Source: imbibemagazine.com via Carol on Pinterest

Investor vs. Trader and the Section 475(f) Tax Election

The information provided in the article below is true and factual to the best of our knowledge as of April 9, 2013. However, it is not intended to be comprehensive or complete. Always discuss your choices and options with a tax professional. Appropriate IRS publications and/or IRC section citations are provided. State tax laws are not discussed.

Disclaimer: Phil’s Stock World website and its affiliates, owners and representatives do not have direct or indirect knowledge of the validity of the statements contained herein, and, therefore cannot express opinions or confirm the correctness of any statement. Moreover, tax laws change frequently, and up-to-date information from a tax professional is always recommended. The author of this article has no expressed or inferred liability for the accuracy of the statements in the article below.

****

Investor vs. Trader and the Section 475(f) Tax Election

By Dawn Rinaldi (Dawnr)

As you begin your trading activities, you probably don’t want to think about taxes! However, a little bit of time reviewing tax details with a tax adviser can help you keep more of your hard earned trading profits or allow you more effective write-offs for losses.

Let’s start exploring the issues…

Are you a ‘Trader’ or an ‘Investor’ as defined by the IRS?

Special, more favorable tax rules apply if you are a trader in securities – i.e., if you are in the business of buying and selling securities for your own account. To be engaged in business as a trader in securities, you must meet ALL the following conditions:

- Only trading in TAXABLE accounts (not retirement accounts) counts toward trader tax status.

- You are not a licensed broker or dealer (outside of the scope of this document)

- You must seek to profit from daily market movements in the prices of securities and not from dividends, interest, or capital appreciation.

- Your activity must be substantial, and

- You must carry on the activity with continuity and regularity.

The following factors are considered in determining whether your activity qualifies as a securities trading business:

- Typical holding periods for securities bought and sold.

- The frequency and dollar amount of your trades during the year. (e.g. 500 or more round-turn trades per year)

- The extent to which you pursue the activity to produce income for a livelihood, and the amount of time you devote to the activity.

- Intent: Do you have the intention to run a business activity, to make a living from trading, and act accordingly with formal record keeping and planning?

- Resources: Do you have significant business tools (i.e. multiple computers and monitors) business expenses, training, and a home office?

- Account Size: Do you have a material account size for staging a serious business effort; e.g. $25,000 to be a ‘pattern day trader’?

If the nature of your trading activities does not qualify as a business, you are considered an investor. It does not matter whether you call yourself a trader or a "day trader.” The IRS will come down hard on you if you elect trader status inappropriately.

If you have doubts about whether you meet the trader definition, you probably don’t. You’re entering an audit roulette casino if you elect trader status anyway. W-2 wages, 1099s listing non-employee income, and distributions of capital gains and interest are red flags to the IRS when the amounts are significant. Large losses incurred by a legitimate trader in securities can also attract the IRS’s attention. While claiming documented losses and expenses is allowed, the IRS wants to see you (generally) ‘turn a profit’ within 3 years.

Conclusion: I am an ‘Investor’… then

- Gains/losses on transactions are considered short or long-term capital gains, subject to being offset ‘like-for-like’ only (e.g., short term gains offset against short term losses). Losses exceeding $3,000 are carried forward to future years.

- Investment related expenses are restricted to 2% of adjusted gross income as a Schedule A expense.

- Investment related expenses are NOT an allowable deduction for AMT calculations.

- Futures and options rule 1256, related to taxation on gains and losses of both futures and options, applies. This rule automatically splits your related gains and losses as 60% long term capital gains/losses (at the more beneficial long term capital gain rate), with the remaining 40% considered short term (taxable at the higher ordinary rate). This is allocation is true even if you held the positions for less than 12 months.

- The Wash Sale Rule fully applies. This rule prevents you from claiming a loss on a sale of a stock if you buy ‘substantially identical’ stock within 30 days after the prior sale date. The rule does not apply to gains…IRS wants your taxes on gains.

Example of Wash Sale Rule:

You hold 500 shares of XYZ stock with a current unrealized loss of $500. You decide you want to ‘harvest’ that loss for the 2012 taxable year so you sell it on December 31, 2012. However, you really like the stock so you buy it back on (January 5, 2013).

Because the repurchase date of January 5 is within 30 days of your original sale date (December 31), the IRS considers the activity ‘a wash’ and treats it as though you never sold it. Thus, you cannot recognize the $500 loss in 2012. (For a good discussion on wash sales, see http://www.smartmoney.com/taxes/income/understanding-the-wash-sale-rules-9860/)

- Commissions are considered as an addition to your cost of the trading position you hold (increases your ‘tax basis’), and not considered an immediate deductible expense. Thus, if you hold your trading positions over year-end you are delaying the recognition of that expense for tax purposes. Overall, accounting for commissions should not be material.

- IRS forms used to report your trading capital gain and loss activities are done on Schedule D (with all individual purchases and sales specifically listed on Form 8949). Expenses go on Schedule A misc.

Conclusion: I am a ‘Trader’…then

Great! Although there are two categories of traders, the following applies whether or not you elect 475(f) mark-to-market status:

- Each purchase and sale must be listed in your return.

- Qualifying traders are NOT subject to self-employment tax.

- Qualifying traders may deduct business expenses (Schedule C) including but not limited to internet, computers, cell phones, periodicals, conferences and other education (including travel), and home office expenses. If you pay your own health insurance, this too is considered an allowable expense (so long as you have net income for the tax year).

