Visit Phil's Stock World for the latest market news, market commentary and investing ideas and strategies.

Financial Markets and Economy

Pearson Close to Selling Financial Times (NY Times)

Pearson Close to Selling Financial Times (NY Times)

Pearson, the British media and publishing company, is close to a deal to sell The Financial Times newspaper, it said on Thursday, part of an overhaul to focus on its growing education business.

The company said in a statement to the London Stock Exchange that it “notes recent press speculation and confirms that it is in advanced discussions regarding the potential disposal of FT Group, although there is no certainty that the discussions will lead to a transaction.”

Oil risks becoming deeper thorn in markets’ side (Market Watch)

Oil risks becoming deeper thorn in markets’ side (Market Watch)

Another day, another tech rout? Investors would be forgiven for some tech apprehension today after a really ugly day for Apple.

After suffering its worst one-day loss on Wednesday, Apple AAPL, -4.23% is headed for its worst week since nearly the start of the year. But on the brighter side, Jani from the CrackedMarket blog points out that while techs have been bleeding billions in market cap, the selling hasn't stretched much beyond that sector.

Oil Warning: Crash Could Be Worst in More Than 45 Years (Bloomberg)

Morgan Stanley has been pretty pessimistic about oil prices in 2015, drawing comparisons to the some of the worst oil slumps of the past three decades. The current downturn could even rival the iconic price crash of 1986, analysts had warned—but definitely no worse.

Interest rate 'dissidents' are growing inside the Bank of England (Business Insider)

Interest rate 'dissidents' are growing inside the Bank of England (Business Insider)

Dissent against a persistently low interest rate policy is growing inside the Bank of England.

And this could lead to a split vote at the central bank's Monetary Policy Committee meeting next month, according to a note from Barclays analysts.

A subtle change in the wording in the minutes of the last meeting this month is the key.

Venture funding on path to historic 2015 (Market Watch)

Bolstered by mega-funding rounds, venture capital is set to have its second consecutive historically active year worldwide, according to a report.

In the first half of 2015, global funding to venture-backed companies reached $59.8 billion, putting it on track to surpass the $88.3 billion invested in 2014, according to global venture capital tracker CB Insights. Last year was the most active for venture investment since 2011 — the earliest year for which CB Insights provided this data.

Bank of Russia Finds Indicator It Likes to Set Stage for Easing (Bloomberg)

Bank of Russia Finds Indicator It Likes to Set Stage for Easing (Bloomberg)

Even as ruble weakness and an uptick in inflation expectations point to Russia’s first pause in interest-rate cuts this year, the Bank of Russia has found a gauge that may tip the scale in favor of another reduction.

The central bank began regular publications of trend inflation on Wednesday, saying it fell to 11.5 percent in June for its first decline in 16 months. That was a day after it issued a report that showed inflation expectations growing last month after stabilizing in March through May. Both indicators will be considered for decisions, the central bank said.

Beijing has Chinese stocks cranking once again (Business Insider)

Beijing has Chinese stocks cranking once again (Business Insider)

The Chinese stock market just lost another friend.

Bridgewater, which has $169 billion (£108 billion) under management and was one of the last bulls on China, is reversing its stance, according to a report in the Wall Street Journal.

“Our views about China have changed,” Bridgewater’s founder, Raymond Dalio, told clients earlier this week, according to WSJ. “There are now no safe places to invest.”

U.S. stock futures climb after Apple-fueled selloff (Market Watch)

U.S. stocks were poised to rebound on Thursday, with futures pointing higher ahead of another earnings-heavy trading session and with a reading on jobless claims ahead.

Futures for the Nasdaq 100 index NQU5, +0.17% rose 9 points, or 0.2%, to 4,626, indicating the index will be on track to break a two-day losing run. The tech-heavy index slumped on Wednesday as Apple Inc. AAPL, -4.23% its heaviest-weighted stock, slid 4.2% after a disappointing outlook.

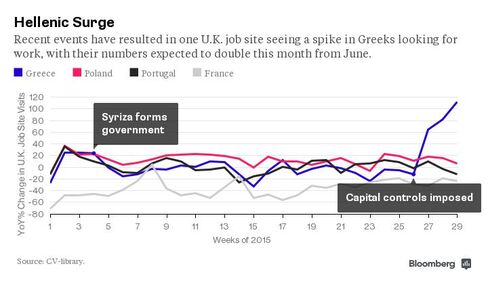

More Brain Drain? Greek Traffic to a U.K. Jobs Site Has Surged (Bloomberg)

For down and out Greeks, the U.K. is the promised land with jobs aplenty.

