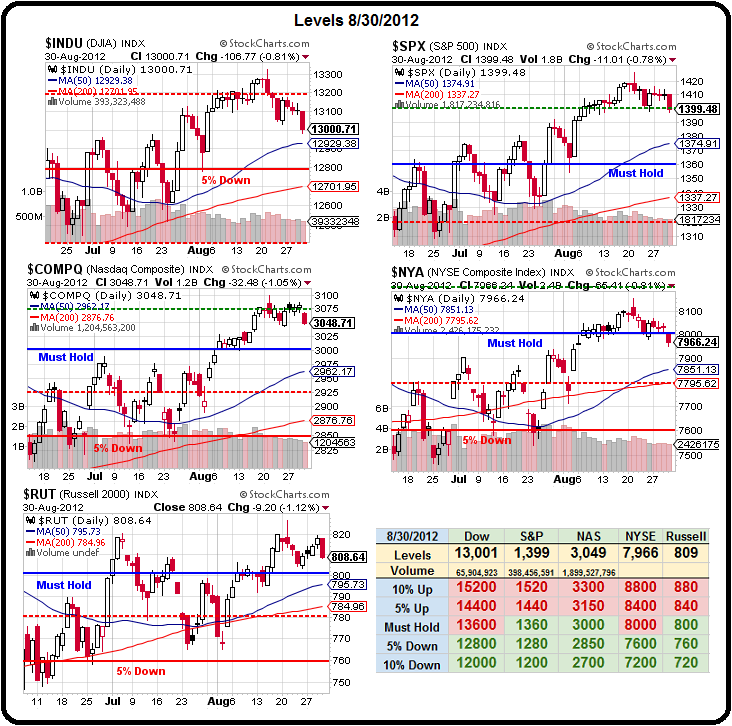

As you can see from our Big Chart, we're getting exactly the sell-off we've expected but, as I've pointed out to Members, things are much weaker than they seem as the Dollar, at 81.50, is down 2.5% from where our levels were drawn (83.50) and that means that each set of lines on the chart – including the 50 and 200 day moving averages, need to be moved up one notch and that means the Dow failed it's 200 dma yesterday (at an adjusted 13,100), the S&P dropped below it's must hold line (adj 1,400) and needs to break back over the 50 dma (adjusted to 1,414) in order to get back momentum.

As you can see from our Big Chart, we're getting exactly the sell-off we've expected but, as I've pointed out to Members, things are much weaker than they seem as the Dollar, at 81.50, is down 2.5% from where our levels were drawn (83.50) and that means that each set of lines on the chart – including the 50 and 200 day moving averages, need to be moved up one notch and that means the Dow failed it's 200 dma yesterday (at an adjusted 13,100), the S&P dropped below it's must hold line (adj 1,400) and needs to break back over the 50 dma (adjusted to 1,414) in order to get back momentum.

The Nasdaq is still above it's adjusted 50 dma at 3,037 but now need to get back over the adjusted Must Hold line at 3,075. The NYSE has failed all of it's support and has to take back 8,000 for any rally to be taken seriously and, finally, the Russell is right on the adjusted 200 dma at 804 and failing to hold 800 would be a huge sell signal.

For now (8 am), none of that is an issue as the Dollar has fallen another full percentage point (81.18) as the Euro climbs back to $1.26 because ECB Executive Board Member, Benoit Coeure said: "ECB bond purchases in the sovereign debt market must be subject to strict conditionality." What? What do you mean that doesn't sound bullish to you? The man said BOND PURCHASES! Don't you see? It's a code – the code means the ECB is planning to buy bonds – if someone asks for them (which Merkel is actively discouraging) and if they meet "strict conditionality." See – IT'S IN THE BAG!

Fortunately, as we learned yesterday, reality is only what you say it is and Mitt did a much better job than his VP in wowing the crowd yesterday with his Reaganesque vision of America and I was particularly impressed by this documentary on his life:

With all this love in the air and the great news out of Europe, we decided to go long on the Nasdaq Futures (/NQ) in early morning Member Chat to lock in yesterday's gains on our bearish positions. Most likely, we'll be back on the short side before the market opens as we're still just a tad skeptical of all the rhetoric but nothing that happens at the open really matters until we get Bernanke's speech from Jackson Hole at 10am. '

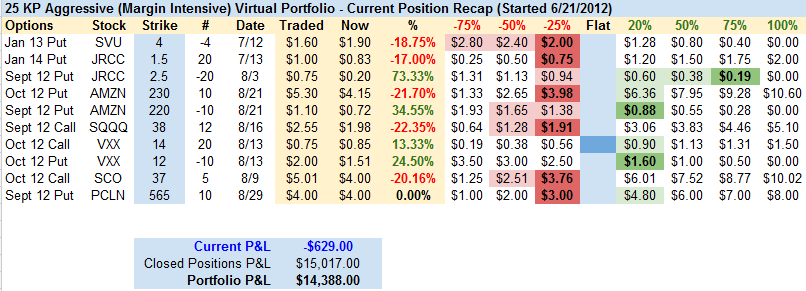

We have our long hedges that we discussed Tuesday, and the Tuesday before that and the Tuesday before that (in case you missed it), but our short-term $25,000 Portfolios are skewed 70% bearish and we added more downside protection to our Income Portfolio, in anticipation of some disappointment from Bernanke this morning.

We have our long hedges that we discussed Tuesday, and the Tuesday before that and the Tuesday before that (in case you missed it), but our short-term $25,000 Portfolios are skewed 70% bearish and we added more downside protection to our Income Portfolio, in anticipation of some disappointment from Bernanke this morning.

As I said earlier this morning to Members, I don't think they can get the Dollar below 81 and it's already (8:50) at 81.05 so we're going to be cashing out our Futures longs already and shorting the Dow (/YM) at 13,100 and the S&P at 1,410 as these are both lines that should be easy to bail out of if they break but this is simply stupid at this point – erasing all of yesterday's losses in the Futures based on an optimistic interpretation of a statement made by a guy we never heard of. You can mess around with the Futures all day long but once you begin to try to push Forex past resistance – you'd better have something more substantial than an out-of-context statement by a minor official.

Jens Weidmann is not a minor official – he is the President of the Bundesbank and he has threatened to resign if the above-mentioned bond-buying program is put into effect by the ECB. Sounds like strong opposition to me… In Berlin, a government spokesman said Chancellor Angela Merkel supports Weidmann but declined to comment on the report, which lays bare a deep rift within the ECB over the bond scheme that is increasingly being played out in public.

Jens Weidmann is not a minor official – he is the President of the Bundesbank and he has threatened to resign if the above-mentioned bond-buying program is put into effect by the ECB. Sounds like strong opposition to me… In Berlin, a government spokesman said Chancellor Angela Merkel supports Weidmann but declined to comment on the report, which lays bare a deep rift within the ECB over the bond scheme that is increasingly being played out in public.

Stepping up the pressure to attach conditions to the plan, fellow German ECB policymaker Joerg Asmussen said late on Thursday the ECB should only buy sovereign bonds if the International Monetary Fund is involved in setting the economic reform programmes that should be demanded in return. "Opposition from Weidmann and reservations from some other Council members will mean that ECB bond purchases would be highly conditional, be focused on the short end and would not aim to bring yields down quite as much as Italy and Spain might like to see," said Berenberg Bank economist Holger Schmieding.

Ah well, enough talk – let's see what Uncle Ben has to say….