CHINA!!!

CHINA!!!

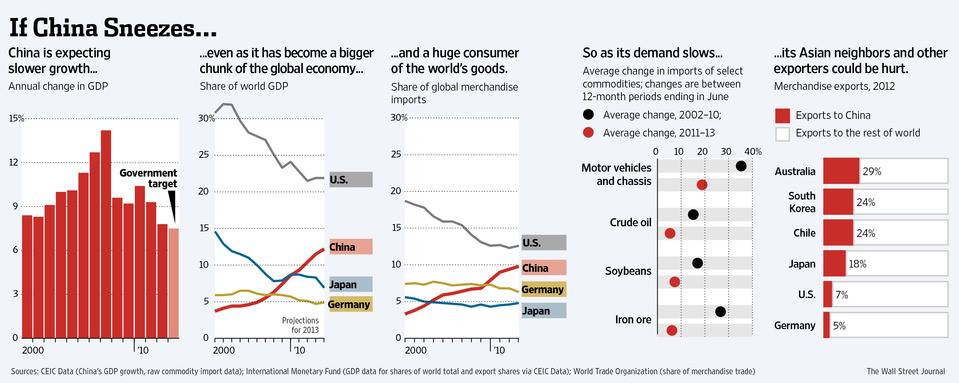

Think about how many companies pin their hopes and dreams on the infinite possibilities of selling stuff in China. If TSLA's stock can pop 10% because Musk announces he's going to put superchargers in China (he announced he'd put them in America 3 years ago – where are they exactly?), why does the stock then ignore declining auto sales in China or the slowdown of the whole economy over there?

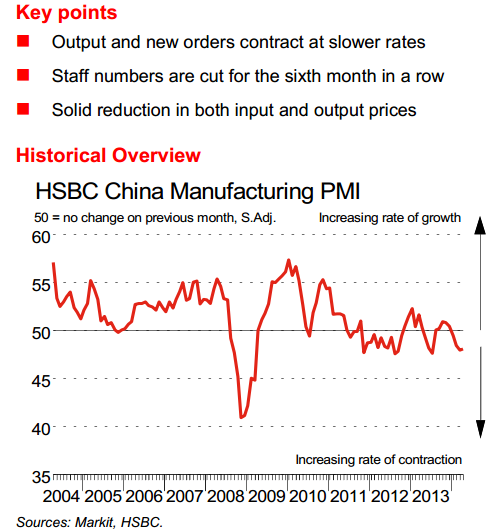

The slide in Chinese manufacturing has been accelerating since the fall and we're in danger of breaking through a floor we haven't seen breached since we ignored it in early 2008 – the last time the MSM shrugged off a China slowdown as "no big deal."

How can China be the biggest deal in the World when you make a bull case but no big deal when it turns the other way? This is why investors are so confused about the markets – the information they are being fed is spun to CAUSE them to make poor investing decisions. Remember when the Senate investigated Goldman Sachs because, internally, they called $600M worth of Timberwolf Securities they were ACTIVELY selling to their investors a "shitty deal" while bonusing their "financial advisors" for pushing it on their clients.

The only thing unique about Timberwolf is that they got caught. China has been a "shitty deal" for years – I've been telling you for years but not the MSM, not the Fund Managers, not the Investment Professionals that get fees for whatever crap they get you to put your hard-earned money into – China is far away, hard to understand and even harder to verify – that makes it a perfect story for con men who want to get their hands on your money.

The only thing unique about Timberwolf is that they got caught. China has been a "shitty deal" for years – I've been telling you for years but not the MSM, not the Fund Managers, not the Investment Professionals that get fees for whatever crap they get you to put your hard-earned money into – China is far away, hard to understand and even harder to verify – that makes it a perfect story for con men who want to get their hands on your money.

Like the US, China's growth story is a stimulus story. China's money supply grows faster than their economy and, in the past 5 years, as you can see on the chart, it's gone into hyper-drive with loans up almost 100%, which is ANOTHER 150% of the country's GDP in debt. China began their stimulus program in 2008, while our Congress was still arguing over TARP.

