Nice and bouncy!

Nice and bouncy!

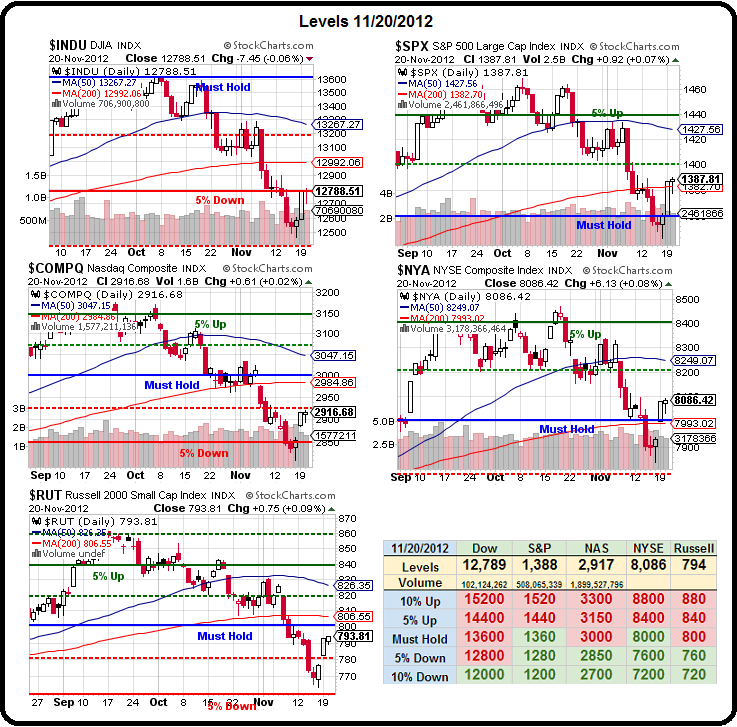

Check out our Big Chart. Check our our bounce levels, which I posted on Monday and still are:

- Dow 12,720 weak, 12,950 strong.

- S&P 1,375 weak, 1,400 strong.

- Nasdaq 2,900 weak, 3,000 strong.

- NYSE 8,000 weak, 8,100 strong.

- Russell 790 weak, 805 strong.

Just two days later we're right in the zone and – most importantly, our weak bounce lines held on yesterday's dip – that's a very good sign.

The best thing about re-establishing trading ranges is that it lets us take advantage of channel bets like yesterday's USO trade from the morning post, where we caught a nice 50% gain for the day and we took that money and ran as oil tested the $86 line – just $1 off our target without all that tedious waiting… Of course the Futures bet on /CL was well-timed and a $3 move in the Futures pays $3,000 per contract so thanks to the oil crooks for being so predictable. We got our cease-fire rumor in the Gaza and that was all it took to knock oil back 3% but it was a rumor only – which is why we quickly got out and now, maybe, we'll be able to do it all again on a new set-up (oil currently back at $87.50).

Unfortunately, the HPQ Jan $12 puts we also talked about in the morning post only made it to $1.17 at the open but, as expected, they have already fallen back to .90 for a 23% gain on the day. Trades like that simply follow PSW's Rule #1 (and there are only 2): "ALWAYS sell into the initial excitement." Our job is to sell premium – so we always look for ways to take advantage of a good opportunity to make a sale at inflated prices.

Notice that HPQ made a nice bottom in the morning and that inflated the price of the Jan $12 puts to $1.17 and, even though the stock only recovered .20 by the end of the day, the puts dropped .27 – still with a pretty hefty premium at .90 (net entry of $11.10). In Member Chat, we also took advantage of the situation to sell some long-term HPQ puts, as well as BBY, which had similar action on their AWFUL earnings.

We're certainly not expecting much of a move today as it should be light trading into the long weekend (the markets are open 1/2 day on Friday but no one takes that seriously). Also, next week, we still have 5 trading days to the end of November so there's no need at all for positioning this week.

We're certainly not expecting much of a move today as it should be light trading into the long weekend (the markets are open 1/2 day on Friday but no one takes that seriously). Also, next week, we still have 5 trading days to the end of November so there's no need at all for positioning this week.

We'll have more information on Europe and the US Fiscal Cliff and whether China will provide more stimulus next week than we do now – all the better to make our trade decisions with.

Yesterday's EU meeting broke up without "fixing" the Greek situation after EU Finance Ministers and the IMF failed to agree on a debt-reduction package. True to form, Germany refuses to put up fresh money or offer any debt relief and there simply isn't enough available from other sources to do it without them. Thank goodness Spain says they don't need any aid or we'd be really screwed, right?

We'll see if we can hold those weak bounce levels for one more day (we should) and then, next week, it's time to attack those strong bounce lines. Meanwhile, have a very Happy Thanksgiving!

– Phil