Courtesy of Declan.

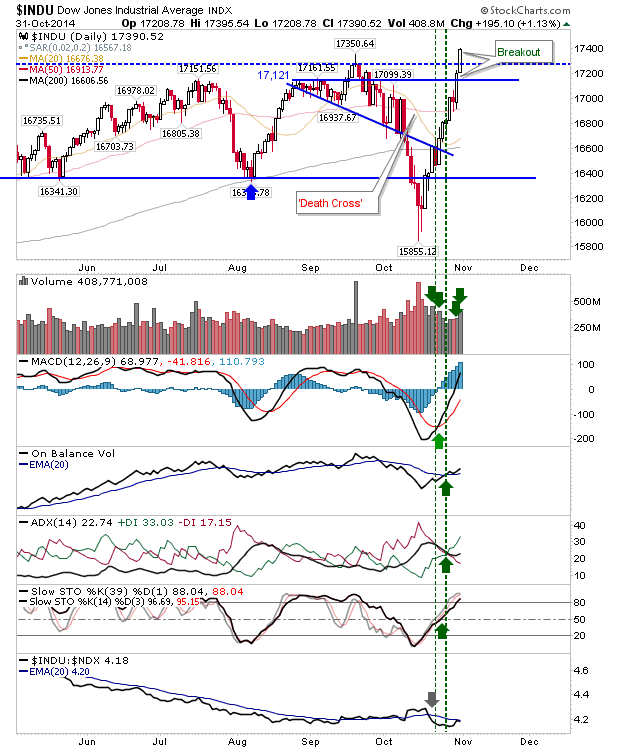

Another days’ gain, another set of breakouts in the bank. The Dow took out the September ‘bearish evening star’ with Friday’s close. At some point, this rally will have to confirm one of these levels as support, but for now, a new support level has been created.

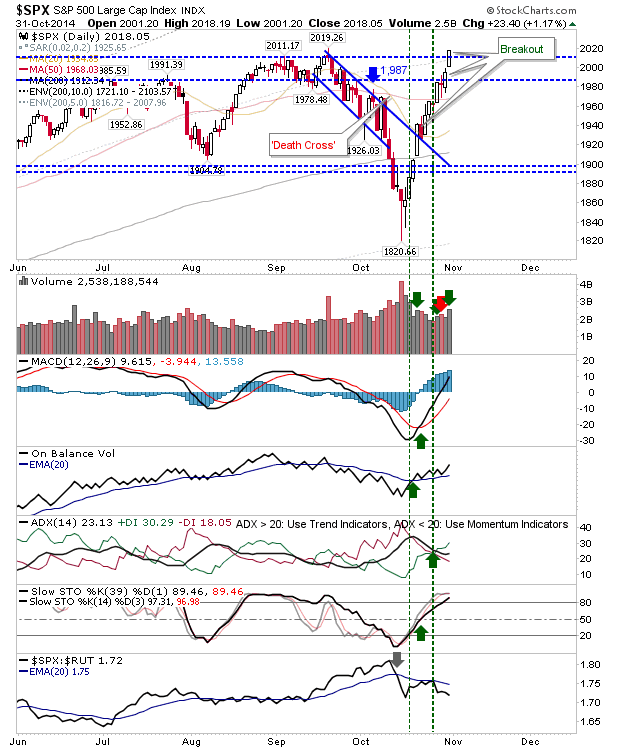

The S&P also broke to new highs on higher volume accumulation. It has gained almost 200 points (or 10%) since the October low; not exactly the best example of an efficient market! Remains to be seen how strong these buyers are on the next sell off, although the likelihood is that this low has substance to back it.

