Does this look healthy to you?

We did manage to pull out of a tailspin back in 2011 – the last time our GDP went negative but, funny story – in July of 2011, the S&P fell from 1,350 to 1,100 by August 9th and it gyrated between 1,100 and 1,200 until October when the Fed's "Operation Twist" (because "Operation Screw the Poor" got bad test scores) gave us a boost.

Notice how this post picks up right where yesterday's post left off – I'm clever that way! Yesterday we had the chart that showed us that 10% of our GDP ($1.5Tn) is the result of Fed fiddling and, without it, the GDP would be right back at those 2009 lows. Whether or not you THINK QE will ever end, you sure as hell better have a plan for what you will do in case it does!

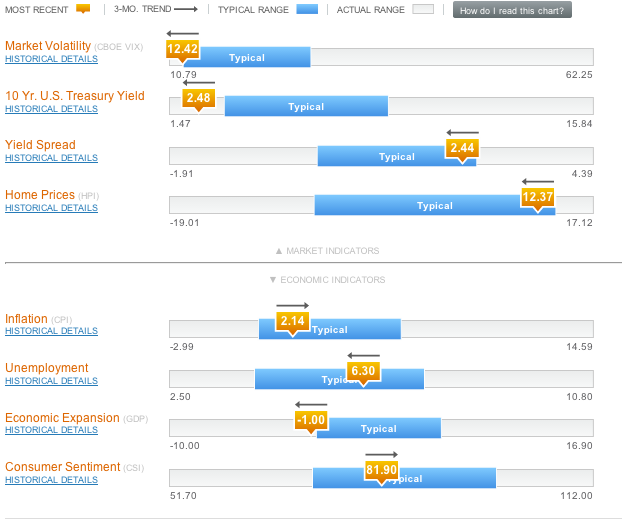

Russell Investments put out their Economic Indicators Dashboard yesterday and it's a nice snapshot of the where the economy is.

Russell Investments put out their Economic Indicators Dashboard yesterday and it's a nice snapshot of the where the economy is.

The lines over the boxes are the 3-month trends and, thanks to the Fed, 10-year yeilds are just 2.48% and that's keeping home prices high (because you don't buy a home, you buy a mortgage).

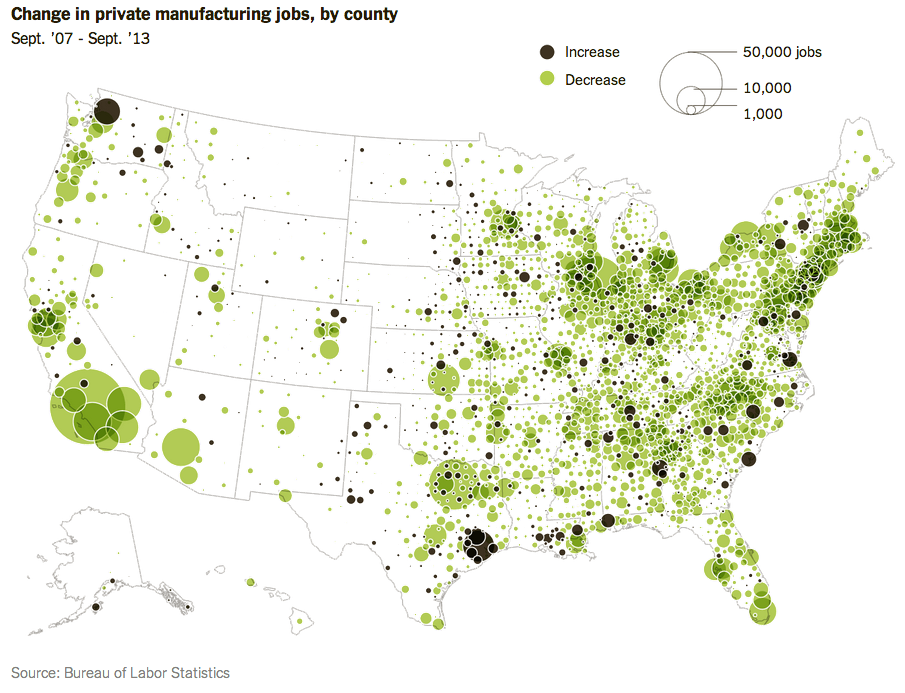

Inflation is creeping up and expansion (today's topic) is negative and getting lower. Meanwhile, consumers remain oblivious as the Corporate Media fills them with happy talk. Meanwhile, this BLS chart (via Barry Ritholtz) says it all as manufacturing (good) jobs continue to leave our country at alarming rates:

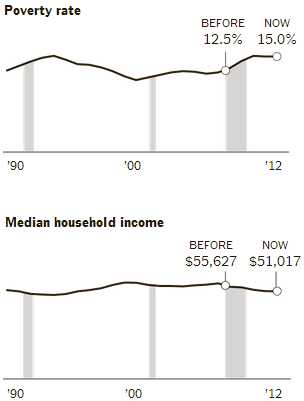

Almost all of the growth spots are from fracking with a little auto production picking up as well. Overall, 1.6M net manufacturing jobs have been lost since 2007 and, much more alarming, the median household income for those lucky enough to still have jobs is down almost 10% over the same period of time.

