View Single Comment

-

Phil

October 2nd, 2014 at 6:27 amHoly Crap did we miss some fun!

I went back to sleep at 3 as I wanted to be wide awake for Draghi this morning and I missed oil COLLAPSING to $88.18!

That's why A) We take our stops VERY seriously and B) We don't go to sleep with an open oil trade!

Tempting at $88.50 looks , there's no real support there – the real support was $89 and that failed already. This is all about the combination of oversupply and lack of demand as we head into the low-consumption fall and warmer weather is keeping heating demand off the table too and now Ebola has people thinking travel will be curtailed further.

Or, essentially, what I said last Wednesday:

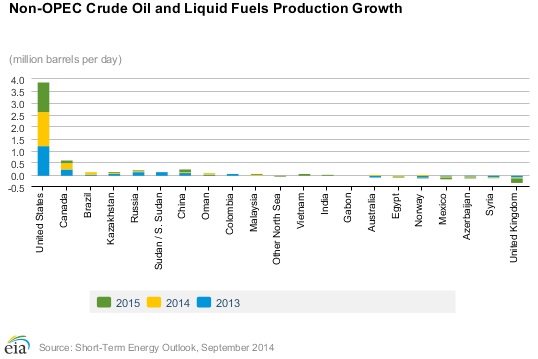

So both OPEC and Non-OPEC producers can either gamble that cutting their production by 10% will lead to a 10% rise in prices and get them even eventually or they can just pump 10% more oil and get even with projections now. This is how commodity markets often crash themselves. The US alone is projected to produce 1.25Mb/day more than this year in 2015 and this year was 1.5Mb/day more than last year and last year was 1.25Mb/day more than 2012 – and we're not the only country ramping up production:

So I still think oil will bottom out this winter at $85 and that will finally shut enough production to lead to a rally back in the spring. In between, I predict we will go up and down.

Meanwhile, I do like shorting /CL below the $93 line but tight stops over now that it's back to it.

As you can see there's "only" 600,000 open barrels in the front 3 months, less than the 700K last month so, we can assume, less downside pressure. Without negative news, they should be able to give it a lift on almost any excuse – so best to wait for them to make a play. As we're now in the bottom of the big channel ($105-85) it's harder and harder to make short bets but, until we test $85 – I'm not too keen on making long ones either!

Oil/Pwright – Those are all factors but they are also merely indications of expectations of the average trader, don't read too much into it. We make our best money betting against the trend but, unfortunately, you can't come up with little crib notes for Fundamentals – so hardly anyone is interested in doing the homework that we do here at PSW. Right now, I'm waiting for a bottom to go long – I'd like to see $85 but I'm also going to wait patiently to see where a new channel forms rather than jump in and guess. As our first stab on being bullish on oil, we picked RIG – so far, so bad on that one! If that's not working – why would I want to play oil at all?

Or July 2013, for that matter!

So anyway, now we are so near our $85 goal on oil but you have to be very careful with commodities as they unwind because people get caught with margin calls and such and are forced to unwind – especially something as widely held as oil. Don't forget, almost ALL of these open orders on the NYMEX are FAKE, not only don't these traders actually want to own these barrels but it's physically impossible for them to take delivery as the capacity at Cushing, OK is only 50Mb and it's almost full already.

Click for

ChartCurrent Session Prior Day Opt's Open High Low Last Time Set Chg Vol Set Op Int Nov'14 90.74 91.00 88.18 88.70 06:11

Oct 02

–

-2.03 48026 90.73 260981 Call Put Dec'14 89.81 89.96 87.22 87.73 06:11

Oct 02

–

-2.01 13460 89.74 245862 Call Put Jan'15 89.08 89.23 86.57 87.06 06:11

Oct 02

–

-2.05 6740 89.11 95252 Call Put Feb'15 88.67 88.75 86.17 86.54 06:11

Oct 02

–

-2.12 2664 88.66 47089 Call Put NYMEX traders have violated one of our trading rules – they sold puts in something they don't REALLY want to own if the price drops!

So, let's be careful playing oil Futures here as we could get more downside pain BUT $88.50 is 2.5% down from $91 so it SHOULD be bouncy back to $99 (weak) and $99.50, so that's worth a long trade but NOT A PENNY UNDER $88.50.

Once the market opens, we'll look at maybe an ETF play long on oil.