What a recovery!

What a recovery!

Things are so good, they could hardly be better – as long as we ignore the non-existent volume that this house of cards is being built on, of course. 80M shares traded on SPY is half of the volume we got during the sell-off but it doesn't take 2 up days to make up for one down day – not at all. In fact, it's only taken 5 up days with a total of 548M shares traded to erase 6 prior days of declines in which 860M shares were traded to the down side.

Still, we have to respect the phony technicals while they last and it's not like we're not willing to play along. Our Long-Term Portfolio remains very bullish, as we only expected a short-term correction anyway, and has jumped $13,000 (2.6%) since last Thursday's review. So GO MARKETS, from that perspective. We don't care if it's a fake rally – as long as we can make some real money trading it, right?

Yesterday we did a Live Trading Webinar (replay available here) where we reviewed a dozen bullish trade ideas in 90 minutes and today, at noon (EST) we will do a special presentation expanding on our "7 Steps to Constistently Making 30-40% Annual Returns" featurning two additional trade ideas and you can sign up for a FREE CLASS RIGHT HERE. Here's the intro video:

And what is step one of our 7 step program? Wait for a sell-off! Well, we just got one and that's why we found lots of things to buy. Despite our Long-Term Portfolio's impressive gains over the past two days, it's still playing catch-up to our Income Portfolio, which is up 7% for the year because we cashed it out at the top in March and now we are able to go on a shopping spree, picking up things that have gotten cheap in the recent sell-off.

The S&P may have come roaring back but it didn't bring everything back with it. CMG, for example, is still down 20% after an earnings disappointment but people are very hung up on the fact that food costs went up faster than CMG is hiking prices (squeezing margins) while ignoring the 13.4% same-store sales growth. Overall revenues for the chain were up 24.4% from last year – as they are also rapidly adding new stores while YUM and MCD have both reported flat numbers – and CMG hasn't even gone to CHINA!!! yet!

Needless to say, we picked them up as a long as they tested $510 and I outlined that trade in detail in yesterday's Webinar (link above). We don't expect a rapid turnaround – we're playing for 2016 and they may re-test $480 so we only have a 1/2 position on so far – but it's certainly worth watching and the stock will rise sharply if their planned 5% price increases doesn't impact their turnover. And, of course, should food prices moderate – big bonus!

Last Wednesday, in the morning post, I mentioned that we were shorting oil at $104.95 and, as you can see from the chart on the right – we did very, very well on the sell-off we've been telling you would happen for weeks. Oil hit $101.50 and, at $10 per penny, per Futures contract (/CL), I'll let you calculate the profits for yourself!

Last Wednesday, in the morning post, I mentioned that we were shorting oil at $104.95 and, as you can see from the chart on the right – we did very, very well on the sell-off we've been telling you would happen for weeks. Oil hit $101.50 and, at $10 per penny, per Futures contract (/CL), I'll let you calculate the profits for yourself!

We took the money and ran on our USO and Futures plays at $101.50 yesterday (because we're not greedy) but we did leave our SCO spreads intact, as those were simply bets that oil would stay below $105 into May expirations (16th), which is two weeks before the holiday weekend that kicks off summer driving season – so I think we're good with our target on that one.

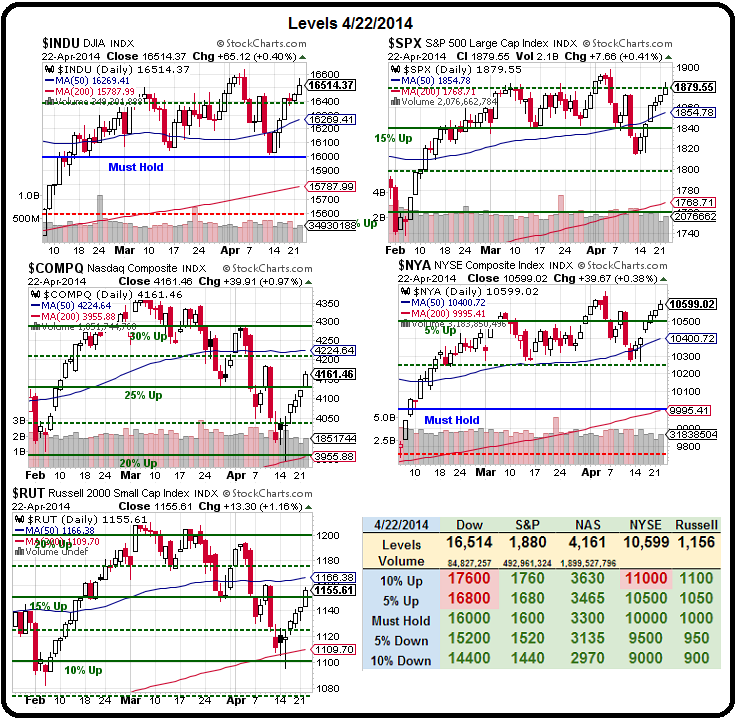

I had mentioned last Monday that we were looking for strong bounces, so we took our TZA calls (ultra-short Russell) and XRT puts (short Retail) off the table and we discussed our targets, per the 5% Rule™, that we expected to hit on strong bounces which were: Dow 16,240, S&P 1,850, Nasdaq 4,150, NYSE 10,430 and Russell 1,145.

I had mentioned last Monday that we were looking for strong bounces, so we took our TZA calls (ultra-short Russell) and XRT puts (short Retail) off the table and we discussed our targets, per the 5% Rule™, that we expected to hit on strong bounces which were: Dow 16,240, S&P 1,850, Nasdaq 4,150, NYSE 10,430 and Russell 1,145.

It was only yesterday that the Nasdaq finally popped over 4,150 and the Russell cleared 1,145 so now we'd like to see them hold it for a full day and THEN we will be in the mood to buy some more.

Though we don't generally give away free trade ideas in our morning posts during earnings season (but you can sign up here and get them every day), we did point out that our TZA April $14/17 bull call spread paired with the short $15 puts that we had shared as a Twitter Alert on 2/28, was still "just" $1.90 last Wednesday morning with 2 days to expiration. I suggested that, even though we were already up 115%, there was still another $1.10 of potential upside in the next two days.

TZA closed at $16.83 on Friday, just short of our goal but the spread netted out at $2.83 and that was up 49% in two days, though up 221% from where our Members took the trade. Now it's back to $16 and, at $15, we're going to like it again. See – it's not complicated, is it?

That's because our VALUE outlook for TZA doesn't change just because the PRICE does. In Thursday's post we discussed RIG at $40, and HAL just had fantastic numbers, indicating strength in the sector, so you might want to re-read that one and consider that trade, we're likely to discuss it in today's Webcast, as it's one of my favorite upside deals at this level.

Join us at noon (EST) and we'll continue this discussion LIVE!