Now what?

Now what?

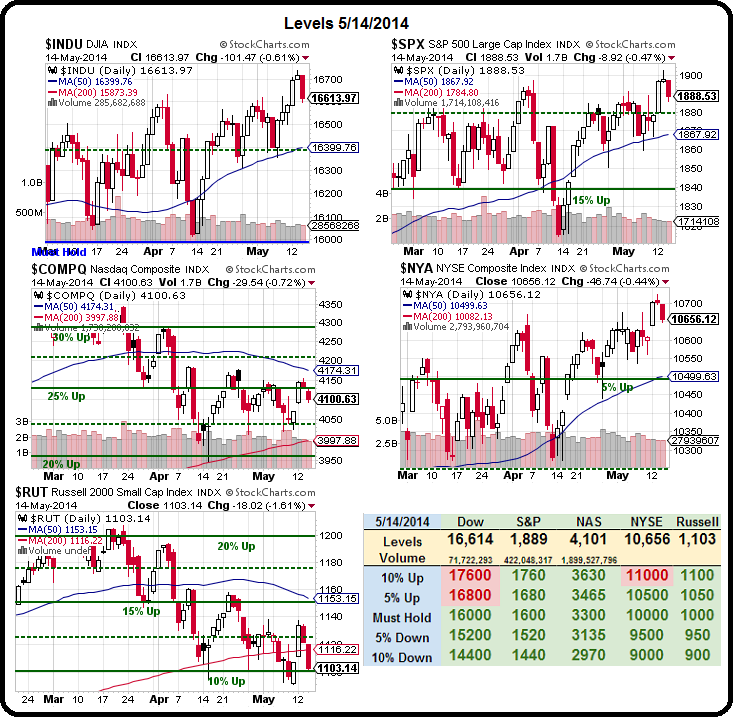

Options expire on Friday and last expiration day (4/18), we were 2.5% higher on the Russell and Nasdaq , which is about how much higher the Dow, S&P and NYSE are from where they were at the time.

It's been an interesting month watching our indexes diverge but, as we discussed in our Tug Boat Example last week, this sort of behavoir simply doesn't last very long. The end of that discussion (last Thursday) was:

NYSE 10,000 was clearly the right line and 10,500 is the 5% line and 10,750 is 7.5% with the NYSE now at 10,667. Another reason we don't move the Must Hold lines is the NYSE has given no indication at all that it will be able to go over 11,000 (10% line) and we're back the tugboat that holds the others back.

RUT 1,100 is the 10% line and 1,200 is the 20% line and the RUT moves like the only thing trading it is a computer running on the 5% Rule. Complete obedience of the lines makes it fantastic to trade – except the direction it moves is quick and seemingly random! Still, 1,100 is a very good floor (so bullish above) and 1,200 has been too hard to hold (so short below) and, at the moment, it's fallen into the lowest quadrant of that range – not able to stay over 1,125. That indicates a downward bias as it makes a triangle squeezy thingy down there (and it's below the 200 dma at 1,115 at the moment).

So, either the RUT comes out of the triangle squeezy thingy to the downside and drags the others with it or the Dow, NYSE and S&P pop over their resistance and bring the RUT along for the ride. Interesting times indeed…

As you can see from Dave Fry's Russell Chart, the RUT resolved it's triangle sqeezy thingy to the downside – after the requisite head-fake and now we're back to the good old 1,100 line, where we're happy to go long again if it holds on the /TF Futures (with tight stops below).

As you can see from Dave Fry's Russell Chart, the RUT resolved it's triangle sqeezy thingy to the downside – after the requisite head-fake and now we're back to the good old 1,100 line, where we're happy to go long again if it holds on the /TF Futures (with tight stops below).

We've moved our main hedges already from TZA (ultra-short Russell) to DXD (ultra-short Dow) since the Dow has a lot more room to fall from it's loft new heights.

Finding fresh horses is one of the things we like to teach our Members to do at Philstockworld. We already rode the Russell horse down from 1,200 to 1,000 – it's tired now but the Dow was over 16,700 when we added our shorts this week, almost 10% over the year's low at 15,400 – a juicy short indeed!

I know, I sound like a broken record warning you not to trust the rally and calling for cash but if you don't believe me, how about listening to the highest-earning hedge fund manager of 2013? David Tepper gave the keynote speech at the SALT Conference last night and his opening comments to top hedge fund managers and investors were my opening comments to you this motth (plagurism forgiven):

"I think we're OK. But, listen, there's times to make money and there's times not to lose money. This is probably you're supposed to think about preserving some of your money…I think you can still be long, but I think you're supposed to have some cash now."

