Courtesy of Lee Adler of the Wall Street Examiner

With the quarter now one third complete just about all the pundits are predicting a sharp slowdown in the economy for the April-June period. Today Jamie McKeever of Rheuters reported that Barclays and Morgan Stanley expect GDP growth of just 1% to 1.5% for the quarter.

The all knowing punditocracy will need a total collapse in May and June in order to be correct, based on first time unemployment claims and real time Federal Withholding Tax data. That, ladies and gentlemen, is simply not on the radar, at least not in the available real-time data. At this moment the economy is melting up, not down.

The following excerpt from the Wall Street Examiner Professional Edition Treasury Update illustrates why the pundits are probably wrong (… again… as usual… What else is new?)

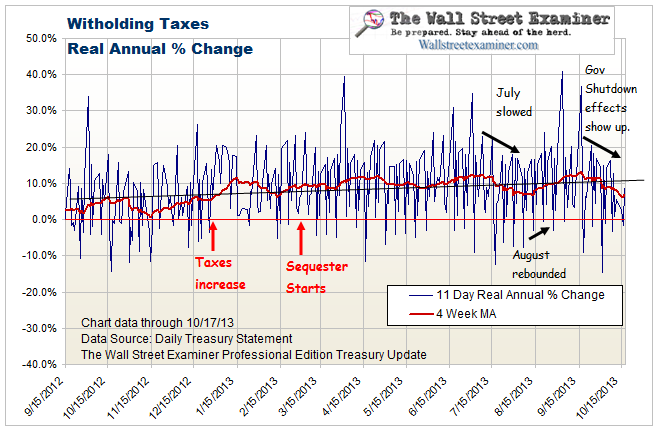

The 4 week average of the 11 weekdays (half month) total of withholding taxes was up 12.6% in nominal terms versus the corresponding period a year ago [as of April 23]. That’s an increase from +12.1% last week. The tax rate change at the beginning of the year appeared to result in a 6.5% increase in withholding tax collections. (Withholding taxes in Q1 accurately foreshadowed GDP growth for that quarter). That suggests that the net gain not attributable to tax rate changes is around 6.1% year over year. Part of that is inflation and part is an increase in economic activity

Changes in average weekly compensation fluctuate wildly, so getting a handle on the real rate of gain becomes little more than swag as the month goes on until the next BLS employment data release. The BLS figures for March showed a year to year increase of 1.9%. Average weekly compensation gains each month, while volatile, have been averaging near a 2% annual rate. That would mean that real gains for the past 4 weeks were near 4.1%. I’m skeptical about this number. It probably includes other, non employment related forms of withholding which are withheld quarterly. They are usually minor but can skew the numbers from time to time. The effects of the tax rate increase and inflation may also be greater than estimated here.

Still, there’s no clear evidence of economic weakening in this data. The uptrend has been remarkably stable dating back to May 2012. The second quarter is off to a good start., contrary to the conventional wisdom.

As of April 23 month to date withholding tax receipts were 11% ahead of last year (see table below). Non withheld individual taxes were up 53%. They are material at this time because quarterly estimated individual income taxes and underpayments for 2012 are due on April 15. The enormous bulge was partly due to the rate increase that went into effect in January, but even with that, this is a spectacular increase.

Quarterly excise taxes are due at the end of the month so that number isn’t material yet.

Corporate taxes for the first quarter were collected on April 15. They show a 27% gain suggesting strong profit growth.

Outlays were up sharply indicating that the drop in March was due to calendar factors, and not the sequester. Those expecting an economic slowdown in the second quarter may be in for a shock. April’s numbers should be very good. That may have begun to show up in the claims data for last week.

Read Big Improvement In Unemployment Claims Suggests Fed Rigging May Be Trickling Out

Get regular updates the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the US market, in the Fed Report in the Professional Edition, Money Liquidity, and Real Estate Package. Click this link to try WSE's Professional Edition risk free for 30 days!

Copyright © 2012 The Wall Street Examiner. All Rights Reserved. The above may be reposted with attribution and a prominent link to the Wall Street Examiner.