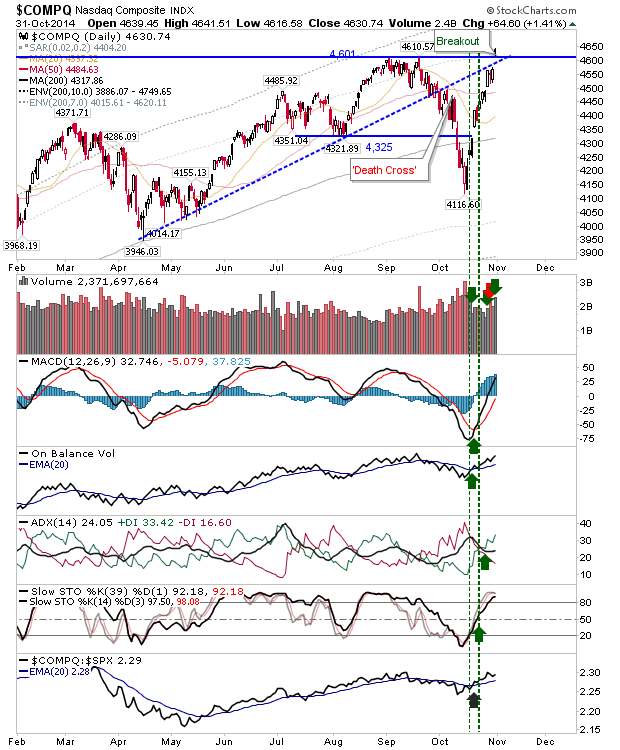

The Nasdaq was not to be left out, although it’s clear that the bulk of the gain was booked at market open, and little headway was made beyond that. However, it did negate whatever shorting opportunity was to be had at the former support line turned resistance.

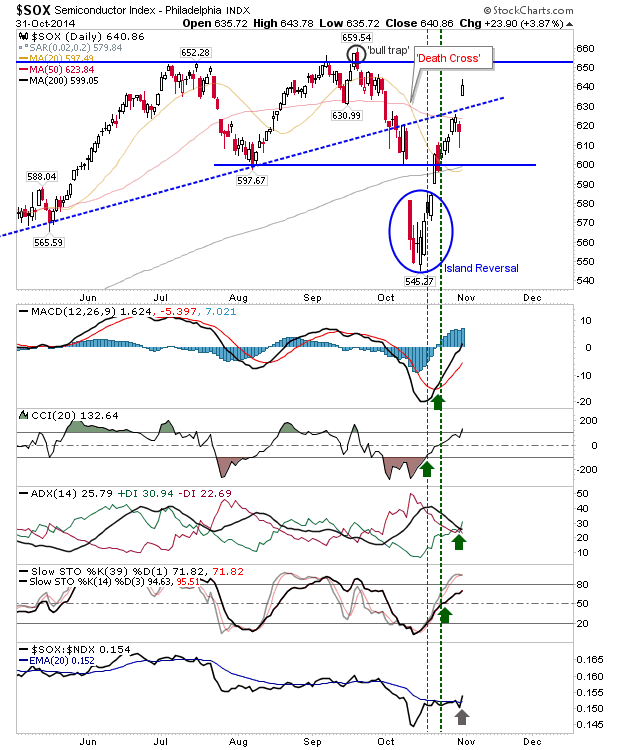

However, another index to come out well from this is the Semiconductor Index. It gapped through its earlier trendline, which shorts may have looked to attack, but will have to look elsewhere now.