- Expenses are allowable deductions for AMT calculations.

Next, you must decide if it makes sense for your own tax situation to elect Trader in Securities Section 475(f).

Making the “Trader in Securities” Section 475 (F) Election

In general, the “tax trader” election determines the method of accounting that an electing taxpayer is required to use for federal income tax purposes for securities or commodities. Referred to as the mark-to-market election in the IRS documentation, as explained below, the material purpose is to tax gains and losses on securities and commodity transactions on a mark-to-market basis where any position held at year end is considered effectively ‘sold’ at the December 31 closing price for the purpose of calculating gains and losses for the taxable year.

The basis of the asset is adjusted for the recognized gain or loss and is taken into consideration when the asset is sold. For example, suppose you purchased 50 Jan 13 contracts in November 2012 for $10,000. On December 31, 2012, they were worth $12,000. You recognize a $2,000 gain on your 2012 tax return and increase the basis by $2000. In January 2013, you sell the options for $11,000. You then realize a $1,000 loss on your 2013 tax return. ($10,000 original cost + $2,000 recognized gain = $12,000 – the new basis for 2013. $11,000 proceeds on the sale, minus the $12,000 adjusted basis means you will have a $1,000 loss in 2013.)

Other key provisions include:

- Gains/losses are considered ORDINARY income/expenses instead of capital gains/losses. These ordinary income/expenses:

-May be used to offset ordinary income/expenses derived elsewhere.

-May be used to offset expenses incurred in the pursuit of trader income. These are not subject to the 2% (of income) expense limitation rule for non-traders.

-Expenses are allowed as deductions for AMT purposes.

- 1256 Futures and Options Treatment: ALL considered ordinary income at short term rates. (There may be exceptions for positions deemed investments. However, that is outside this article’s scope. Contact your tax adviser for more information.)

- Positions that you consider an ‘investment’ are allowed under the election if clearly identified. As such, these investments are NOT mark-to-market at year end.

- Hedging transactions: Marked to market rules do not apply to hedging transactions. A transaction is a hedging transaction if both of the following conditions are met:

-You entered into the transaction in the normal course of your trade or business primarily to manage the risk of: (a) Price changes or currency fluctuations on ordinary property you hold (or will hold), or (b) interest rate or price changes, or currency fluctuations, on your current or future borrowings or ordinary obligations.

-You clearly identified the transaction as being a hedging transaction before the close of the day on which you entered into it. The gain or loss from hedging transactions is reported in the tax year incurred and on Schedule C (Business gain or loss).

- Wash Sale rules do NOT apply.

- Commissions are treated as expenses as incurred (not as an adjustment to basis if you did not elect 475(f)).

- All trading activity is reported on Schedule 4797 (no longer on Schedule D as capital gains/losses)

Making the Election:

The 475(f) election must be made no later than the due date of the federal income tax return for the taxable year immediately preceding the election year. Thus, to be able to use the election for tax year 2012, the required statement must have been attached to the 2011 tax return. Note the IRS does NOT need to consent to the election. If you are filing an extended tax return, attach a copy of the election again (once to the extension, second to the actual return). The election is good for all subsequent tax years.

The statement should include the following information:

- That you are making an election under section 475(f) of the Internal Revenue Code;

- The first tax year for which the election is effective; and

- The trade or business for which you are making the election

- Include the name and social security number of the person making the election.

After making the election to change to the “tax trader” or mark-to-market method of accounting, you must change your method of accounting for securities. This requires filing form 3115, (Application for Change in Accounting Method). The procedures for making an election are described in publication 550 under the section called "Special Rules for Traders in Securities." You may also refer to Revenue Procedure 99–17.

Note for ‘new taxpayers’: If you have created a separate business entity (i.e. LLC) to conduct your trading activities that has no prior year(s) federal income tax return required, then that entity is considered a new taxpayer. New taxpayers may elect Section 475(f) MTM treatment. This election is made by placing in the separate business entity’s books and records, no later than 75-days after the formation date, a memo to files stating your intention to follow Section 475(f) treatment. To notify that the election was made, the new taxpayer must attach a copy of the statement to its original federal income tax return for the election year.

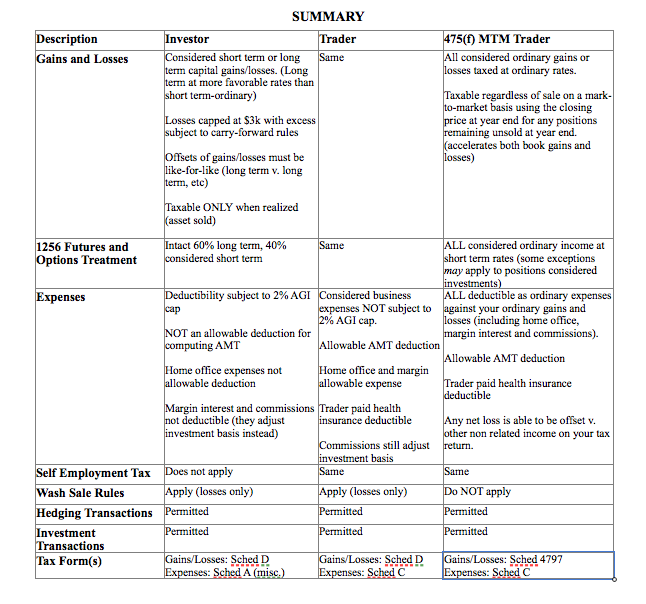

[click on summary table to enlarge]