Greece was already suffering from a bad case of brain drain but recent debacles, which ushered in capital controls and almost got the country ejected from the euro, have turbocharged the pace of human capital flight. Direction of travel: west across mainland Europe and the English Channel.

Coca-Cola Profit Up 19%, Despite Lower Sales (NY Times)

Coca-Cola Profit Up 19%, Despite Lower Sales (NY Times)

How long will consumers continue to pay more for less soda?

Consumers paying more for an ounce of soda served in a smaller package than they would pay for an ounce packaged in a 12-ounce can or a two-liter bottle helped propel profits at theCoca-Cola Company, despite lower sales in the quarter that ended July 3.

This emerging Eastern European country is a lot like America (Business Insider)

This emerging Eastern European country is a lot like America (Business Insider)

Joanna Sawicka still remembers having to wait in line for hours to buy food and school supplies. In communist-controlled Poland, such basic goods were rationed. Families received special government-issued cards that permitted them to buy only the minimal amount of meat per month. This experience made a lasting impression on Joanna as a child and inspired her to work toward a life in which she would not want for anything.

Now the research analyst for our Emerging Europe Fund (EUROX), Joanna recently visited her native Poland and found it to be a drastically different country from the one she grew up in. I sat down with her to chat about her travels and where she thought the Eastern European country might be headed from here.

These world stock markets give you more for your money now (Market Watch)

If the current level of U.S. stock prices is concerning, consider leaving home. Other countries’ markets are offering compelling investment bargains

That doesn’t mean buying into Greece or China. You can even avoid euroEURUSD, +0.6679% exposure.

Greece Approves Second Raft of EU Demands Closing In on Bailout (Bloomberg)

Greece Approves Second Raft of EU Demands Closing In on Bailout (Bloomberg)

Greece passed a second bundle of policy measures demanded by the country’s European creditors as Prime Minister Alexis Tsipras urged lawmakers to stop the country being forced out of the euro.

Tsipras won the support of at least 151 lawmakers in a televised, public vote in the 300-seat parliament in Athens for a bill that will simplify court decisions and transpose European rules on failing banks.

"No Longer Confined To The Lunatic Fringe": SocGen Admits Markets Are Completely Manipulated (Zero Hedge)

Perhaps the most interesting thing about China’s "unprecedented" plunge protection efforts – which, as we outlined on Wednesday, have succeeded in making China Securities Finance Corp. a top-10 shareholder in at least eight firms – is that in some ways, they aren’t “unprecedented” at all. That is, while some of what we’ve seen out of Beijing over the past month – notably the sweeping trading halts and the Politburo agitprop campaign aimed at "malicious" foreign short sellers – was more overt than what we might expect to see in more "developed' markets, there’s certainly nothing terribly unusual about a central bank propping up equities.

Small Exporters Back Obama on Export-Import Bank (NY Times)

Small Exporters Back Obama on Export-Import Bank (NY Times)

President Obama on Wednesday met with small exporters to make his case that Congress should quickly reauthorize the Export-Import Bank, even as legislative turmoil in the Senate threatened supporters’ strategy for reviving the bank, which helps finance sales of American products abroad.

“For us to be the only country that leaves these outstanding companies high and dry makes absolutely no sense,” the president told reporters who were briefly admitted to his White House meeting with 10 business owners, two mayors and several Democratic lawmakers. “This should be a no-brainer,” he added.

Global steel production continues to fall (Business Insider)

While the world keeps on producing abundant ingredients to build it, global steel production continues to slide.

European stocks hold to gains after Greek vote (Market Watch)

European stocks hold to gains after Greek vote (Market Watch)

Markets in Europe rose slightly after two sessions of losses, after getting an early boost from a Greek parliamentary vote, as investors weighed corporate earnings and economic data.

European equities posted stronger gains at the open, encouraged by hope Greece is moving closer to its third bailout package after the parliament passed a second round of reform measures. The legislative approval was a precondition by the Greece’s international creditors for starting official negotiations on the aid program.Read: What’s next for Greece now second austerity package is approved.

