Iraq, Ukraine, Ebola…

Iraq, Ukraine, Ebola…

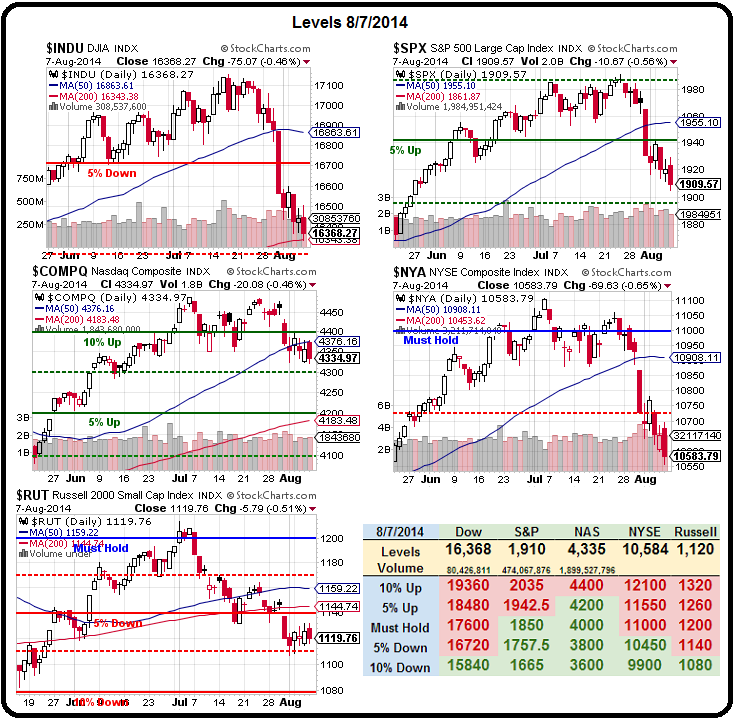

PLENTY of things to worry about and we've ONLY corrected 10 points (7.5%) on the Russell – exactly what we predicted under our fabulous 5% Rule™! None of the other major indexes have fallen as far, so we continue to watch that line very closely for support.

This morning we played the S&P (/ES Futures) bullish in our Live Member Chat Room (you can join us here) off the 1,900 line and were rewarded with a quick 10-point gain (+$500 per contract) already (7:45) as our assessment of the Global situation (that it's not all that bad) seems to be playing out with Russia making a few conciliatory noises over in Ukraine though, of course, any good game of brinksmanship involves a bit of give and take – so it ain't over until it's over.

As you can see from our Big Chart, we're still down 3 of 5 Must Hold lines and, when the Must Hold lines don't hold – we stay bearish! Not too bearish, mind you, we've pretty much shifted to neutral in our Member Portfolios and our Long-Term Portfolio closed the day at $587,490 (up 17.5% for the year) while our Short-Term Porfolio finished at $132,314 (up 32.3% for the year) for a combined $720K up $1,000 for the week and down $4K on the day as we added more BULLISH positions (bottom fishing) into the weekend.

We'll quickly abandon our hopes for a bounce if the Dow fails to hold it's 200 dma at 16,343 and we're keeping an eye on the Transports, where IYT is testing it's 100 dma at 142, which Scott Murray's chart shows us has held firm for two years now.

We'll quickly abandon our hopes for a bounce if the Dow fails to hold it's 200 dma at 16,343 and we're keeping an eye on the Transports, where IYT is testing it's 100 dma at 142, which Scott Murray's chart shows us has held firm for two years now.

Having well-balanced portfolios let's us quickly pivot to take advantage of changing conditions and this is an inflection point, so we have bullish and bearish trades ready to trigger – depending on how these lines play out.

While we're waiting, we have tons of fun with our Futures Trading. In yesterday's moring post, I mentioned that we were going short on /TF (Russell Futures) at 1,130 and those contracts dropped all the way to 1,105 this morning (+$2,500 per contract) before finally turning back up, where we called longs on our Futures at 6:45. My comment to our Members in our Live Chat Room at 9:05 (after taking our first, quick profits on a /TF dip) were:

Futures in a good spot to go bearish but not sure bearish is going to work today: /YM 16,425, /ES 1,920, /NQ 3,875 and /TF 1,128. I think if /TF tests 1,130 I'd like the short as long as /ES is under 1,920 and /YM under 16,450 and /NQ under 3,875 otherwise, it's short the laggard if 3 of 4 below those lines.

Of course, all the short ideas paid well and the Futures are an excellent tool to make quick adjustments to otherwise-balanced portfolios, but can be very dangerous if used incorrectly! We also took advantage of TSLA's silly run to $255 to sell the Sept $260s for $11.75 to over-excited Musk fans. Those calls finished the day at $9.85 up a quick 16% in 5 hours, but not a day trade. We also took an earnings spread on SCTY and we'll see how this one plays out:

SCTY hanging on to great expectations at $76 and we can sell 5 Sept $77.50 calls for $6.50 ($3,250) against 5 Jan $80/95 bull call spreads at $4.55 ($2,275) for a $975 credit in the STP.

Ideally, we would have liked SCTY to get a worse reaction to doubling their losses than being up 3% but Musk is the kind of the Conference Call and we will have to ride out the nonsense as the stock tests our $77.50 short target.

During Live Member Chat yesterday, we also found a bullish trade on WAG ($60), bearish on GMCR at $120, bearish on TLSA at $255 (above), bullish on NLY at $11.40, bearish on SCTY (above) and our last trade of the day was bullish on SSO (ultra-long S&P).

During Live Member Chat yesterday, we also found a bullish trade on WAG ($60), bearish on GMCR at $120, bearish on TLSA at $255 (above), bullish on NLY at $11.40, bearish on SCTY (above) and our last trade of the day was bullish on SSO (ultra-long S&P).

As you can see from Doug Short's SPY chart, we're not doing anything complicated, just playing for the bounce and shorting stocks we don't like and bottom-fishing the stocks we do. Our trades are still leaning mixed as we're not sure if those lines are going to hold, but our LTP is still full of bullish trades and the fact we haven't cashed them yet tells you we're still very hopeful that this correction will be a mild one.

We're still at the top of a massive rally that saw us test a 200% run from our 666 low in March 2009. 1,332 points of upside NEEDS a 20% correction for it to be healthy. That would take us from 1,998 back to 1,732 – around where we consolidated last Fall before breaking higher. When the S&P ran it's first 100% from 666, to 1,332 in 2011, we corrected back 20% of that 666 run (133) back to 1,200 (after spiking down to 1,100), which was also our predicted line per the larger 5% Rule™.

Our new "Must Hold" line on the Big Chart for the S&P is 1,850 and it REALLY must hold or that 1,732 drop will come into play but, at the moment, we're comfortably in between 1,850 and the +5% line at 1,942.50, so playing the middle is an excellent strategy while the market digests the current risk climate.

Have a great weekend,

– Phil