Wow, what a fun day yesterday was!

Wow, what a fun day yesterday was!

As you can see from Dave Fry's SPY chart, we went up in the Futures 30 S&P points and then we fell from the open 30 S&P points and then we recovered into the close 30 S&P points. This is what we call a "Bugs Bunny Market," where Bugs throws a switch and people stamped in and out of the theater (5:00 on this video) – and it's not usually a good thing.

In fact, that's the action we saw back on 2/28, when I was warning people to get to cash and, in fact, I tweeted out a similar comment (with the same video link) and our trade idea for playing the next 45 days was:

TZA/Craig – Well, the April $14/17 is still doable at $1.30 and you can sell the $15 puts for .88 for net .42 now.

Even with the Russell's bounce off our 1,100 goal yesterday, TZA is still at $17.65 and the April spread, which expires tomorrow, is net $1.90 – up a very nice 350% in 45 days (you can follow me on Twitter here, but I rarely tweet our Member Trade Ideas – for those, you have to sign up HERE).

Even with the Russell's bounce off our 1,100 goal yesterday, TZA is still at $17.65 and the April spread, which expires tomorrow, is net $1.90 – up a very nice 350% in 45 days (you can follow me on Twitter here, but I rarely tweet our Member Trade Ideas – for those, you have to sign up HERE).

We actually flipped long on the Russell during our Live Trading Webcast at 1pm yesterday, catching it pretty much on the button and I showed people, LIVE, how to make hundreds of dollars in just 15 minutes trading the Futures (replay available here).

In yesterday's post, I reminded you we were shorting oil at $104 and we caught a $500 per contract move back to $103.50 but then (also live in the Webcast), we decided to wait for $105ish to re-short today (/CL Futures). This morning, I posted early (6:22) to our Members that we had our shorting opportunity at $104.95 and already (8:06) we're back to $104.65 and that's good for $300 per contract after a hard morning's work – plenty of money for breakfast!

We're still expecting a much bigger drop, probably not until after the weekend though, as Ukraine tensions are keeping oil high. Rather than play the volatile Futures over the weekend, we have SCO and USO plays set up for our Members to take advantage of the potential correction. Today though, we can still have fun with the Futures (stop at $104.75 at the moment) into inventories at 10:30.

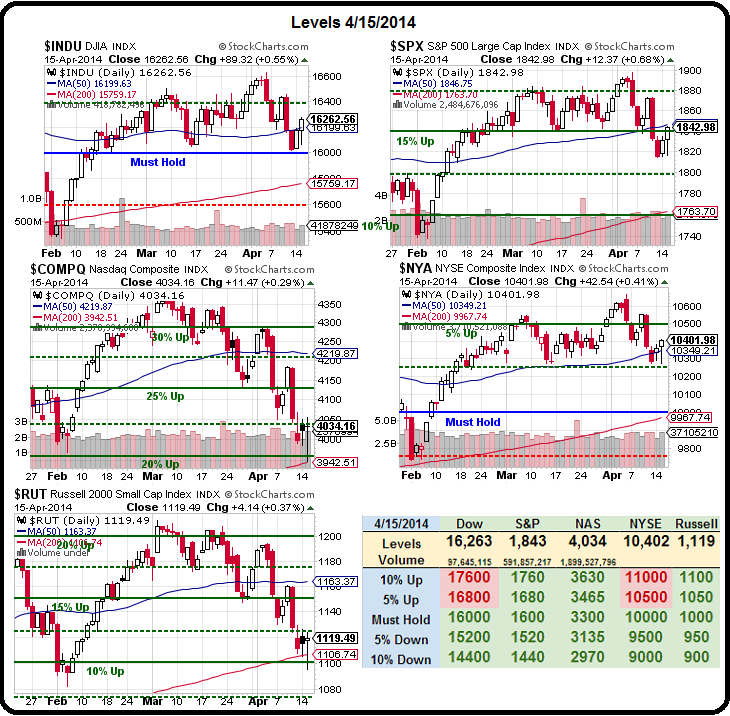

We're past the weak bounce lines on our indexes and now we're looking for the strong bounce lines to be taken and held at Dow 16,240, S&P 1,850, Nasdaq 4,150, NYSE 10,430 and Russell 1,145 (noted in yesteray's post) but none of it matters until the Fed's Beige Book this afternoon at 2pm and then that doesn't matter either as we have a holiday weekend and there's no sense in betting on that – better to have a nice Easter and see what happens next week – that's why we picked the April time-frame on our TZA hedges (which can still make another 250% if TZA stays over $17 through tomorrow!).

So let's all relax and have a happy Easter with our sidelined CASH!!! and let's reflect, in this holy season, on the new study done by Princeton and Northwestern Universities, which has concluded that "The US government does not represent the interests of the majority of the country's citizens, but is instead ruled by those of the rich and powerful." I know – duh, but it's interesting to see it in an official study, isn't it?

No wonder the Kochs are working so hard to defund education – if it's going to uncover this sort of thing:

No wonder the Kochs are working so hard to defund education – if it's going to uncover this sort of thing:

After sifting through nearly 1,800 US policies enacted in that period and comparing them to the expressed preferences of average Americans (50th percentile of income), affluent Americans (90th percentile) and large special interests groups, researchers concluded that the United States is dominated by its economic elite.

Researchers concluded that US government policies rarely align with the the preferences of the majority of Americans, but do favour special interests and lobbying organizations: "When a majority of citizens disagrees with economic elites and/or with organized interests, they generally lose. Moreover, because of the strong status quo bias built into the US political system, even when fairly large majorities of Americans favour policy change, they generally do not get it."

Ask yourself this weekend, WWJD?