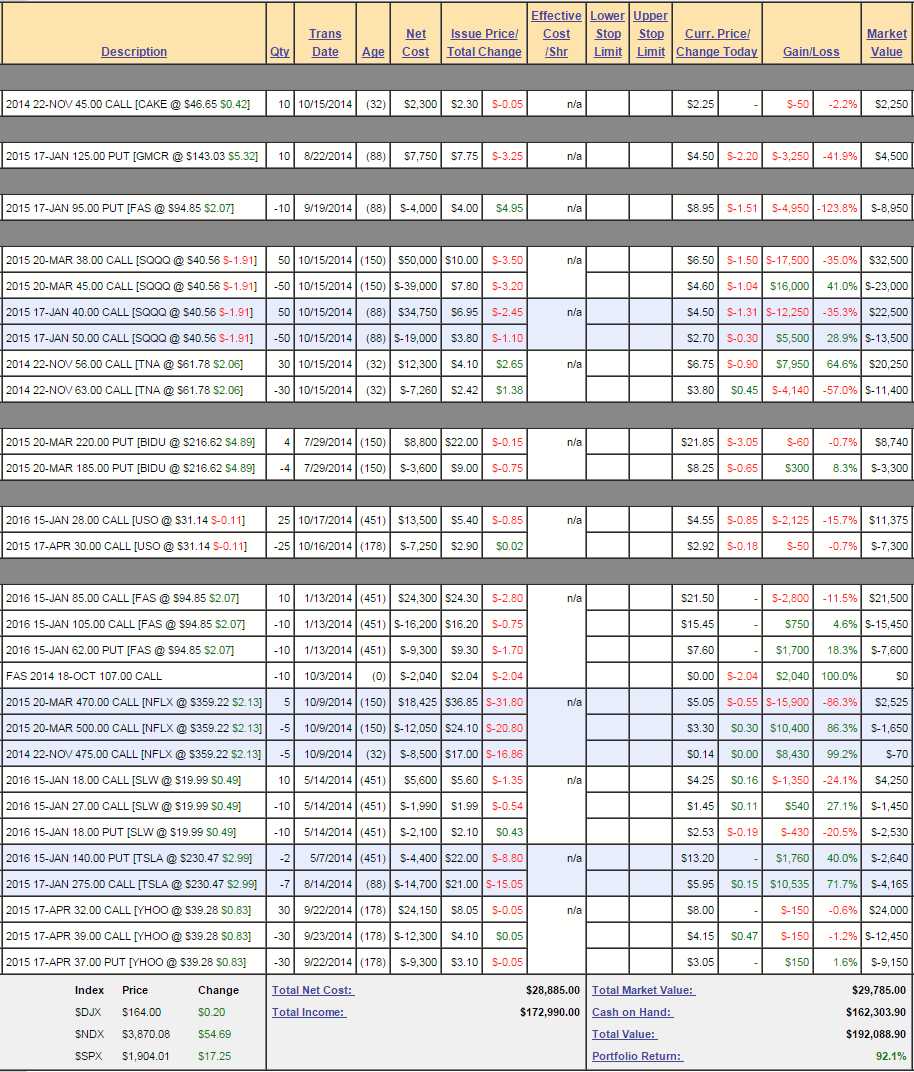

It LOOKS impressive, doesn't it?

It LOOKS impressive, doesn't it?

As I said to our Members this morning in our Live Chat Room, all is going according to plan, as we expected to see strong bounces in our indexes by Wednesday – no matter what news or earnings turned out to be. If the powers that be want the market to bounce – it bounces.

Our general rule of thumb is that dip buyers only learn their lesson after they have been burned 3 times and, so far, only the August dip buyers are being relly burned but a failure to retake that line and a move lower – that might get them to think twice about mounting another rescue effort next time we test 1,050 on the Russell.

On this next chart, you can see how the various Fed speakers were used at key inflection points to guide the markets exactly where they wanted them to go.

As you can see from this S&P chart with Fed notes attached, the manipulation we told you about on 10/6 (see: "Market Mayhem – 12 Fed Speeches in 5 Days Causes Chaos") is merely playing out according to plan and this is why we were able to take full advantage of both the dip (see: "Money-Making Monday: How to Profit from a Market Correction") and the bounce (see: "Wednesday Market Weakness – Oil Collapses to $80, Good or Bad?").

In fact, the TNA Oct $58/60.50 bull call spread that we pointed out last Wednesday at $1.12 closed on Friday morning at $2.40 – up a very nice 114% in 48 hours for those of you who get our morning newsletter (which you can subscribe to here). Our suggested roll to the Nov $56/63 bull call spread at $3 still has to play out but, so far, we're at $4, so up 33% in 4 trading days is "on track" towards our planned 133% gain in 30 more days.

This is how rich people get richer folks – if you are in the top 1%, the Fed is out there working for us – and they are going to make sure we can make nice, little leveraged bets like these to pull off some stunning returns in any kind of market conditions. That's why, on a Monday two weeks ago, I was able to tell you what the market was going to do for the next 10 sessions – it's all according to plan – "even when the plan is horrifying."

This is how rich people get richer folks – if you are in the top 1%, the Fed is out there working for us – and they are going to make sure we can make nice, little leveraged bets like these to pull off some stunning returns in any kind of market conditions. That's why, on a Monday two weeks ago, I was able to tell you what the market was going to do for the next 10 sessions – it's all according to plan – "even when the plan is horrifying."

Yesterday, we used our 5% Rule™ to plot the action ahead for the next few days, the bounces we're looking for are:

- Dow 16,466(weak) and 16,632 (strong).

- S&P 1,878 (weak) and 1,903 (strong).

- Nasdaq 4,280 (weak) and 4,360 (strong).

- NYSE 10,360 (weak) and 10,540 (strong).

- Russell 1,104 (weak) and 1,128 (strong).

At yesterday's close, we hit 1,903 on the nose on the S&P (turning it from red to black) and added a green on the Nasdaq but that was it – not a great start towards our strong bounce goals but the markets were held down by IBM's poor performance, which dragged down the Dow, S&P and NYSE so we remained bullish and we're still looking for those strong bounce lines by Wednesday.

At yesterday's close, we hit 1,903 on the nose on the S&P (turning it from red to black) and added a green on the Nasdaq but that was it – not a great start towards our strong bounce goals but the markets were held down by IBM's poor performance, which dragged down the Dow, S&P and NYSE so we remained bullish and we're still looking for those strong bounce lines by Wednesday.

Failing those bounce lines would be BAD!!! and we'll cross that bridge if we come to it but already we're not liking the way what we are seeing in the Futures as overnight selling was reversed on rumors (false) of more ECB stimulus. When they jam up the low-volume Futures ahead of the open – you know someone big is manipulating the tape so they can dump their shares on the retail schmucks.

As noted yesterday, our virtual Short-Term Portfolio has gone bearish again, in anticipation of failing those strong bounce lines and that TNA long we're working on can be dismantled by selling those Nov $56 calls, which would leave us agresssively short on the $63 calls – and that's how quickly we can flip our portfolio from slightly bearish to VERY bearish – even as we move our cash to the 90% level.

Cashing out those TNA Nov $56 calls at $9 (assuming RUT 1,100) will drop $27,000 on our cash pile and leave us aggressively bearish with our SQQQ spreads and the naked, short TNA Nov $63 calls, so it's not a decision we'll make lightly but that's our PLAN if it looks like we are topping out at 1,100 on the Russell.

We'll discuss this and other strategies today in the Live Member Chat Room as well as during our Live Trading Webinar at 1pm (EST) this afternoon.

Until then, be careful!