Wheeeeeee – isn't this fun?

Wheeeeeee – isn't this fun?

We're certainly having a good time and, if you've been following our posts and getting our trade ideas – you probably are too as yesterday's DXD trade idea, for example, made 100% in a day for the 2nd time this week!

Now let's say you put just 2% of your portfolio into a hedge like that against a worry that we'd have a 5% drop. Well, on Tuesday we collected 100% of that 2% on a 2.5% drop and yesterday we collected another 100% of 2% on another 2.5% drop – there's 4% back and we never even fell 5%. This is how you hedge and hedging is what we teach you to do at PSW (sorry, Memberships now full, try the wait list for next month).

Of course, if you find yourself on the wrong side of the market, the Futures also make excellent hedges and it just so happens that we teach that as well! We did a Futures Webinar just this Wednesday and you can watch us make money live on the replay.

Of course, if you find yourself on the wrong side of the market, the Futures also make excellent hedges and it just so happens that we teach that as well! We did a Futures Webinar just this Wednesday and you can watch us make money live on the replay.

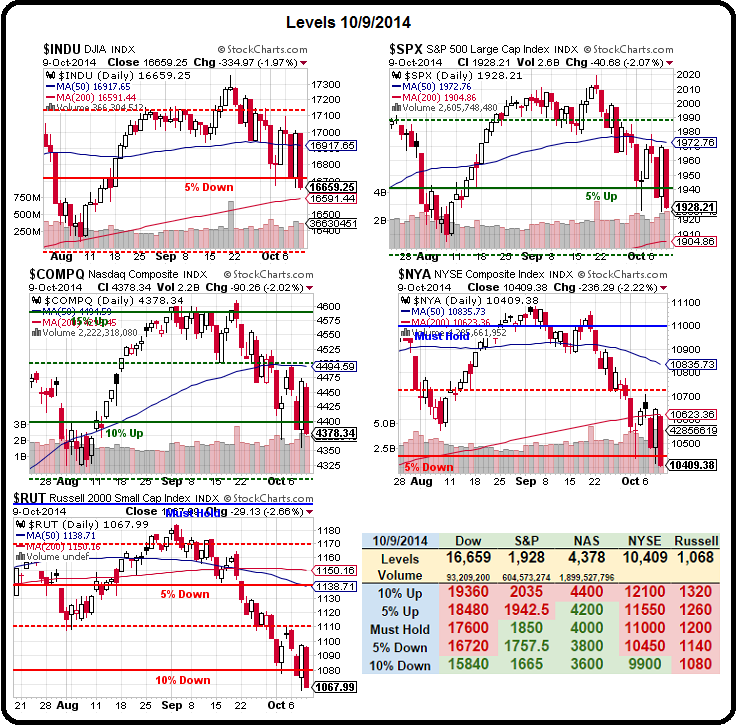

Those are the hedging strategies that led us to call for shorts yesterday (right in the morning post) at 1,100 on /TF (Russell Futures), 4,040 on /NQ (Nasdaq Futures), 1,965 on /ES (S&P Futures) and 16,900 on /YM (Dow Futures). Aside from the Alert we sent to our Members, we also Tweeted out and Facebooked? the trade ideas – THAT'S HOW SURE WE WERE! If you followed those, we closed the day at:

.jpg)

- Dow (/YM) 16,550: down 350 points at $5 per point – Gain of $1,750 per contract

- S&P (/ES) 1,918: down 47 ponts at $50 per point – Gain of $2,350 per contract

- Nasdaq (/NQ) 3,950: down 90 points at $20 per point – Gain of $1,800 per contract

- Russell (/TF) 1,060: down 40 points at $100 per point – Gain of $4,000 per contract

The margin requirements for the Futures trades are roughly $4,000 per contract so we're talking net gains of roughly 50-100% IN A SINGLE DAY on our hedges. It's a very simple process – we send out an alert pre-market and we have a Live Member Chat Room where we discuss these and other trade all day long as the market progresses – this allows us to adapt to changing market conditions very quickly.

