Remember this?

Remember this?

Sure you do, this was Friday's intra-day chart of SPY, the ETF that tracks the performance of the S&P 500. It's pretty similar to what happened every day last week, with a high-volume (relatively) sell-off followed by a recovery on almost no volume into the close, giving us the impression that the markets are flat.

Only Friday was a bit different. On Friday, the market manipulators were so desperate to close the week on a high note and so greedy, that they also got sloppy and now we have some very clear evidence of what complete and utter BULLSHIT this market is:

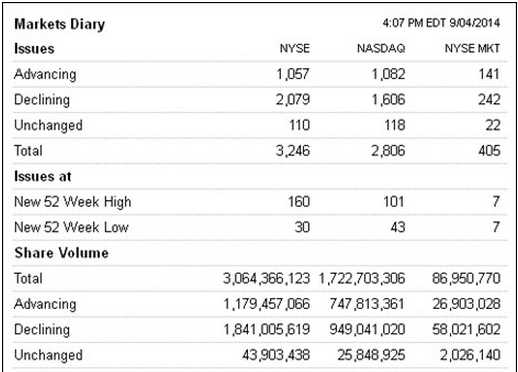

What do we see here? Despite a 0.45% rise in the S&P and a 0.39% rise in the NYSE, 0.4% in the Dow, 0.45% in the Nasdaq and 0.25% rise in the Russell, the FACT is that there were FAR MORE shares DECLINING than there were advancing. In fact, on the NYSE MKT (what used to be called the AMEX), declining volume outpaced advancing volume by 115%. 115%! Yet we get a 0.4% RISE in the index?

On the NYSE itself, 2,079 stocks declined while only 1,057 (33%) of the stocks advanced and there was 56% more volume to the declining shares than the advancing shares yet, MIRACULOUSLY, 160 NYSE stocks made new 52-week (and, often, all-time) highs while just 30 made 52-week lows. That's 84% positive! Isn't that amazing? Isn't that UNBELIEVABLE???

It is unbelievable, as in – something that should not be believed by intelligent people. When you see a magician on stage sawing a woman in half or levitating – you might be amazed at what a good trick it is but you don't start believing in magic, do you? What if that magician asks you to bet your retirement on the fact that he is really levitating people or that his assistant can medically be cut into pieces and reassembled?

It is unbelievable, as in – something that should not be believed by intelligent people. When you see a magician on stage sawing a woman in half or levitating – you might be amazed at what a good trick it is but you don't start believing in magic, do you? What if that magician asks you to bet your retirement on the fact that he is really levitating people or that his assistant can medically be cut into pieces and reassembled?

You wouldn't risk your money on such obvious fakery, would you? You wouldn't give your hard-earned money to a person whose job it was to deceive you, would you? THEN WHY ARE YOU PUTTING YOUR MONEY INTO THIS FARCE OF A MARKET? The action on Friday wouldn't even constitute a "good" magic show: Boo, hisss – we can see the wires! The fakery is so obvious a child would question those numbers vs the illusion of the chart that the magicians produce. Yet people are literally betting their life savings on this ridiculous fakery. Crazy, isn't it?

By manipulating a few key, popular stocks that are overweight in the indexes (indexes the same manipulators designed and control) and pushing them to new all-time highs, the market manipulators are able to lead investors around by the nose. As noted in Edwin Lefevre's no-longer published "Reminiscences of a Stock Operator":

By manipulating a few key, popular stocks that are overweight in the indexes (indexes the same manipulators designed and control) and pushing them to new all-time highs, the market manipulators are able to lead investors around by the nose. As noted in Edwin Lefevre's no-longer published "Reminiscences of a Stock Operator":

"Manipulation consists in leading the stock market horse, otherwise known as the public – to water, and making him drink; or, as the case might be, in making the public believe the securities it holds are worthless or about to sell on that basis.

Most of the time, manipulation was used to advertise a certain stock by creating an illusion of deep trading interest through action on the ticker machine. Such action piqued the interest of the gambling, bucket-shop types who shunned statistics and earnings trends for the latest hot tip.

It allowed insiders to distribute their holdings.

When a man sees a stock going up, up! UP! something goes to the very soul of the greed-stricken man, who visioning to himself a dazzling money-happiness, reaches out quivering fingers, clutches eagerly in the air for the fortune within his grasp… Men do not read the papers with their very soul; and that is the only way they reach the ticker. The mirage is so real! They buy and later, they curse the manipulator who deceived them."

We accept a little manipulation in the markets as a usual cost of doing business but Friday's action illustrates how blatant it has now become. Lack of enforcement by the regulators coupled with ENCOURAGEMENT by our own Central Bank has led to a completely out of control market that has risen 200% in 5 years and is STILL being cheered on by a Mainstream Media that is owned by the very same people who manipulate the markets in the first place.

We accept a little manipulation in the markets as a usual cost of doing business but Friday's action illustrates how blatant it has now become. Lack of enforcement by the regulators coupled with ENCOURAGEMENT by our own Central Bank has led to a completely out of control market that has risen 200% in 5 years and is STILL being cheered on by a Mainstream Media that is owned by the very same people who manipulate the markets in the first place.

It's a never-ending feedback loop. Well, never-ending until it all blows up in our face in a "black swan" event that the MSM will convince you that no one could have seen coming. Well, we see it coming and we flipped our Short-Term Portfolio more bearish on Friday because we can clearly see the way shares are, in fact, being distributed by insiders while, at the same time, their media lackeys chase the retail shareholders into the markets to hold the bag.

It's almost like a cattle drive to push small investors into the market. Inflation and a weak Dollar is eating into their buying power and salaries aren't keeping up and the banks don't pay any interest to save the money and housing isn't an attractive investment anymore and bonds don't keep up with inflation either. It's like sealing off all the exits and driving the cattle into the pass, isn't it?

It's almost like a cattle drive to push small investors into the market. Inflation and a weak Dollar is eating into their buying power and salaries aren't keeping up and the banks don't pay any interest to save the money and housing isn't an attractive investment anymore and bonds don't keep up with inflation either. It's like sealing off all the exits and driving the cattle into the pass, isn't it?

The fact that the actual state of the World Economy is bad and getting worse is simply one of those "inconvenient truths" that the media has already practiced getting you to ignore so their Corporate Masters can continue plundering and pillaging without criticism.

You might think that Central Bank policies that accelerate the decline in Global GDP would be called to task but, instead, they are cheered on by the press – mostly because the press is owned by the kind of people (a few Billionaires) who benefit from the current Central Bank policies and not by the Billions of poor schlubs whose standards of living depend on that GDP number.

You might think that Central Bank policies that accelerate the decline in Global GDP would be called to task but, instead, they are cheered on by the press – mostly because the press is owned by the kind of people (a few Billionaires) who benefit from the current Central Bank policies and not by the Billions of poor schlubs whose standards of living depend on that GDP number.

Like frogs in slowly boiling water, people don't even know there's a problem until it's far too late to do anything about it but, if this house of cards gets too high and things begin to collapse – you will feel a lot more like a frog in a blender – there may not be time to save yourself from that!

Be careful out there,

– Phil