I'm NOT going to depress you.

I'm NOT going to depress you.

If you want to be depressed about the market, check out my Twitter Account, where I posted our Morning Alert to Philstockworld Members (and you can become one of those HERE) in which I aired my concerns with the Global Macros.

As you can see from Dave Fry's SPY chart, the volume on Friday was very low – incredibly so as it was a Russell re-balancing day, when we can usually expect very HEAVY volume. Today is, in fact, the very last day of Q2, so we expect "window-dressing" to hold us up for at least another day but then there's only 2 and 1/2 days until the 3-day weekend, so perhaps the charade can continue all week.

Last week we discussed the various forms of market manipulation that are keeping us at record highs and, on Friday, I asked "How Many Countries are Faking Economic Data?"

I didn't mention the US because we've already had extensive discussion of how the US changed the rules on GDP calculations last year to add 3% to our GDP but NOW I need to mention the US's contribution to data manipulation because it turns out that a revision to the way Pensions are being accounted for has goosed Corporate profits by 6%, adding another $500Bn (3%) to our GDP!

I didn't mention the US because we've already had extensive discussion of how the US changed the rules on GDP calculations last year to add 3% to our GDP but NOW I need to mention the US's contribution to data manipulation because it turns out that a revision to the way Pensions are being accounted for has goosed Corporate profits by 6%, adding another $500Bn (3%) to our GDP!

Even worse, it's retroactive (see chart above) and improves HISTORICAL EARNINGS as well! This smoothes out the GDP charts and doesn't make it look like we did something in 2014 to pump it up – isn't that clever? Not only does it pretty up the GDP and boost Corporate Earnings (so the S&P's p/e looks like 18.5 when it's well over 20), but it also fools investors into thinking that pension obligations at blue-chip companies are not as bad as they really are.

No wonder the volume in the market is approaching zero – who can play in a game where they change the rules every few months (and surreptitiously, at that!)? Even with the record amount of buybacks by US Corporations in 2013, GAAP (Generally Accepted Accounting Principles) show earnings DROPPING 2.2% but, using the magic accounting allowed by our Government, earnings LOOKED up 4.6%.

No wonder the volume in the market is approaching zero – who can play in a game where they change the rules every few months (and surreptitiously, at that!)? Even with the record amount of buybacks by US Corporations in 2013, GAAP (Generally Accepted Accounting Principles) show earnings DROPPING 2.2% but, using the magic accounting allowed by our Government, earnings LOOKED up 4.6%.

As owners of the stocks in question, we LOVE it when earnings go up – even if they are faked but, as INVESTORS in the company, we need to be aware that there are only so many rule changes and so many buybacks and so many spending cuts a company can go through before it actually has to actually start selling more stuff to make more money. That's why I've been saying lately that we may have now passed "peak profits" for corporations and that's not a good thing because never before have we been so leveraged into equities – NEVER:

Dave Fry and I have been warning all year that the "rallies" have been coming on low volumes while the sell-offs are coming on stronger volumes as the Fund Managers are manipulating the markets while their Media Lackeys are convincing the Retail Suckers to take over holding the bag in what is essentially a financial game of hot potato. As you can see from the above charts, margin debt (smart money) has been exiting since February and, as you can see from previous peaks – there's a 3-6 month lag before the market collapses. July will be month 5.

