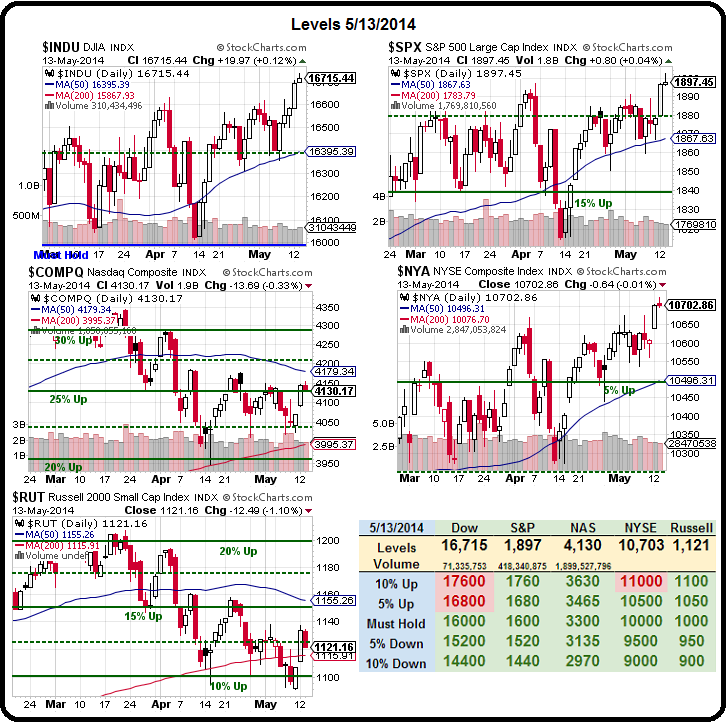

Three out of five indexes look very good!

Three out of five indexes look very good!

The same can be said about a dog with three legs and no tail, I suppose. So, the question is, is the market a dog in a nice sweater or whatever the metaphor would be for something where 3 healthy guys drag two dead guys around and win the race.

Hmmm, I guess there is no metaphor for that – BECAUSE IT'S RIDICULOUS, isn't it? A healthy market looks like a healthy market and this does NOT look like a healthy market.

You can ignore Russia invading Ukraine, you can ignore China's exploding debt bubble, you can ignore collapsing German Investor Confidence, you can ignore Japanese Inflation, you can ignore all the stuff we already talked about in this morning's news alert – but that's not going to make it go away!

Yes, we made new highs yesterday but look at the crap volume. The volume on the Friday after Thanksgiving (half a day) was 55M on SPY, the volume on Dec 26th was 63M and New Year's Eve was 86M – that's how ridiculous yesterday's volume was.

Yes, we made new highs yesterday but look at the crap volume. The volume on the Friday after Thanksgiving (half a day) was 55M on SPY, the volume on Dec 26th was 63M and New Year's Eve was 86M – that's how ridiculous yesterday's volume was.

We're still in the pattern of the market rising on low volumes and selling off on high volume, which is simply the way the Banksters pump up their holdings into the opens and then dump them on what few retail suckers are participating into the closes.

You can hear their media puppets ramping up the rhetoric at the same time, wagging their fingers at the retail investors and telling them they are "missing" the rally. Why weren't they saying that when the markets were 50% cheaper? Why not when they were 25% cheaper? No, only at a market top does the Corporate Media tell you to BUYBUYBUY because their masters already bought their fill and now they need someone to hold the bag. Same as it ever was.

![[image]](http://si.wsj.net/public/resources/images/BN-CU011_PageOn_E_20140514002520.jpg) Check out the front page of Mr. Murdoch's Wall Street Journal, nothing about Russia and they spin the Administration's attempt to boost Housing as a positive when it's actually a reaction to the horrific numbers (but a reaction we bet on with our HOV and KBH plays, so thank you Obama!). Below the fold in this morning's Journal is the spin article "Tech Firms' Cash Hoards Cool Fears of a Meltdown," right next to "The Buxom Boys of Bawdy Birding."

Check out the front page of Mr. Murdoch's Wall Street Journal, nothing about Russia and they spin the Administration's attempt to boost Housing as a positive when it's actually a reaction to the horrific numbers (but a reaction we bet on with our HOV and KBH plays, so thank you Obama!). Below the fold in this morning's Journal is the spin article "Tech Firms' Cash Hoards Cool Fears of a Meltdown," right next to "The Buxom Boys of Bawdy Birding."

The WSJ practices what Zero Hedge rightly calls "drop box journalism" as the 150-year tradition of excellence the Journal fought hard for is now being squandered to support a single Billionaire's agenda. It's not just the Journal, of course, most of the media has been corrupted and a majority of the information we get these days is more like propaganda – hardly surprising when just 6 companies control virtually everything you see or hear:

Do any of these companies or the Billionaires who own them want to tell you anything is wrong with the economy? They certainly don't want you to sell their stocks or stop buying their sponsors' products, do they? Why is German consumer confidence plunging for five straight months while ours is rising? Could it be that we're not reading the same news?