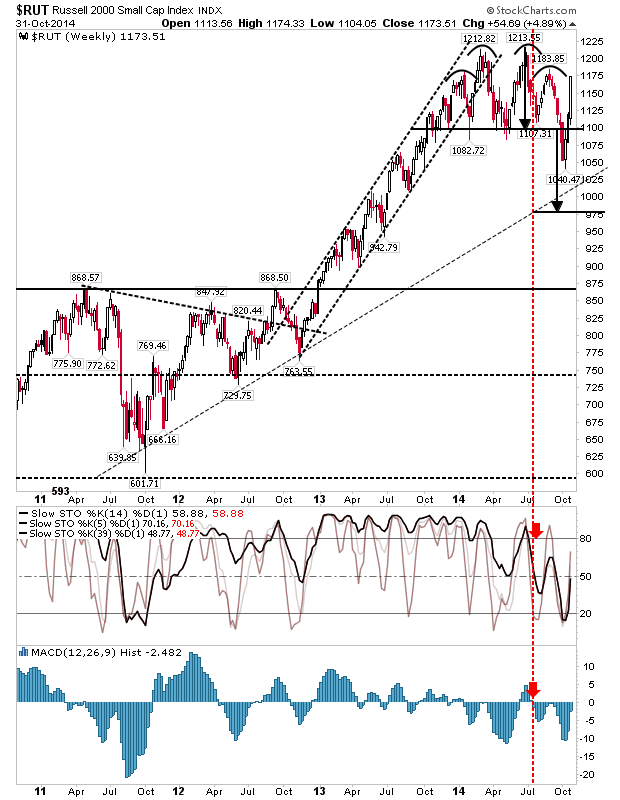

The Russell 2000 doesn’t look like it will be fulfilling the breakdown target from the head-and-shoulder pattern, although there is still work to do to break beyond 1,212.

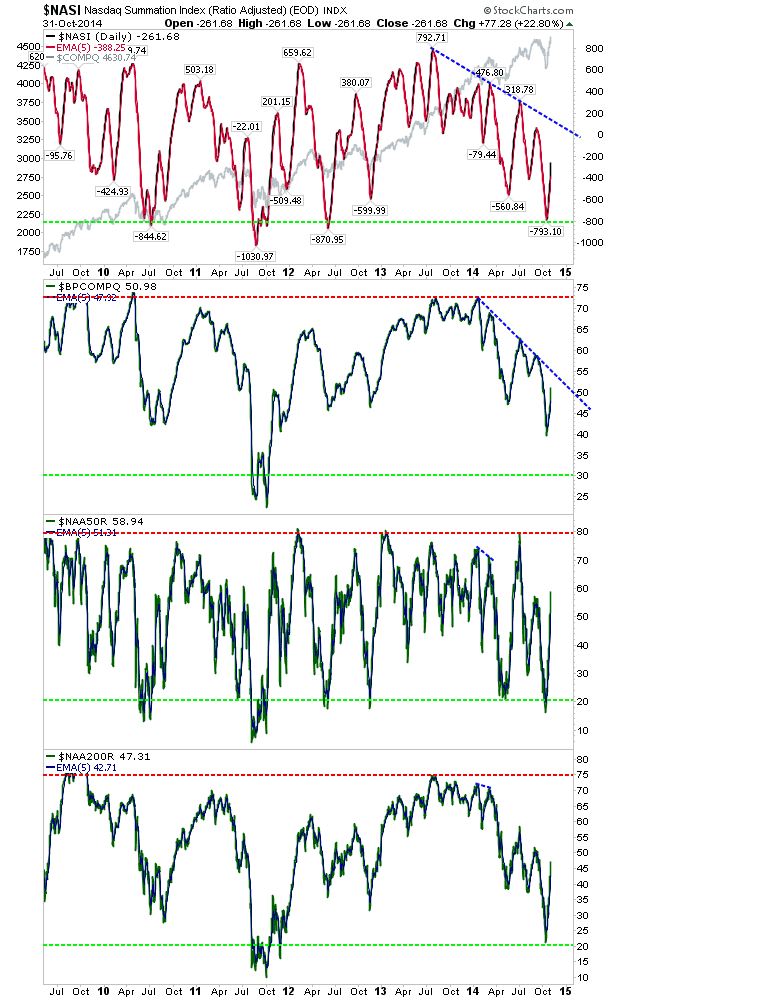

Nasdaq breadth continues its recovery from lows. Looking at this it still has room to run to resistance.

For next week, it would be good to see some consolidation of the October rally, but there is still plenty of room to run before market breadth approaches resistance (or even becomes overbought).

—

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.