We're back in business baby!

We're back in business baby!

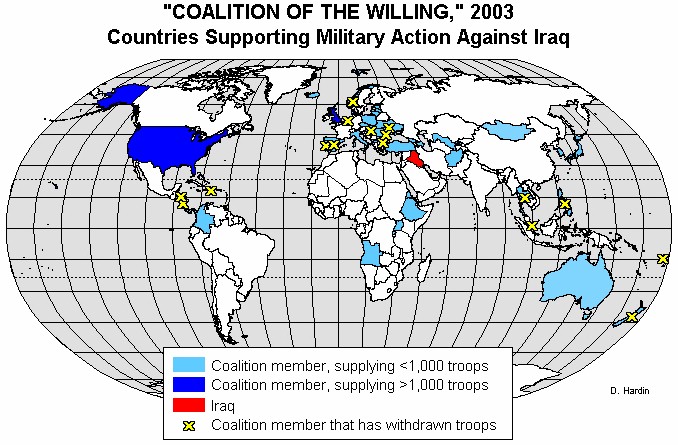

It's been 12 years since GW Bush first assembled the "Coalition of the Willing" in November of 2002 (a full year after we were attacked by 15 Saudi hijackers), to go after Osama Bin Laden, (who was hiding in Afghanistan) by attacking Iraq. Interestingly, Bush only stole that phrase from Bill Clinton (what, you thought Bush had an original thought?), who first mentioned it in a 1994 interview.

Now, in 2014, we're ready to go back to war – in Iraq (did we ever really leave?) – with another coalition of the willing staring most of the same players but this time, we have Germany on our side – so you know we're serious. According to the WSJ, they've already spotted a training camp for Syrian rebels in Saudi Arabia and – oops, wait – that's being run by us – WE'RE arming and training Syrian rebels – what can go wrong?

Well, as they say, politics make strange Bedouin fellows and I guess we'll ignore the fact that the current ISIS rebels were the same people we armed and trained to fight Saddam 12 years ago. While we're training and arming Syrians in Saudi Arabia, we'll be bombing their country as well. Again, this is pretty much how we handled Iraq but hey – at least we're consistent!

At PSW, we're consistent too. While we love war as much as any other red-blooded Americans, we question this one as well – even when there's a Democrat in charge. It's funny because, just the other day, I suggested that Congress, rather than rejecting the call for $40M to help combat Eblola (as they just did), could have scraped together that money by simply firing one less $1M Tomahawk missile each week. I was wrong, and I apologize – it turns out they cost $1.41M each.

This is, of course, great news for RTN, whose stock has already run up 13% in the past 30 days as the fear of peace flushes out of the stock price. If you want to bet on this war not ending quickly, we have thousands of additional $1.4M missiles to fire and RTN usually sells about $23Bn worth of goodies each year but it's a way better gig than HPQ because, when HPQ sells you a printer, you don't hurl it at your enemies and blow it up!

Obama promises a "steady, relentless effort" and that means steady, relentless profits for RTN and we can cash in on this one by selling the 2016 $80 puts for $3.25 and buying the 2016 $100/115 bull call spread for $5.20 for net $1.95 on the $15 spread (669% upside potential). Isn't war great?!?

War profiteering is, of course, as American as Haliburtun selling apple pies to our troops for $5 a slice and we'll be looking over the usual list of suspects but the real winners and losers will be determined in November, when companies like HAL (who donate 95% to Republicans) will be rewared or punished – depending on who's in power come January.

War profiteering is, of course, as American as Haliburtun selling apple pies to our troops for $5 a slice and we'll be looking over the usual list of suspects but the real winners and losers will be determined in November, when companies like HAL (who donate 95% to Republicans) will be rewared or punished – depending on who's in power come January.

I like RTN because we love our long-range weapons and GE usually does well, no matter who wins. We'll look at some of the other players but mainly, we're still concerned about a market pullback and yesterday we doubled down on shorting the Dow with the DXD October $25 calls at 0.50 to hedge our portfolio against a breakdown below 17,000 that seems kind of inevitable to us.

It's a real shame that, on the 13th anniversary of the September 11th attacks, we are once again preparing for war in the Middle East. ISIS is exactly the kind of enemy we were worried about in 2001 – an enemy without a country yet we are fighting them the same way we always do. Why don't we just curtail arms sales so they run out of weapons, rather than send more over and train new people to use them?

It's a real shame that, on the 13th anniversary of the September 11th attacks, we are once again preparing for war in the Middle East. ISIS is exactly the kind of enemy we were worried about in 2001 – an enemy without a country yet we are fighting them the same way we always do. Why don't we just curtail arms sales so they run out of weapons, rather than send more over and train new people to use them?

Why indeed?