And then there were 2.

And then there were 2.

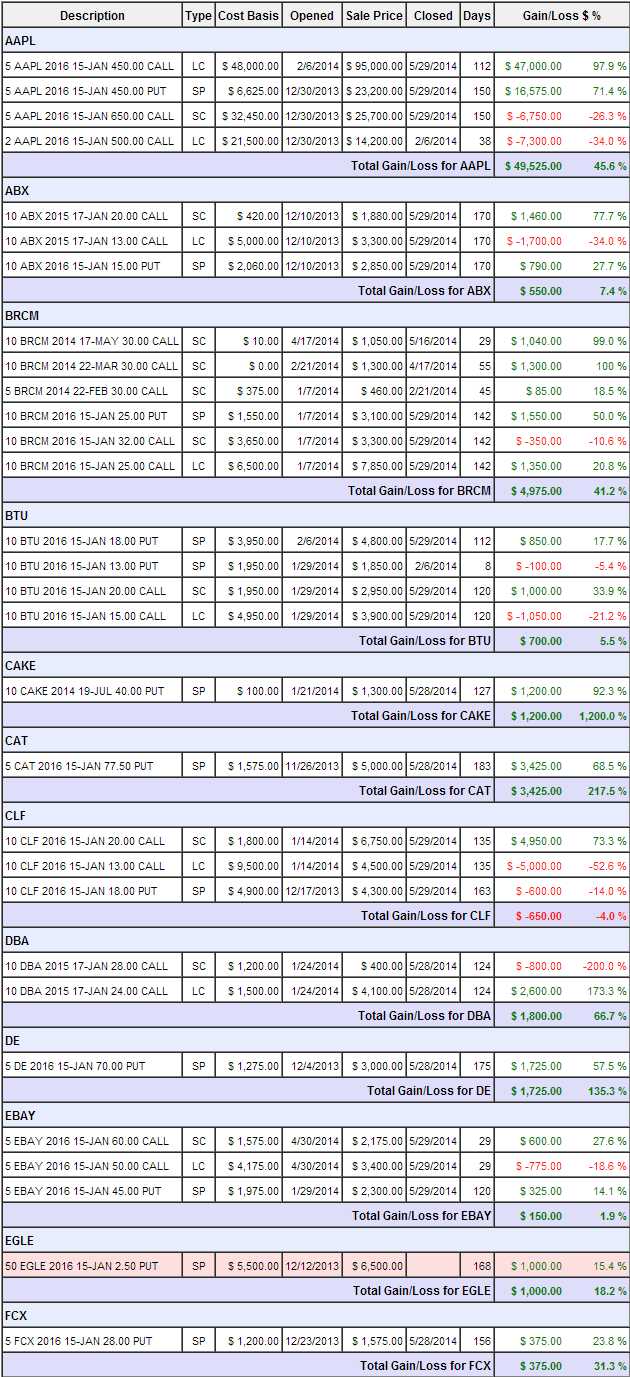

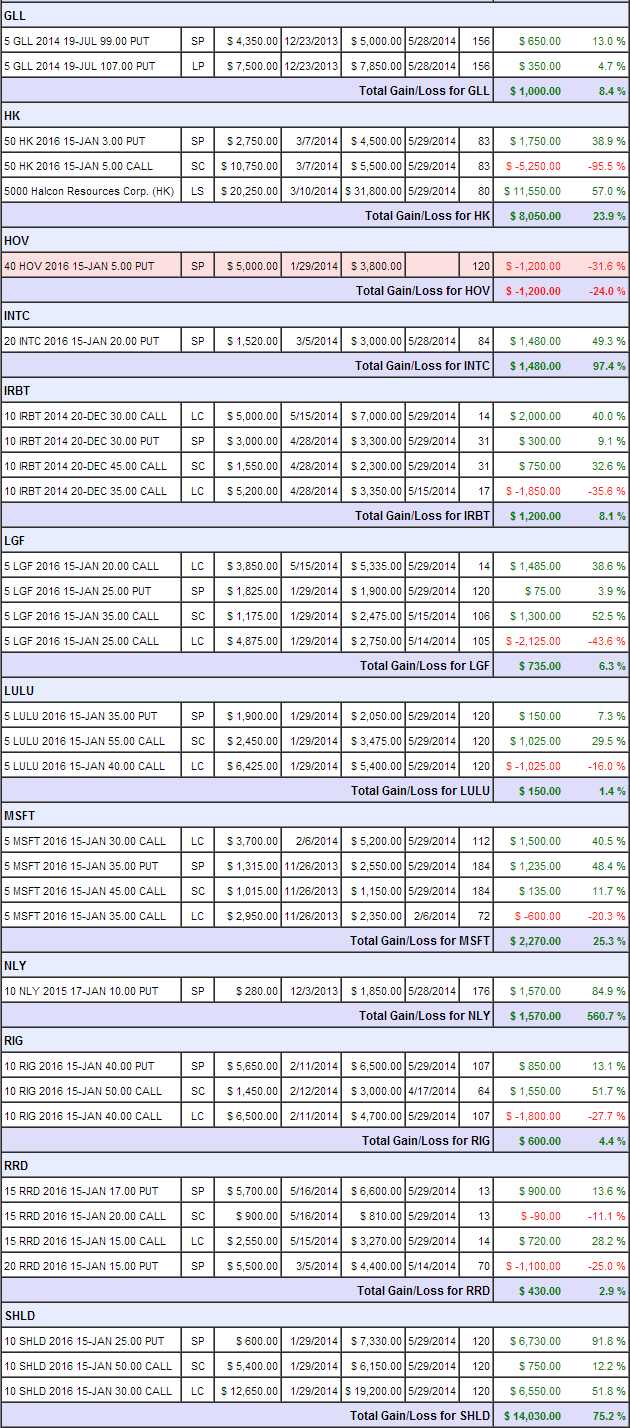

Just two positions remain in our Long-Term Portfolio now, short puts we sold against HOV an EGLE that are "losers," so far. Of our other 29 virtual trades, which we finished closing today, only 3 have a loss, which gives us an 83% winning percentage - which is pretty much in-line with our usual performance for PSW Members (see our Trade Reviews).

If you want a quick summary of my reasoning for getting back to cash - it's the same one I had back in March, when we cashed out our Income Portfolio. I was interviewed on TV at the time, where I made my case for caution. Since then, the S&P is up from 1,890 to 1,920 and that rubber band is simply stretched too tightly for our liking now - so we cash out our more aggressive portfolio too.

Without further ado, here's our trade history in the Long-Term Portfolio, which died a sudden death on May 28th and 29th (there were a lot of positions to close) of 2014, at the age of just 6 months:

AAPL was our Stock of the Year pick, so that was a no-brainer and we were willing to allocate a much larger than usual block to it. ABX is one that can still work (and we will certainly be going back to this portfolio - in addition to our new Buy List, as we seek to redeploy our cash in the 2nd half of 2014) as are BTU, CLF and EBAY. EGLE is still open and the price is now correct, which is one of the reasons we ended up with more profit than we thought.

GLL taught us not to play GLL, the bid/ask spreads were ridiculous. HOV is our other still-open position, IRBT is new but we shut it down anyway (still playable) and LGF, LULU and RIG are still playable as new positions.