Courtesy of Mish.

Albert Edwards at Society General emailed a PDF on PE expansion and other equity trends. Albert comments …

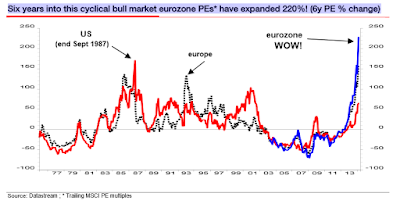

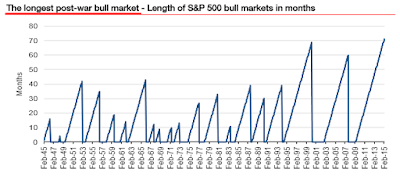

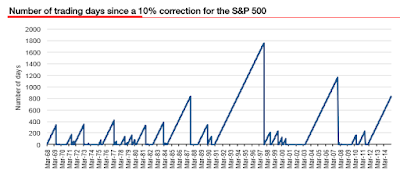

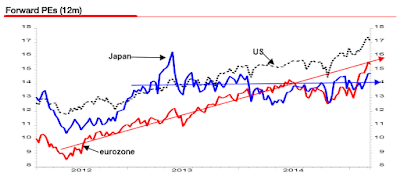

“Mario Draghi and the ECB’s manipulation of asset prices make s Greenspan’s Fed look like a rank amateur. More shocking though than the plunge in the euro, and more shocking even that 25% of sovereign eurozone bonds now trade in negative territory, is what has happened to eurozone equity valuations. For, as we approach the sixth anniversary of the US cyclical bull market (a post-war record), the PE expansion of eurozone equities is simply off the scale. History suggests this will end very badly indeed. Ask Alan!“

Eurozone 6-Year PE Expanded 220%

click on any chart for sharper image

Longest Post-War Bull Market in Months – S&P 500

Trading Days Without 10% Correction – S&P 500

12-Month Forward PEs Japan, US, Eurozone