There are not the vague, empty promises you get from other Newsletter services – this is our LIVE performance! We gave you the trade idea yesterday, for free – no credit card, no firewall, no nothing – and now we're discussing the results. Usually we don't give out free trades in October but, this being a crisis and all – we felt it was a valuable public service (plus it sold a lot of new Memberships to people who realized these are JUST the free ideas!).

There are not the vague, empty promises you get from other Newsletter services – this is our LIVE performance! We gave you the trade idea yesterday, for free – no credit card, no firewall, no nothing – and now we're discussing the results. Usually we don't give out free trades in October but, this being a crisis and all – we felt it was a valuable public service (plus it sold a lot of new Memberships to people who realized these are JUST the free ideas!).

Of course, our whole Short-Term Portfolio is a hedge for our 2 Long-Term Portfolios, so we are very happy campers as we closed the day up 63%. Of course our Income Portfolio and Long-Term Portfolio (one is Conservative and one is Aggressive) both lost some money, but, as we discussed extensively in Member Chat this morning (very good discussion on Portfolio Management Techniques as well as Crash Management, Following the Crowd and Valuation Studies in a Down Market), we are more than happy to use the short-term cash gains to add to our long-term positions.

And what do we do when we add more long-term positions? We buy more short-term hedges! See how easy this concept is? At the moment though, we're playing for a bounce but we're not expecting too much as those 200 dmas are starting to act like magnets for our indexes.

And what do we do when we add more long-term positions? We buy more short-term hedges! See how easy this concept is? At the moment though, we're playing for a bounce but we're not expecting too much as those 200 dmas are starting to act like magnets for our indexes.

That's fine, as this is the 5-10% correction we had been waiting for. In fact, just over a week ago, in our Live Member Chat room at 9:41am – I said:

Dow 17,350 to 16,800 is 550 = 3.17%. That could be 2.5% with a 0.5% overshoot or it could be (since we finished at the low) a fairly good indicator that we'll be completing the 5% drop to 16,500.

As you can see from Dave Fry's Dow chart, that was a pretty good call, as were our EWJ Oct $12 puts at 0.20 (from last Tuesday's post) that are now 0.85 – up 350% in 10 days – yet another nice hedge that was given away for free. We really don't mind giving away free trade ideas because – unlike other market newsletters – we have hundreds of them.

As you can see from Dave Fry's Dow chart, that was a pretty good call, as were our EWJ Oct $12 puts at 0.20 (from last Tuesday's post) that are now 0.85 – up 350% in 10 days – yet another nice hedge that was given away for free. We really don't mind giving away free trade ideas because – unlike other market newsletters – we have hundreds of them.

In that same post we called gold (/YG) long at 1,200 (now $1,221 and up $750 per contract) and silver long at $17.15 (now $17.30 and up $750 per contract too) and GDX has now completed the down pattern we were following that day so we'll be pulling the trigger on some miners back in our Live Member Chat Room today and next week.

Yesterday we flipped long into the close with a very aggressive TNA bull call spread into next week's expiration. It was the October $58/60.50 bull call spread, which filled at 0.95 and finished a bit lower with TNA at $57.50 into the close but we needed a long for our Short-Term Portfolio, as well as our $25,000 Portfolio.

This morning, in Member Chat, we went long on /TF (Russell Futures) at 1,057 – just in case the Fed speak isn't as bearish as we thought it would be. We're not enthusiastic about it and we do expect to complete our down move to 16,500, etc but we're already very bearish, so we like to have a little balance. So far so good at 1,062 but we'll stop out at 1,060 if it fails with a 2-point trailing stop ($100 per point, per contract).

This morning, in Member Chat, we went long on /TF (Russell Futures) at 1,057 – just in case the Fed speak isn't as bearish as we thought it would be. We're not enthusiastic about it and we do expect to complete our down move to 16,500, etc but we're already very bearish, so we like to have a little balance. So far so good at 1,062 but we'll stop out at 1,060 if it fails with a 2-point trailing stop ($100 per point, per contract).

No matter which way today goes, we intend to keep a bearish stance into the weekend. In fact, like Wednesday, when we shorted the open – the higher the market goes today the more we'll see it as a chance to beef up our shorts. Still, I think it's more likely the relentless Fed hawks will give us the nice, blow-off bottom we've been waiting for – and then we can hit the Buy List!

Have a great weekend,

– Phil