Just a quick post to summarize our four Member Portfolios.

Just a quick post to summarize our four Member Portfolios.

As noted on Wendesday, we are well-balanced and very, very Cashy in our portfolios as we head into the end of the year. We've made great profits and we're not sure which way the market will end up so, essentially, we're taking a defensive stance to lock in our virtual gains and, as you can see from Dave Fry's Russell Chart - we're certainly not missing anything as the broad-based indexes (NYSE as well) have been flatlining since October.

As noted on Thursday, our main portfolios, the Long-Term Portfolio, which is hedged with the Short-Term Portfolio began the year with a combined $600,000 ($500/100) and have been holding the $760,000-$785,000 range since November, when we parked our positions in neutral (balanced between bullish and bearish) into the holidays. The two portfolios are up $179,000 for the year (29.8%) so of course we want to protect those gains!

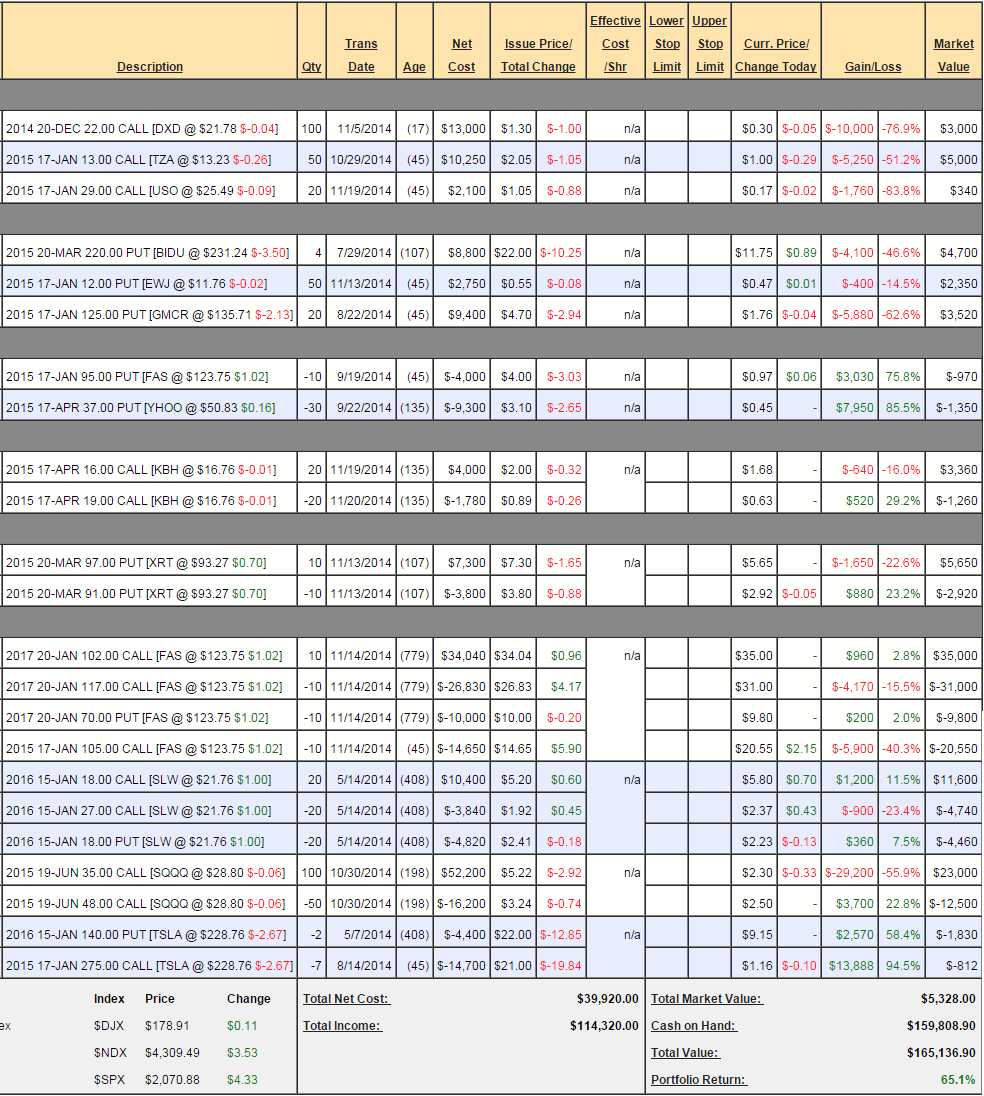

Short-Term Portfolio Review (STP): Back to $165,000 (up 65%) after a scare on Tuesday as the SQQQs got priced really low, for no particular reason. We'll have to consider if we are too bearish here, or perhaps simply not bullish enough in the LTP. Remember, this portfolio isn't SUPPOSED to make money – it's here to protect the LTP – this is just a happy accident…

- DXD - Why do we have so many of those? We'll leave them this weekend but no point in rolling them since we have TZA for Jan protection.

- TZA - Speak of the devil. Well, since we're killing the DXDs next week, TZA becomes our primary short-term hedge and I'm good with that with the RUT back at 1,180 and TZA is at $13 so the $13 calls at $1 start making money on an over 5% drop between now and Jan - that's what a hedge is supposed to do.