"I am nervous. I think it's nervous time."

He said the market is probably OK. "But it's getting dangerous."

Anthony Scaramucci asked for any opportunities that are glaring.

Nothing.

"I'm not saying go short. Just don't go too friggin long."

Hmm, now where have we hear that before? Tepper couldn't say "Cashy and Cautious" without sending me 15 cents first but you get the gist of it. He pointed to the Central Banks. He has a new phase for Central Banks – "Coordinated complacency…the market's kind of dangerous in a way. I think the ECB…they better ease in June. I don't know how far they are behind the curve…We are a fairly leveraged world…I'm not so keen about deflationary forces."

Hmm, now where have we hear that before? Tepper couldn't say "Cashy and Cautious" without sending me 15 cents first but you get the gist of it. He pointed to the Central Banks. He has a new phase for Central Banks – "Coordinated complacency…the market's kind of dangerous in a way. I think the ECB…they better ease in June. I don't know how far they are behind the curve…We are a fairly leveraged world…I'm not so keen about deflationary forces."

I can only tell you the same thing as the top hedge fund manager in the World tells you a month before he tells anyone else (probably at the same time as he was acting to reduce his own positions). What you do with that information is up to you. Internally, we reviewed all 5 of our Member Portfolios in yesterday's Live Chat Room and. so far, we're outperforming Tepper by an average of 8% this year – not too shabby!

Yesterday morning, we began our day in Chat shorting all the Futures at Dow 16,650 (/YM), S&P 1,890 (/ES), Nasdaq 3,600 (/NQ) and Russell 1,110 (/TF) and the Russell was our big winner with a $1,000 per contract gain during the day while the other indexes as well as oil (/CL) gave us $500 per contract gains. Just because we're mainly in cash, doesn't mean we can't have a little fun.

Yesterday morning, we began our day in Chat shorting all the Futures at Dow 16,650 (/YM), S&P 1,890 (/ES), Nasdaq 3,600 (/NQ) and Russell 1,110 (/TF) and the Russell was our big winner with a $1,000 per contract gain during the day while the other indexes as well as oil (/CL) gave us $500 per contract gains. Just because we're mainly in cash, doesn't mean we can't have a little fun.

On Friday, I listed a few stocks we are buying in the morning post and this week, we went over 9 trade ideas (so far) on some of our favorite bottom-fishing plays and, of course, we made our portfolio adjustments as well – still generally bullish for the long-term but, as Tepper says, there's simply not a lot to buy at these prices.

Europe had weak GDP numbers this morning (0.8% growth) and China is still falling apart and Russia is still pushing into the Ukraine – ignore these things at your peril! As I keep saying as we drift along the top of the S&P range – I'll be very happy to get more bullish AFTER we break out to new highs over 1,900 but, until then – CASH!!! makes me more comfortable.

Europe had weak GDP numbers this morning (0.8% growth) and China is still falling apart and Russia is still pushing into the Ukraine – ignore these things at your peril! As I keep saying as we drift along the top of the S&P range – I'll be very happy to get more bullish AFTER we break out to new highs over 1,900 but, until then – CASH!!! makes me more comfortable.

While we sit at the sidelines, we can still make a few bucks trading on earnings and news, of course. Last Thursday, for free, right in the morning post, I suggested buying 2 TSLA 2016 $220/300 bull call spreads for $20 ($4,000), selling 2 2016 $140 puts for $22 ($4,400) and selling 3 Sept $200 calls for $26.50 ($7,950) for a net $8,350 credit.

- We had a great oppen with TSLA spiking up to $194 making easy fills, even after the earnings news but, as we expected, the excitement died down and now they are stuck at $190 and the bull call spread is $17.30 ($3,460) and the short $140 puts are $21.70 ($4,340) and the Sept $200 calls are $17.50 ($5,250) for a net credit of $6,130 – up $2,220 (26%) in just 7 days.

- In the previous day's post, we had 4 FSLR Jan $77.50/85 bull call spreads at $2 ($800), selling 5 July $75 calls for $3 ($1,500) as another bearish earnings play. FSLR dove to $62 and already the July $75 calls are down to $1.03 ($515) and the Jan spread is down to $1.30 ($520) but that net's out to -$5 if we wanted to close the trade now and we had a $700 credit so $695 profit is a 99% gain in 7 days.

This is why David Tepper and I don't mind going to cash – there's always something fun we can trade!