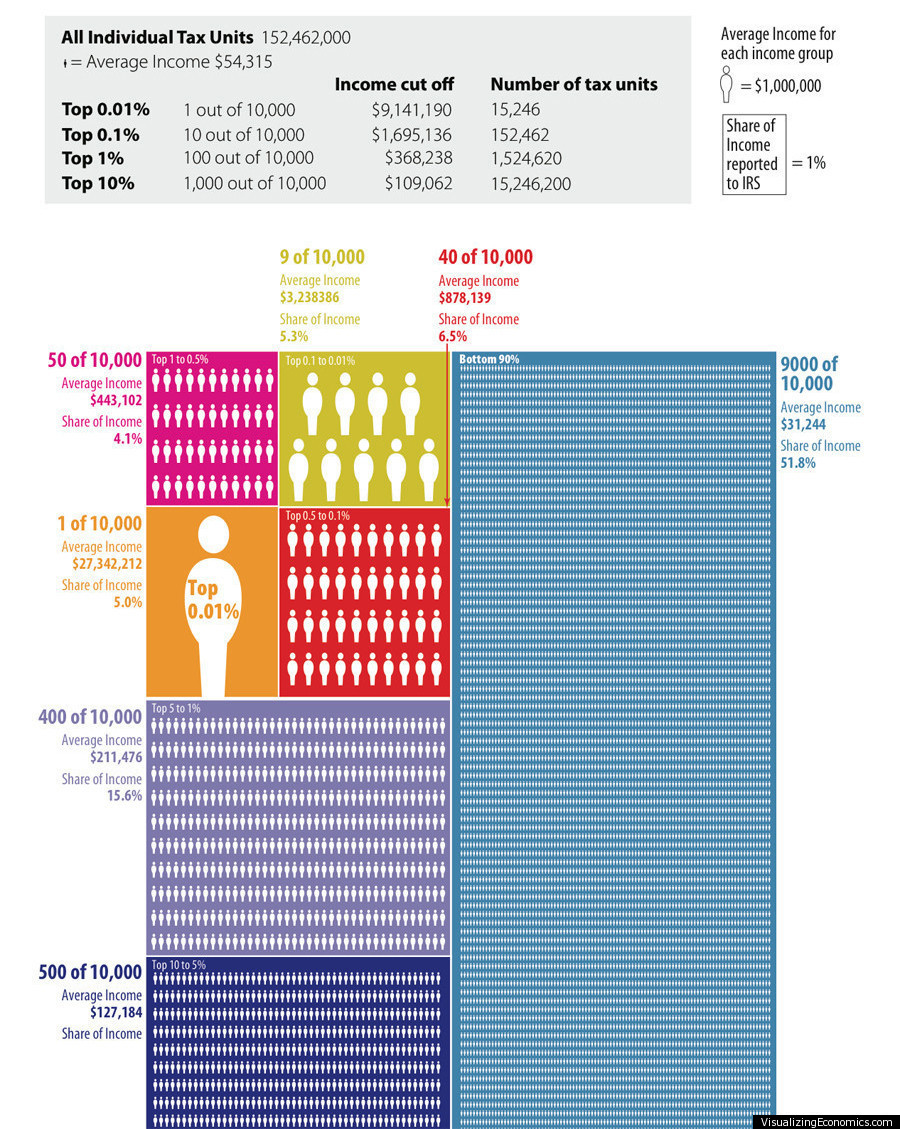

We'll see how Q2 earnings look but my big issue remains the Consumer who, by all indications, is tapped out. Not us (top 10%) – we're doing great but the other 90%, who still represent 52% of the income in this country (but the GOP vows to "fix" that in 2016!) simply have no money to spend and Consumer Spending is 70% of our GDP (the real one).

We'll see how Q2 earnings look but my big issue remains the Consumer who, by all indications, is tapped out. Not us (top 10%) – we're doing great but the other 90%, who still represent 52% of the income in this country (but the GOP vows to "fix" that in 2016!) simply have no money to spend and Consumer Spending is 70% of our GDP (the real one).

They don't do studies like this in the US (because it might make people angry) but, in the UK, they care about their people's Standard of Living and the numbers they have been showing since the Financial Crisis are shocking.

The measure, calculated every year, includes enough to provide ordinary food, clothes, and leisure activities, as well as items judged necessary to survive in modern Britain, without extravagance.

Overall the study, compiled for the Joseph Rowntree Foundation by academics at the Centre for Research in Social Policy in Loughborough University, concludes that a single person with no children would need £16,284 a year to be able to get by and maintain a basic decent standard of living, up from £13,450 in 2008.

By contrast a couple with children, would now need to earn £20,287 each – or £40,574 to maintain a minimum standard. In 2008 they would have needed just under £28,000 between them to get by to roughly the same standard. That increase of 46 per cent compares with a rise of only nine per cent in average earnings in that time.

Not only is the US not very different than the UK but, with a much lower social safety net, conditions in the US are likely much worse. We'll find out as companies begin reporting earnings in the next few weeks but it's hard to imagine a great deal of sales growth as the entire World remains in a Recession – albeit one that is being covered up by Central Bank machinations.

Not only is the US not very different than the UK but, with a much lower social safety net, conditions in the US are likely much worse. We'll find out as companies begin reporting earnings in the next few weeks but it's hard to imagine a great deal of sales growth as the entire World remains in a Recession – albeit one that is being covered up by Central Bank machinations.

We just got an adjusted Q1 GDP of -2.9% last week, not +2.5% as the chart above shows. If the other developed countries are starting the year off with negative numbers – how likely is it that we're going to hit those goals?

While we can keep dream-walking for quite some time (especially with all the drugs the Fed is giving us), there's always the danger that people will eventually wake up so keep one hand firmly on the exit door at all times. On Friday we discussed a DXD hedge in the morning post and, for our Members, we had TZA (now $14.19) hedges as well and, as I've mentioned, we are VERY LIGHTLY INVESTED in our major portfolios.

If the crash never comes, then we have plenty of cash to buy things with but, if it does – then we have plenty of cash to buy things with. That's a win-win!