I feel so lucky

Hey, hey, hey

You wanna hug me

Hey, hey, hey

What rhymes with hug me?

Hey, hey, hey – Blurred Lines

Sadly, this is what passes for music these days.

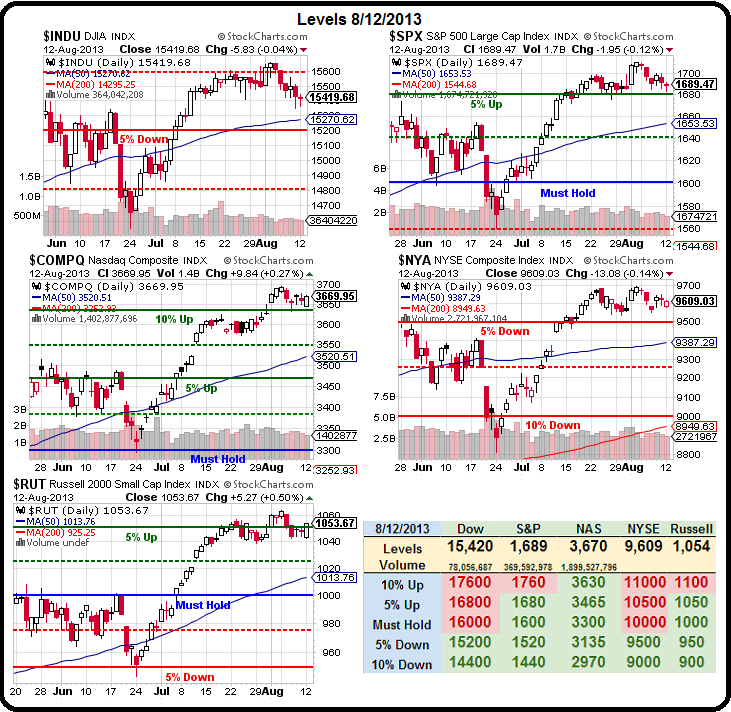

Also sadly, this is what passes for a rally these days, with our major indexes skipping along their 5% lines on our Big Chart like stones across a pond. Of course, we know what usually happens to stones that skip across a pond after a bounce or two…

We're PATIENTLY waiting for the big splash on oil, which gave us a small dip on Friday (0.50) down to the $104 line but then jammed way up to $106.50 and has been over $107 this morning. This is why we keep VERY tight stops over our .50 lines and already this morning we got another ride down from $107 to $106.25, which makes up for a bunch of dime losses on the stop lines. Now the NYMEX crooks are pretending to want 243M barrels for September delivery and that's down just 18M from Friday and there's only 6 trading days left before they're forced to take them! Still plenty of time to execute my plan to sell all 243M contracts (now $106.50) and force the bastards to choke on the deliveries next month!

Oh sorry, when I said that 243M barrels are down from last week, I may have given the wrong impression as the criminal oil manipulators trading at the NYMEX haven't done anything but ROLL the contract to other months so they can keep the con going. As you can see from Friday's chart, there were "only" 220,000 fake demand contracts written for October but now there are 233,000.

So 13,000 of our 18,000 conracts that disappeared from September are now in October – driving those prices artificially higher. November is up 13,000 to 150,000 and December is up 9,000, from 205,000 to 214,000. Are you starting to feel like one of those kids who's drunk uncle is trying to show a "magic trick" to by making quarters disappear and then come out of your ears? That's the scam: A 5-year old can see the trick but not our regulators or Congresspeople, apparently.

Fortunately, we can profit from the trick by shorting those Futures contracts (/CL) at each .50 line they test with tight (.05) stops over the lines. You don't want to go in and out over and over of course but, with practice, you can fish for nickels and dimes at the lines and, at $10 per penny, per contract – those nickels and dimes are worth taking.

We teach our Members how to play them with plenty of weekly examples (oil isn't the only thing we play, of course) but now, for the laymen out there, USO has gotten cheap again, with the Oct $37 puts at $1.10 with oil at $106.50 and USO at $37.75 so you need a move down to $35.90 or lower to be in the money and that's down 5%, which would be $101 oil. That's the bet between now and October that we currently have in our Short-Term Portfolio.

If not for the high price of gas, in fact, today's Retail Sales number would have been a negative as that component of Retail Sales rose 0.7% while overall Retail Sales rose a very disappointing 0.2% and our Export Prices were DOWN a recessionary 0.1% as well.

If not for the high price of gas, in fact, today's Retail Sales number would have been a negative as that component of Retail Sales rose 0.7% while overall Retail Sales rose a very disappointing 0.2% and our Export Prices were DOWN a recessionary 0.1% as well.

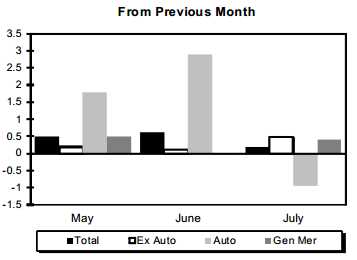

Food prices popped 2.3% at the grocery stores as well as the Fed's lack of inflation just keeps slapping the consumer right in the face. In something that seems obvious to us but seems to catch analysts by surprise – Department Store Sales dropped 4.8% since the extra money paid for food and groceries has to come from somewhere. As you can see from the chart on the left, Auto Sales also suffered as consumers were forced to cut back to fill up their tanks.

I already put up a note to our Members at 4:13 this morning to look for $106.50 to short oil (/CL) and 15,450 to short the Dow (/YM) and I was kind enough to tweet it out as well – so don't say you didn't have a chance to play!

9:25 Update – Wheeee! already and oil is down to $106 for a $500 per contract win first thing in the morning (so far). Even if you don't want to subscribe to www.philstockworld.com – you should at least consider following me on Twitter if you want to get those early morning chances to make some MONEY!