Almost all of the growth spots are from fracking with a little auto production picking up as well. Overall, 1.6M net manufacturing jobs have been lost since 2007 and, much more alarming, the median household income for those lucky enough to still have jobs is down almost 10% over the same period of time.

In other words, if it wasn't for Fed Money, we'd have no money at all! In yesterday's Webinar (replay available here) we talked about how the Fed is like a guy spraying a hose on kids in the back yard – he isn't making it rain for real, but the kids are still going to get wet. That's what stocks are at the moment, a bunch of kids who are atificially wet – but don't bet on them to stay that way after the water is shut off because there's no rain in site!

While our long-term Portfolios remain bullish for as long as the Fed keeps the hose turned on, we're still using our Short-Term Portfolio to hedge for a correction (2011's was 18.5%, which would take us back to about S&P 1,600) as well as our Futures bets, like /NKD short at 15,400, which made a quick $500 per contract in last night's fall to 15,300.

Members get to hear these picks LIVE in our weekly Webinars and LIVE every day in our Member Chat Room – where we also picked a Russell Futures (/TF) short at 1,187.50 at 11:37, which is now good for over $2,000 per contract at $1,167 this morning. This morning I sent out an alert to short Oil Futures (/TF) at $106.25 and we got a .10 move ($100 per contract) and then a cross back to $106.50, where we shorted again and now (8:29) we're back to $106.30 for another $200 per contract gained.

Members get to hear these picks LIVE in our weekly Webinars and LIVE every day in our Member Chat Room – where we also picked a Russell Futures (/TF) short at 1,187.50 at 11:37, which is now good for over $2,000 per contract at $1,167 this morning. This morning I sent out an alert to short Oil Futures (/TF) at $106.25 and we got a .10 move ($100 per contract) and then a cross back to $106.50, where we shorted again and now (8:29) we're back to $106.30 for another $200 per contract gained.

8:30 Update: Oops, I spoke too soon as Durable Goods just came out at -1% and that's bad but the GDP is TERRIBLE at -2.9% vs -1% previously. That should send us back below $106 on oil and lower on our indexes as well. If S&P (/ES) 1,940 breaks, those Futures are a good short below that line as it's an easy stopping point (heavy resistance).

