Yesterday went as expected.

Yesterday went as expected.

As I told you in the morning post, the "rally" was nothing more than a prop job to allow a full day of selling right into the close. Now that the markets are closed, the S&P is being propped back up – 0.3% as of 7:30 am. May the farce be with you!

Of course, this morning, there may actually be something to get excited about as the 2nd Quarter GDP Report will come out at 8:30 and economorons are expecting a full reversal of Q1s 2.9% dive with a 2.9% gain forecast for Q2.

I don't know what numbers they are looking at (assuming they even bother – from their usual performance, they would be better off using darts) but I'm not seeing a big resurgance in Consumer Spending, which is 70% of the US economy. I don't see how our Trade numbers improved, although we did import less oil (to create artificial shortages and drive up prices for the consumers).

Business Investment seems to be up a bit and Inventories are a real wild card where a build will be a huge plus – even though, to me, it sort of indicates they are not selling anything and it's piling up on the shelf.

This is the fantasy chart for the GDP that is making the rounds this morning. Notice it's from the Commerce Department (aka MiniTru) and, like our Chinese Masters – they are able to make those numbers dance when they want to and, believe me, they REALLY WANT TO this Q as two down quarters in a row = the "R" word.

This is the fantasy chart for the GDP that is making the rounds this morning. Notice it's from the Commerce Department (aka MiniTru) and, like our Chinese Masters – they are able to make those numbers dance when they want to and, believe me, they REALLY WANT TO this Q as two down quarters in a row = the "R" word.

So we'll see if the GDP can get the rally back on track and, if not, it will be up to the Fed this afternoon (2pm) to pump up the jam and get the party going again with their statement. It's very possible the Fed timed their announcement on the afternoon of the GDP release BECAUSE they know they'll have to make a save in the afternoon. Also, it's no coincidence that Treasury is pushing $44Bn of 2-year and 7-year notes between GDP and the Fed – just in time to get a good price on those rates!

We gave you the SQQQ trade last Friday, that's a really nice market hedge and easily available at a net $400 credit or better to buy $20,000 worth of upside protection.

We gave you the SQQQ trade last Friday, that's a really nice market hedge and easily available at a net $400 credit or better to buy $20,000 worth of upside protection.

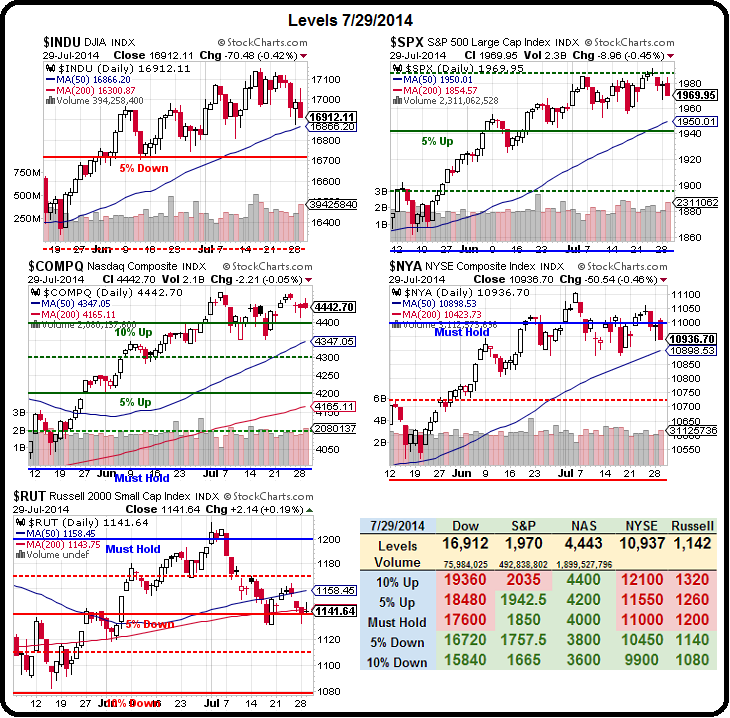

We are already "Cashy and Cautious" in our Member Portfolios but still leaning bullish in our positions although that will change quickly if one of the major indexes joins the Russell (our old main hedge) below the 50 DMA line.

