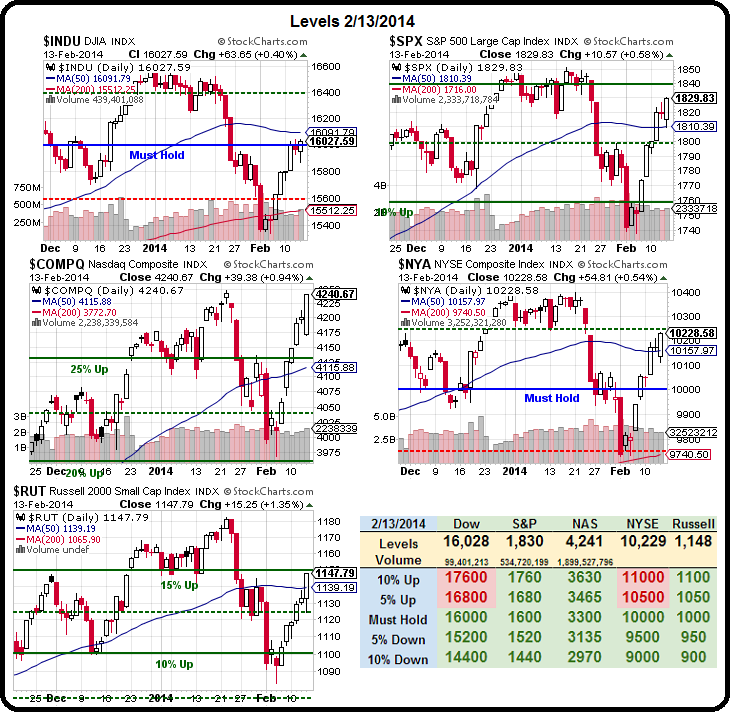

Dip? What dip? I don't see no dip.

Dip? What dip? I don't see no dip.

Look, I'm from Jersey – I can appreciate the idea that, if you pretend something never happened (and there's no evidence), then everyone can just "fuggedaboutit" and move on with their lives (except, of course, the "evidence").

The Nasdaq is already heading back to record highs (fuggedding about 1999, of course!) led by our Stock of the Year pick, AAPL, as it climbs back to $550, fuggeding about their brief dip below $500 just two short weeks ago.

Our spread on AAPL, which is in our Long-Term Portfolio and our Income Portfolio was selling the 2016 $450 put for $46.40 and buying the 2016 $450/650 bull call spread for net $44.60 for a net $2 credit ($200 per spread) and already that combo is worth $40.70 ($4,070 per contract) – up 1,935% from when we featured it on December 30th (and it was adjusted to be more aggressive on the dip, because we had CONVICTION and because we managed our portions to take advantage of the dip!). In fact, on 1/28, when AAPL was falling below $500, I said in Member Chat at 4:15 am:

Amazingly, AAPL has pretty much announced they'll be moving into the mobile payment space with their 400M ITunes users (Visa has 50M users) and no one seems to be doing the math on that! Of course, it's hard to get traction when CNBC runs headlines like this:

In the article, they are talking about a 40% drop ($350) due to these "horrific" earnings, especially guidance, where AAPL "only" forecasts $43Bn in sales with the usual 37% margins. This Q they made $13Bn per $550 share (now $505). At $505, that's about $14.50 per share or a current p/e of 8.7 (assuming 3 more "terrible" quarters like that one) NOT INCLUDING, of course, their $160Bn pile of cash which at $420Bn, is 40% of their market cap.

So AAPL $505 is RIDICULOUS. It's a BUYBUYBUY and, if they drop to $400, then it's a BUYBUYBUY. You will hear ever single moron who ever had an opinion lining up to dis AAPL today but keep in mind we EXPECTED this reaction – we took a very light bullish entry in our LTP, despite the fact that AAPL is my stock of the year because we were only worried it might go up and we'd miss our chance but mostly, we were waiting for this!

That's what I call CONVICTION! Of course, $4,070 per contract is merely "on track" as this trade, if successful, will return $20,000 per contract if AAPL is at $650 or above in Jan 2016. Even if it flatlines at $550, we still net out $10,000 as the premium we sold expires over time. This is why we are teaching our Members to "BE THE HOUSE – Not the Gambler" in 2014!

AAPL was one of our 5 featured macro trade ideas for 2014 and you can see the others in our Holiday Webcast or Join our Members at Philstockworld, where we discuss trade ideas like this every day!

Other trades of the year were bullish on Silver, Gold, DBA (agriculture ETF) and CLF. ABX was our runner-up trade of the year and that idea was published back on Jan 2nd and you could have had this one by just reading our Morning Post for that day (Report Members or above):

Buy 100 ABX 2016 $13/20 bull call spreads for $3, sell 100 ABX 2016 $13 puts for $1.80 for net $1.20 ($12,000 net cash, about $13,350 in margin). This trade will pay you back $70,000 (+483% on cash) if ABX closes over $20 in Jan 2016. The very good news is it's currently $4.63 in the money, so this trade returns $46,300 (285% profit) if ABX just flat-lines at $17.63 and the worst case is ABX falls below $13 and you end up owning 10,000 shares of it for net $14.80, which is $148,000 or about $74,000 of ordinary margin.

As you can see from the chart, ABX is now $20.09 and the 2016 $13/20 bull call spreads are now 100% in the money at $3.90 (out of $7 if ABX holds $20 to expiration) and the short 13 puts have dropped to $1.10 for net $2.80 or $28,000 off the original $12,000 entry, so up 133% already but, as with AAPL, only "on track" towards our 285% goal of $70,000 (up 483%).

So you don't have to take risky, short-term plays to make nice short-term returns. In a bullish market, our long, well-hedged trades make very nice returns as well and, unlike short-term plays, they are easy to adjust and have conservative fall-back positions and, in most cases, built-in downside protection.

We're not going to miss anything by remaining a little cautious in this low-volume snap-back rally and, if we do miss a few opportunities – fuggedaboutit – we'll catch the next one!

Have a great weekend,

– Phil