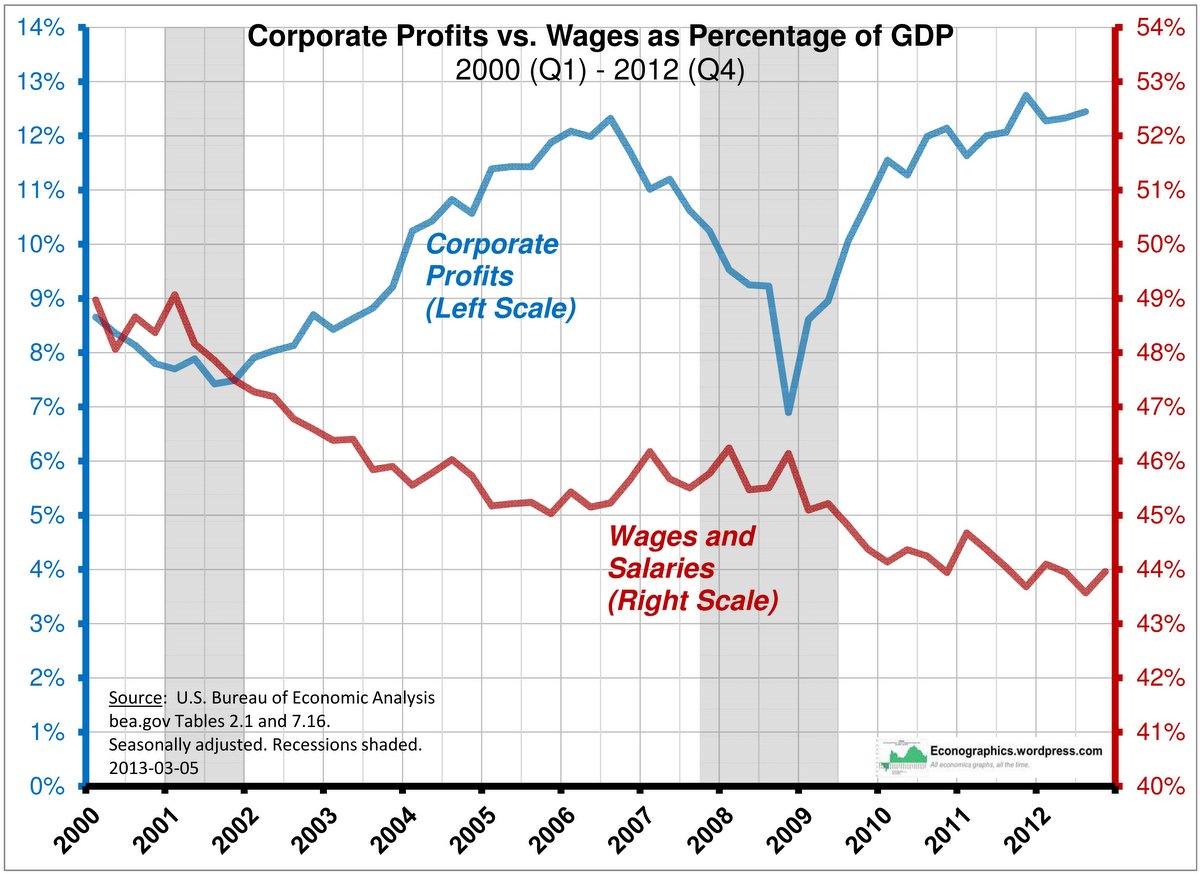

Don't worry though, Corporate Profits were UP 5.3%, mainly because they decreased their capital consumption by $198.3Bn as the "job creators" continue to magically create no jobs at all (unless you are a tax-avoidance expert).

Don't worry though, Corporate Profits were UP 5.3%, mainly because they decreased their capital consumption by $198.3Bn as the "job creators" continue to magically create no jobs at all (unless you are a tax-avoidance expert).

They also paid out $87.1Bn less dividends, leaving an extra $139.1Bn in undistributed profits on the books. Due to fines, the Financial Sector was a drag this quarter, down $52.6Bn from Q4 against the Trillions they've already stolen.

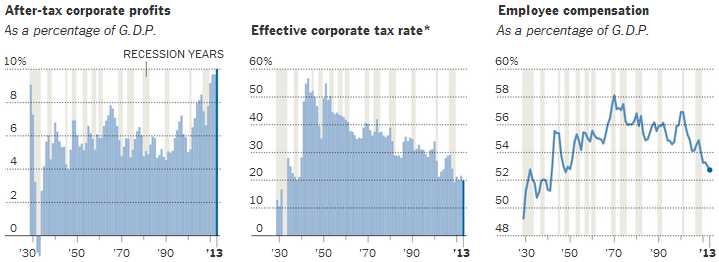

Corporate profits have never been higher and relative wages have never been lower. It's not good for America, it's not good for our Citizens but it's FANTASTIC for our Corporate Masters. As long as the Fed and the other Central Banksters keep feeding the beast, they will be able to continue to fiddle while the Global Economy burns around them. As I noted yesterday, I am concerned that we are at peak Monetary Accomodation and peak Abuse of Workers and that means we may be seeing peak Corporate Profits – but we're not going to fight the Fed.

Very likely the poor GDP numbers will be spun as "bad news is good news" by the MSM and we'll hear about more ways the Fed can stimulate what is now, undeniably, an economy that is back in recession (but do not expect to hear the "R" word from anyone who is allowed on TV).

Very likely the poor GDP numbers will be spun as "bad news is good news" by the MSM and we'll hear about more ways the Fed can stimulate what is now, undeniably, an economy that is back in recession (but do not expect to hear the "R" word from anyone who is allowed on TV).

As I noted yesterday in our Portfolio Review – we reamain "Cashy and Cautious" – at least until after 14th, when we'll have a good amount of Q2 earnings to look at.

Can our Corporate Masters pull off another miracle and prosper while simultaneously crushing the Middle Class? Don't forget, it's an election year and those in power would hate to have the markets in a massive slump while they are hitting the top 1% up for donations – so expect all stops to be pulled out to avoid a repeat of the summer of 2011 (when we also had a low-volume rally in the 2nd half of June) .

Tune in this summer – but watch out for that first step – it can be nasty!