They have plunged their entire nation into massive debt (like us) in order to keep up GDP appearances (like us) and last week, just to confuse potential investors further – the MSM began talking our China's PPP (Purchase Power Parity) GDP surpassing the US. What utter nonsense that it – go to China and see what $9,844 buys you.

They have plunged their entire nation into massive debt (like us) in order to keep up GDP appearances (like us) and last week, just to confuse potential investors further – the MSM began talking our China's PPP (Purchase Power Parity) GDP surpassing the US. What utter nonsense that it – go to China and see what $9,844 buys you.

That's the trick though, isn't it? They know that you (the generic you, of course) aren't very likely to go to China and check out their story and you probably don't even know anyone who has gone to China unless they were fairly well off and had a nice vacation. That doesn't tell you anything about an economy. Knowing you can't check a story out is step one into conning people out of their money – it's the same scam they've been running for hundreds of years – because you'll believe almost anything if it supposedly happened "a long time ago, in a galaxy far, far away."

Instead of "amazing medicines and treasures from the far east" we now have BIDU and QIHU and soon we'll have Alibaba to invest in. We also have TSLA and 100 other companies who tell you how great their sales are going to be in CHINA!!!

Instead of "amazing medicines and treasures from the far east" we now have BIDU and QIHU and soon we'll have Alibaba to invest in. We also have TSLA and 100 other companies who tell you how great their sales are going to be in CHINA!!!

But look at the chart above, even with the best estimates, the average Chinese citizen has just 20% of their counterparts in the US. How then, is China going to "save" us? I like that chart because it points out that China's economy is roughly on par with turn of the century America – an example I used to use with my consulting clients who were looking to do business in Asia.

This is not to say there's not business to be had in Asia. You can even sell $100,000 Teslas because, even if you went back to 1900 with a few hundreds Teslas – there'd be plenty of people rich enough to afford them then as well. I just wouldn't recommend opening up too many dealerships west of the Mississippi at those prices. Just like 1900s America, China is a vast nation that is only recently getting electricity, telephones, internet – and now it's being connected by rail and air and new cities are sprouting up along the transport routes.

The long-term growth story is definitely there – it's the expectations for the time-horizon I take issue with. China is benefiting from a well-educated, cheap labor force – just as we did in the 1900s, as people left the farms for the factories. That gave us a huge boom that lasted until 1929, when the farms began failing and a speculative bubble burst and the banking system collapsed. Think we're too smart to repeat those mistakes 100 years later? Think again:

The long-term growth story is definitely there – it's the expectations for the time-horizon I take issue with. China is benefiting from a well-educated, cheap labor force – just as we did in the 1900s, as people left the farms for the factories. That gave us a huge boom that lasted until 1929, when the farms began failing and a speculative bubble burst and the banking system collapsed. Think we're too smart to repeat those mistakes 100 years later? Think again:

China’s great real-estate bust has begun, says Nomura. A combination of a huge oversupply of housing and a shortage of developer financing is producing a housing market downturn that could drive China’s GDP to less than 6% this year.

“To us, it is no longer a question of ‘if’ but rather ‘how severe’ the property market correction will be,” three Nomura analysts wrote in a report released Monday. And there isn’t much the government can do to head off problems.

Nomura bases a lot of its argument on the observation that that property investment turned negative in four of China’s 26 provinces in the first quarter of 2014, and in two of them, Heilongjiang and Jilin, the fall was greater than 25%. To Nomura, that’s a warning sign of similar problems to come in other Chinese provinces. Falling investment leads to falling levels of construction and sales. And given the property market’s huge role in the Chinese economy, declining growth in the property sector means declining growth in GDP.

Japan, South Korea, Taiwan and Australia have already shown the negative effects of a Chinese slowdown on their economy and this morning, they were joined by Indonesia, whose GDP came in at just 5.21%, well below the 5.8% forecast – just like our GDP was 0.1% vs 1.1% forecast. China’s economic slowdown is weighing on the outlook for Indonesia’s exports even as the trade balance improves, Finance Minister Chatib Basri said May 2 in an interview with Bloomberg News in Astana, Kazakhstan, where he was attending the Asian Development Bank’s annual meeting.

I wonder what they are saying about us in CHINA!!!?