Want to see more?

Reap the benefits of one of our paid membership plans and get access to articles like these PLUS:

-

Insightful daily market reviews

-

Educational guides and posts

-

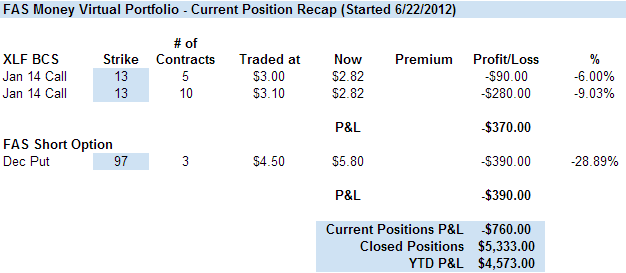

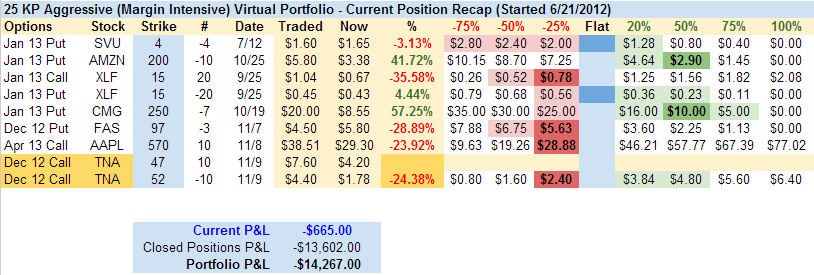

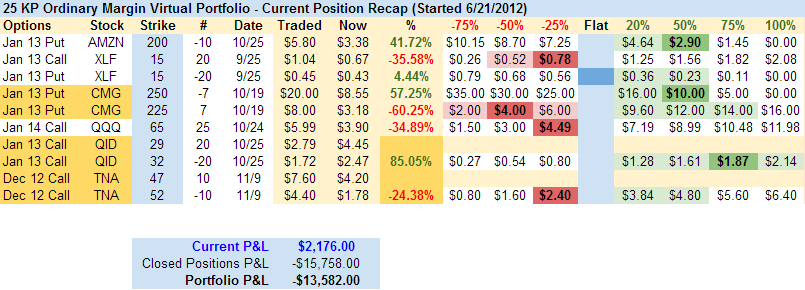

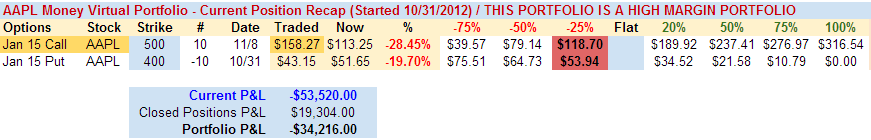

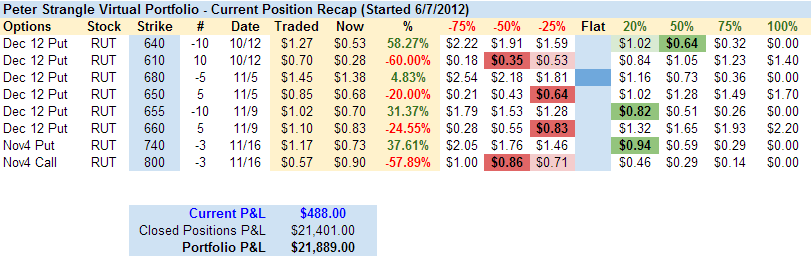

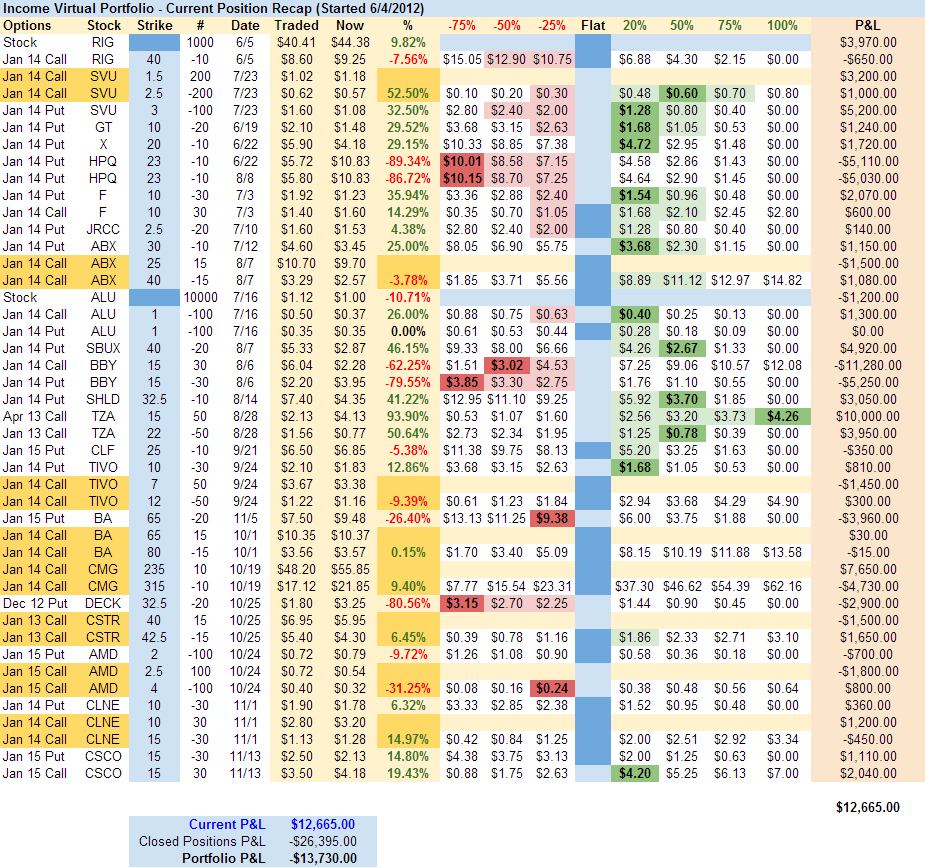

Access to our Virtual Trading portfolios

-

Unique trading opportunities

-

LIVE trading webinars

-

Intraday market commentary from Phil

-

Our community of traders