Do any of these companies or the Billionaires who own them want to tell you anything is wrong with the economy? They certainly don't want you to sell their stocks or stop buying their sponsors' products, do they? Why is German consumer confidence plunging for five straight months while ours is rising? Could it be that we're not reading the same news?

Not for long though – Uncle Rupert is making a play to take control of BSkyB in Europe – a deal that was previously struck down by regulators in the wake of the UK "hacking scandals." BSkyB's strategy mimics that of Murdoch's occasional rival John Malone, who has spent billions over the last decade building Liberty Global's cable TV empire. Last year he spent £15bn acquiring Virgin Media, bringing his global customer base to more than 24 million, with 80% of revenues coming from its pan-European operation.

BSkyB has a more sophisticated operation than its German and Italian sister companies and believes it can boost the proportion of customers that take multiple products, such as TV and broadband, as well as introduce services such as the internet streaming service Now TV and the film service Sky Store. BSkyB's UK and Ireland operation can reach 27m households, while Sky Europe would have a target of 94M households across five countries.

BSkyB has a more sophisticated operation than its German and Italian sister companies and believes it can boost the proportion of customers that take multiple products, such as TV and broadband, as well as introduce services such as the internet streaming service Now TV and the film service Sky Store. BSkyB's UK and Ireland operation can reach 27m households, while Sky Europe would have a target of 94M households across five countries.

One thing's for sure, if this deal isn't stopped, it will be the last you hear of an objection to it because, like the US, it will put almost all of the media in Europe under control of just a few Billionaires. We can expect investor confidence to get right back on track once we weed out all those annoyingly negative stories, right?

As we discussed in yesterday's Live Webinar, I'm a value investor (and we discussed value trade ideas on RRD, WEN, KBH, IGT, WFM, HOV, IRBT and TASR) and, at the moment, I'm not seeing value in many stocks. Not none, of course – those 9 were just the first in a series we're considering – IF the S&P can take out 1,900 and hold it. If not, we're already "Cashy and Cautious" and happy to wait and see which of our picks get cheaper and THOSE will be the ones we end up adding to our portfolios (which we'll be reviewing today in our Live Member Chat Room).

As we discussed in yesterday's Live Webinar, I'm a value investor (and we discussed value trade ideas on RRD, WEN, KBH, IGT, WFM, HOV, IRBT and TASR) and, at the moment, I'm not seeing value in many stocks. Not none, of course – those 9 were just the first in a series we're considering – IF the S&P can take out 1,900 and hold it. If not, we're already "Cashy and Cautious" and happy to wait and see which of our picks get cheaper and THOSE will be the ones we end up adding to our portfolios (which we'll be reviewing today in our Live Member Chat Room).

At the moment, we're long on gold, long on silver, short on the Dow, short on oil (see this morning's conviction trade guidelines) and, looking at Dave Fry's IEV chart above, I think we'll go short on that as well!

Why do we like gold and silver? Our Producer Price index was up 0.6% this month, 3x the 0.2% expected and even core PPI was up an undeniable 0.5% – essentially making a hockey-stick move on this chart which, of course, is being downplayed by the Corporate Media as we speak.

Why do we like gold and silver? Our Producer Price index was up 0.6% this month, 3x the 0.2% expected and even core PPI was up an undeniable 0.5% – essentially making a hockey-stick move on this chart which, of course, is being downplayed by the Corporate Media as we speak.

0.6% – that's OFF THE CHART!!! 0.5% is the top of the chart! What inflation? The Fed doesn't see any inflation, the media doesn't see any inflation – do you? Gold is touching $1,310 and silver (/SI) just hit our goal at $20 and you can see our longs coming off the table with $4,500 per contract gains from our entry back at $19.10 last week. We also have SLW in our Short-Term Portfolio along with a bear put spread on GLL (ultra-short gold) in our Long-Term Portfolio so we have been firmly in the bull camp all year – as I noted, $20 is where we take profits on our Futures trade but, long-term, we think there's a lot more upside to come as the reality of inflation kicks in.

Inflation was the theme we were playing for early this year as well. DBA was one of our big winners already this year as well as ABX, which is still playable (see yesterday's post for all of our early 2014 trade ideas), since it's "only" up 213% out of a potential 566%, so it can still more than double from here and all gold has to do is tick up just a little and we should get a home run!

Inflation was the theme we were playing for early this year as well. DBA was one of our big winners already this year as well as ABX, which is still playable (see yesterday's post for all of our early 2014 trade ideas), since it's "only" up 213% out of a potential 566%, so it can still more than double from here and all gold has to do is tick up just a little and we should get a home run!

Inflation is the reason we remain long-term bullish on the market (we expect a short-term correction). Stocks are, after all, priced in Dollars and inflation will eat away at the buying power of those Dollars and you'll need more and more of them to buy the same stocks.

Also, earnings will expand with inflation, only the net earnings will be worth less – but that hasn't stopped Japanese stocks from running higher and higher as the Yen has gotten lower and lower. There's no reason we can't have fun as well.