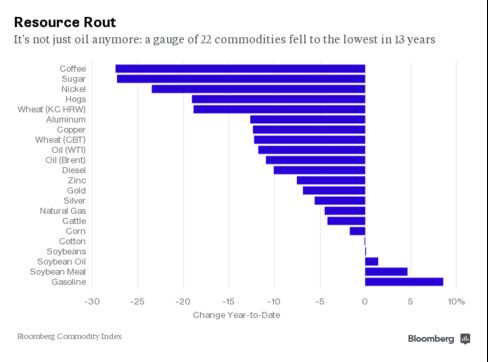

Here's What's Really Driving the Commodity Index Lower (Bloomberg)

Clearly it hasn’t been commodities’ week, month or year. But focusing on the worst-performers doesn’t tell the full story.

Caterpillar Sales Plummet, Outlook Slashed, Says "Stagnant" Global Economy Shows No Signs Of Improvement (Zero Hedge)

For those surprised by today's abysmal CAT Q2 results, we can only assume this is because our post from yesterday "Forget Recession: According To Caterpillar There Is A Full-Blown Global Depression" slipped through the cracks.

China is having a massive impact on Australia’s economy and it could get bigger (Business Insider)

China is having a massive impact on Australia’s economy and it could get bigger (Business Insider)

If you want to see how much China has changed over the past 20 years, you need only look at the Shanghai skyline. In 1990 the peninsula of Lujiazui, now known as the Pudong New Area, was just shanty homes, warehouses and wharfs. Today, it’s China’s answer to Manhattan.

The towering skyscrapers are a lurid expression of China’s new financial power – a physical manifestation of the country’s rejuvenation.

Gold prices rise, trying to halt 10-session slide (Market Watch)

Gold prices rise, trying to halt 10-session slide (Market Watch)

Gold prices gained 1% early Thursday, putting the yellow metal on pace to snap a 10-session losing streak that’s dropped it to its lowest level in more than five years.

August gold GCQ5, +0.83% was last up $11.10, or 1%, to $1,102.60 an ounce, while silver for September delivery SIU5, +0.75% advanced by 14 cents, or 1%, to $14.88 an ounce.

Capital One Hires PayPals Kingsborough to Invest in Technology (Bloomberg)

Capital One Hires PayPals Kingsborough to Invest in Technology (Bloomberg)

Capital One Financial Corp., the credit-card lender that grew into a diversified bank, hired former PayPal executive Don Kingsborough to help run a division that makes strategic investments in technology startups.

Kingsborough, 68, will join as a managing director in San Francisco and work with Jaidev Shergill, the head of the ventures team, Tatiana Stead, a spokeswoman for Capital One, said in an e-mail. The ventures group buys minority stakes and sometimes takes over new technology companies. Re/code reported the move earlier Wednesday.

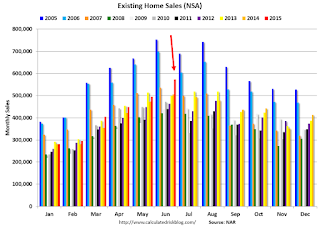

A Few Random Comments on June Existing Home Sales (Calculated Risk)

First, as always, new home sales are more important for jobs and the economy than existing home sales. Since existing sales are existing stock, the only direct contribution to GDP is the broker's commission.

McDonalds Posts Seventh Straight Quarter of Falling U.S. Sales (Bloomberg)

McDonalds Posts Seventh Straight Quarter of Falling U.S. Sales (Bloomberg)

McDonald’s Corp. posted its seventh straight quarter of declining same-store sales in the U.S., a sign that turnaround efforts under new Chief Executive Officer Steve Easterbrook have yet to pay off.

The drop was 2 percent in the second quarter, the Oak Brook, Illinois-based company said in a statement Thursday. Analysts had estimated a decline of 1.5 percent. Globally, sales fell 0.7 percent by that measure, also missing projections.

Chinese stocks end higher for sixth session in a row (Market Watch)

Chinese stocks end higher for sixth session in a row (Market Watch)

Chinese shares notched their sixth straight session of gains Thursday as Beijing-backed funds and buying by large shareholders appeared to support the market’s rebound, according to analysts.

The Shanghai Composite Index SHCOMP, +2.43% closed up 2.4% at 4123.92 while the smaller Shenzhen index 399106, +2.83% gained 2.8% to 2352.65.

