Help, we're being attacked!

Help, we're being attacked!

Not by foreign terrorists, but by the market manipulators who trade at the NYMEX and FAKE Billions of barrels of orders each month in order to drive the price of petroleum higher for US Consumers. Not only do the FAKE demand during the month, but they also then CANCEL the FAKE orders in order to create ARTIFICIAL supply shortages – just ahead of the summer driving season.

This is Financial Terrorism of the highest order yet our Government sends no troops out to the trading floor and orders no drone strikes on the ivory towers where the Banksters mastermind these attacks on the US economy every month, costing American Citizens hundred for Billions of Dollars every year in excess energy costs.

Last Friday, I told you that the 172,551 open contracts that guaranteed delivery of 172,551,000 barrels of crude to the US in July were FAKE and that all but 20,000 of them would be canceled by today. This morning, there are only 28,550 open contracts remaining. That means that 144 MILLION barrels of oil that were scheduled for delivery to supply the US in July have been CANCELED, in order to create an artificial shortage of 36M barrels per week next month.

|

Click for

Chart |

Current Session | Prior Day | Opt's | ||||||||

| Open | High | Low | Last | Time | Set | Chg | Vol | Set | Op Int | ||

| Jul'14 | 106.60 | 106.75 | 106.33 | 106.49 |

07:38 Jun 20 |

– |

0.06 | 1537 | 106.43 | 28550 | Call Put |

| Aug'14 | 106.10 | 106.25 | 105.81 | 105.99 |

07:38 Jun 20 |

– |

-0.06 | 17587 | 106.05 | 314447 | Call Put |

| Sep'14 | 105.27 | 105.41 | 105.05 | 105.20 |

07:38 Jun 20 |

– |

-0.10 | 4119 | 105.30 | 187262 | Call Put |

| Oct'14 | 104.35 | 104.40 | 104.09 | 104.21 |

07:38 Jun 20 |

– |

-0.14 | 1811 | 104.35 | 126731 | Call Put |

As we've noted over the past week, since we KNOW how they manipulate the oil markets, we have a very easy time profiting from the manipulation – so you think we shouldn't complain and just take the money, but it's WRONG!!! It's wrong and it's hurting our country, it's depriving our citizens of money they could be spending elsewhere and it's damaging our competitiveness. IT NEEDS TO STOP!!!

But it won't stop. Now there are 314M barrels worth of FAKE orders for August delivery and I can tell you right now that MORE than 90% of those barrels will never be delivered. For one thing, Cushing, OK (where the contracts deliver to) can only hold 50M barrels total – so the whole idea of over 300M barrels being delivered there in a single month is ridiculous. For another thing – THEY ARE FAKE!!! These "orders" are nothing more than a blatant attempt to create a false demand for crude oil in the US in order to drive up prices.

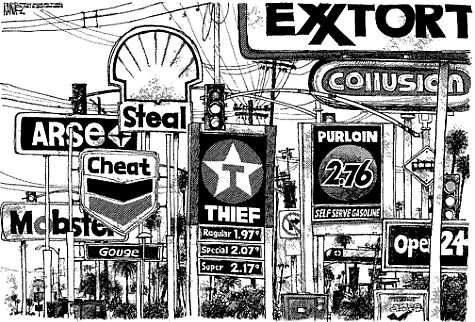

While the difference between $80 oil (a price even XOM's CEO says is unrealistically high) and $106 oil is only $0.62 per 42-gallon barrel, your gas tank, for example holds about 15 of those gallons, so that's $9.30 that is being stolen from you every time you fill up the tank. But, of course, the shippers and the refiners and the friendly guys at your local gas station all need their mark-ups so, by the time you fill up your tank – it's more like $20 per tank you end up paying due to price manipulation.

While the difference between $80 oil (a price even XOM's CEO says is unrealistically high) and $106 oil is only $0.62 per 42-gallon barrel, your gas tank, for example holds about 15 of those gallons, so that's $9.30 that is being stolen from you every time you fill up the tank. But, of course, the shippers and the refiners and the friendly guys at your local gas station all need their mark-ups so, by the time you fill up your tank – it's more like $20 per tank you end up paying due to price manipulation.

Filling up once a week means you are spending an extra $1,040 per year on gas alone and another $1,000 a year to heat your home or as pass-through costs from shippers and airlines and whatever products you use that use oil (most of them) in their process. If you are married, call it $3,000 a year you are being ripped off and, if you have kids, add another $1,000. Now do you care?

Should America care that it's costing us close to $800Bn a year (5% of our GDP) to pay for this scam? Congress cares – they care so much that they accepted $871M in lobbying money from the Oil and Coal Industries in 2012 to kill Obama's energy bill and THAT is how they are able to screw each and every American Citizen out of $1,000 per year.

HALF of our national trade deficit is oil, HALF of all the lobbyists in Washington are energy lobbyists. Almost ALL of our $1Tn annual military budget is there to protect the oil industry, that's another $3,000 per citizen spent to protect that $4,000 per family they are stealing from us!

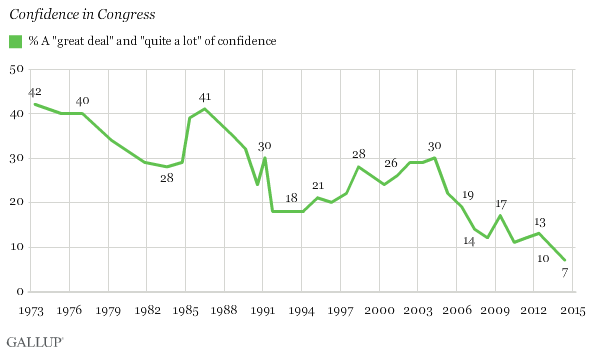

With over $1M being spent in campaign donations and lobbying money on each and every Congressperson, what power do we have to change things? There was a poll yesterday showing that only 7% of our citizens have confidence in Congress and I pointed out that 16% of the population is functionally illiterate (IQ below 85 – you can check your score here), which means that any broad-based poll will get a completely random answer from 16% of the people it surveys – that is the explanation for the 7% that "approve" of Congress – they simply didn't understand the question!

With over $1M being spent in campaign donations and lobbying money on each and every Congressperson, what power do we have to change things? There was a poll yesterday showing that only 7% of our citizens have confidence in Congress and I pointed out that 16% of the population is functionally illiterate (IQ below 85 – you can check your score here), which means that any broad-based poll will get a completely random answer from 16% of the people it surveys – that is the explanation for the 7% that "approve" of Congress – they simply didn't understand the question!

NONETHELESS – in a typical election year, 95% of the incumbents get re-elected. The same random 8% of the people believe Congress is "honest and ethical." So keep them if you want to but, even as I'm writing this, oil is flying back over $107 into the 9am NYMEX open to pump up the prices as they prepare to cancel those last few orders – to insure a "draw" in oil supplies over the July 4th weekend that will then justify rasing your gas prices another 10% this summer due to "demand".

NONETHELESS – in a typical election year, 95% of the incumbents get re-elected. The same random 8% of the people believe Congress is "honest and ethical." So keep them if you want to but, even as I'm writing this, oil is flying back over $107 into the 9am NYMEX open to pump up the prices as they prepare to cancel those last few orders – to insure a "draw" in oil supplies over the July 4th weekend that will then justify rasing your gas prices another 10% this summer due to "demand".

Whatever you do, don't write to your Congressmen – just follow the sage advice of Republican Governor (Texas, of course) Clayton Williams, regarding a similar situation: "If it's inevitable, just relax and enjoy it."