On July 8th, our play (right in the morning post, which you can have Emailed to you every morning by subscribing here) was to add TZA Aug $14 calls at 0.66. TZA has since shot up to $15.69 and those calls are now $1.67, which is a very nice 153% gain on a 4% drop in the Russell – THAT is how you hedge!

In our Live Member Chat Room on July 3rd, when the Russell was spiking higher, our trade ideas to cover a large portfolio with TZA (ultra-short Russell ETF) was to sell 100 TZA 2016 $12 puts for $3 ($30,000 credit) and use that money to buy 100 2016 $13/20 bull call spreads for $1.20 ($12,000) for a net $18,000 credit. As of yesterday's close, on a 5% drop we predicted in the Russell from that high of 1,200 – the spread is now 0.30 or + $3,000 for a $21,000 gain so far.

In our Live Member Chat Room on July 3rd, when the Russell was spiking higher, our trade ideas to cover a large portfolio with TZA (ultra-short Russell ETF) was to sell 100 TZA 2016 $12 puts for $3 ($30,000 credit) and use that money to buy 100 2016 $13/20 bull call spreads for $1.20 ($12,000) for a net $18,000 credit. As of yesterday's close, on a 5% drop we predicted in the Russell from that high of 1,200 – the spread is now 0.30 or + $3,000 for a $21,000 gain so far.

That's enough to protect a $500,000 porfolio from a 5% correction and there is still plenty of upside should we head lower. I don't point these out to brag (you can reveiw all of our past trades anytime right here), I do it so that, when I tell you about the opportunity in SQQQ, you can see how a similar trade recently worked.

Of course we already flipped BULLISH on the Russell (with Futures trades) at the 1,130 line and now we're looking to see if they can retake 1,145 and prove it's more than a bounce. As I said, that 200-day moving average MUST HOLD and no one is going to be too impressed until the Russell is over the 50 DMA at 1,158. If GDP is a miss, however, none of that is likely to happen and down we go again.

8:30 Update: WOW! So much for adding a hedge. Q2 GDP is up 4.1%, not 2.9% – an amazing flip-flop that defies all logic. They also revised the 1st quarter to "only" be down 2.1% as well as revising prior years, to now give us the appearance of steady growth.

8:30 Update: WOW! So much for adding a hedge. Q2 GDP is up 4.1%, not 2.9% – an amazing flip-flop that defies all logic. They also revised the 1st quarter to "only" be down 2.1% as well as revising prior years, to now give us the appearance of steady growth.

We are going to ignore the fact that -2.1% + 4.1% averages to 1% and pretend (in order to be like the masses) that it's all about the one 4.1% gain since -2.1% was so 3 months ago. As we thought, increasing inventories added 1.66% to the GDP, giving us the huge beat. That means we can go long on those /TF (Russell) Futures over the 1,145 line and also /YM (Dow) Futures over 15,700 to tilt more bullish pre-market.

This is why we take our profits after 5% moves in our indexes and look for fresh horse to ride for the next leg. The new SQQQ trade will take far less damage than the old TZA trade would have on this move.

Now the worry shifts back to the Fed because 4% growth is now "too hot" and the Fed wants a Goldilocks number around 3.5% so now it is possible that the move forward their timing on rate increases to cool off the rising economy before the inflation monster comes out of the cave.

Now the worry shifts back to the Fed because 4% growth is now "too hot" and the Fed wants a Goldilocks number around 3.5% so now it is possible that the move forward their timing on rate increases to cool off the rising economy before the inflation monster comes out of the cave.

We are going to take advantage of this rally to add a few hedges ahead of the Fed this afternoon. We had a nice short yesterday on the Nikkei off the 15,700 line in our Live Trading Webinar that netted $350 per contract in the afternoon and today we should get a crack at the 15,750 line (/NKD) for another nice short opportunity. Japan had HORRIFIC Industrial Output numbers this morning – down 3.3% on a slump in consumer spending – only the strong Dollar and GDP expectations kept them up overnight – now it's time to "sell on the news."

So enjoy this little rally while it lasts – I very much doubt it will take us to new highs and, if not, then it's just a pause in the larger correction but we are going to watch our levels and not get too bearish because it seems there's always somehting to prop these markets back up – for now.