The indexes are still down about a fifth and a quarter, respectively, from their June highs.

Politics

Why everyone hates Obama's signature trade deal (CNN)

Why everyone hates Obama's signature trade deal (CNN)

After years of painful, drawn-out meetings, negotiators are preparing for what could be the final round of talks over the biggest free trade deal in history, the Trans-Pacific Partnership.

Even as the deal nears completion, plenty of groups are trying to scuttle the agreement. Here are five reasons why almost everyone hates the Trans-Pacific Partnership, or TPP.

Donald Trump is worth at least $1.5 billion, campaign filing shows (Market Watch)

Donald Trump is worth at least $1.5 billion, campaign filing shows (Market Watch)

Republican presidential candidate Donald Trump holds stakes in a sprawling network of real estate and entertainment companies from India to Turkey, his federal financial disclosure shows.

The filing with the Federal Election Commission, released Wednesday, was the first time the real-estate developer and television star had ever publicly tallied his holdings.

Technology

Hearing Aids Meet the Future with Bluetooth Tech (Scientific American)

Hearing Aids Meet the Future with Bluetooth Tech (Scientific American)

The most game-changing wearable device on the market right now may not be a fitness tracker or a smartwatch: It’s a hearing aid.

Unlike fitness trackers, which are often tucked away in a drawer in just a few months, hearing aids are changing the way that people with hearing impairments live in the digital age, researchers say.

This Fashionable Bracelet Transforms Into A Set Of Bluetooth Headphones (Fast Company)

This Fashionable Bracelet Transforms Into A Set Of Bluetooth Headphones (Fast Company)

Why stuff your headphones in your pocket when you can turn them into a wearable?

When they're not in or on your ears, headphones are a pain to carry around. Wear a pair of over-the-ear cans around your neck, and you look like a dweeb; stuff a pair of earbuds in your pocket when they're not in use, and the cords get all knotted up. It goes to show that while headphone designers have long since solved the mobility problem, they still haven't addressed the portability problem: namely, how to store them easily on your body when they're not in use.

Health and Life Sciences

Better method for building with DNA (BBC)

Better method for building with DNA (BBC)

Scientists have come up with an improved method for building tiny 3D structures out of strands of DNA.

Using an approach from computer science, they were able to calculate the best way to fold almost any given shape out of a long, continuous strand.

Then, using the principles of "DNA origami", hundreds of shorter strands were used to "staple" the joins.

Veteran Genome Project Serves as Early Test Bed for Customized Care (Scientific American)

Veteran Genome Project Serves as Early Test Bed for Customized Care (Scientific American)

Four years before Pres. Barack Obama unveiled plans for a $215-million Precision Medicine Initiative designed to better understand genetic variations within disease and develop treatments, veterans were already volunteering to be part of an avant-garde effort to boost such tailor-made medicine. The venture, called the Million Veteran Program (MVP), aimed to get complete health information and DNA analysis from one million volunteers receiving health services through the Veterans Health Administration (commonly called the VA). Now, as other research groups try to scale up their own efforts for the president’s initiative, the VA effort is one of the lone guideposts in a field with few landmarks.

Life on the Home Planet

Ebola’s Not Done With West Africa (Wired)

Ebola’s Not Done With West Africa (Wired)

OFFICIALLY, IT’S CALLED the Ebola Outbreak of 2014. But it’s 2015 now, and the disease is still infecting people. For the past two months, that rate was about 15 people a week. But in the past two weeks, the rate has doubled.

This is bad. Not last summer-bad—when weekly infection rates were in the hundreds—but bad enough that relief agencies have begun to worry about a resurgence. And even a trickle of infections is a wear on the aid workers, government authorities, and most of all, communities living in months of fear. “I was here in 2014. If you would have told me in 2014 I would see 30 cases of Ebola every week I would not have believed it,” says Marc Forget, Doctors Without Borders’ relief coordinator for Guinea.

The butterfly that feeds on rotting flesh (BBC)

The butterfly that feeds on rotting flesh (BBC)

The Purple Emperor is one of Britain's most elusive butterflies, but its beauty disguises gruesome habits. It feeds on rotting flesh and faeces – which is why aficionados can be found wandering English woods in July with everything from dirty nappies to a 15lb salmon in hand to lure this enigmatic insect.