Courtesy of Doug Short.

With the S&P 500 hitting a new high, let’s take a look at Treasury Yields.The first chart shows the daily performance of several Treasuries and the Fed Funds Rate (FFR) since 2007. The source for the yields is the Daily Treasury Yield Curve Rates from the US Department of the Treasury and the St. Louis Fed’s FRED repository for the Fed Funds Rate.

Here is a closer look at the 10- and 30-year yields along with the FFR.

A Long-Term Look at the 10-Year Note Yield

A log-scale snapshot of the 10-year yield offers a more accurate view of the relative change over time. Here is a long look since 1965, starting well before the 1973 Oil Embargo that triggered the era of “stagflation” (economic stagnation with inflation). The trendline (the red one) connects the interim highs following those stagflationary years. The red line starts with the 1987 closing high on the Friday before the notorious Black Monday market crash. The S&P 500 fell 5.16% that Friday and 20.47% on Black Monday.

The dashed lines on the chart above were provided by Bob Bronson of Bronson Capital Markets Research. Bob comments:

| “The blue dashed lines are much more closely parallel to the all-data, log-linear best fit line – very similar to the high-low mid-channel line – since 1980. Then there is the even more currently relevant downtrend (black dashed line) since the 2007 high.” |

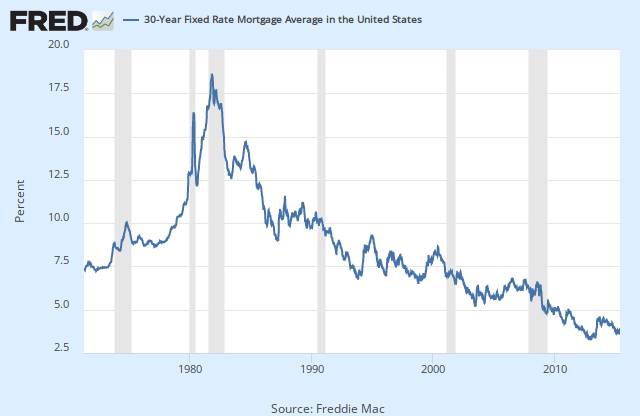

The 30-Year Fixed Rate Mortgage

The latest Freddie Mac Weekly Primary Mortgage Market Survey puts the 30-year fixed at 3.85%, well below its 4.58% interim high in the summer of 2013 but above its 2015 low of 3.59% in early April. Here is a long look back, courtesy of a FRED graph, of the Freddie Mac weekly survey on the 30-year fixed mortgage, which began in May of 1976.

Now let’s see the 10-year against the S&P 500 with some notes on Federal Reserve intervention. Fed policy has been a major influence on market behavior.

For a long-term view of weekly Treasury yields, also focusing on the 10-year, see our Treasury Yields in Perspective, which we usually update on weekends.