I know, it's boring!

I know, it's boring!

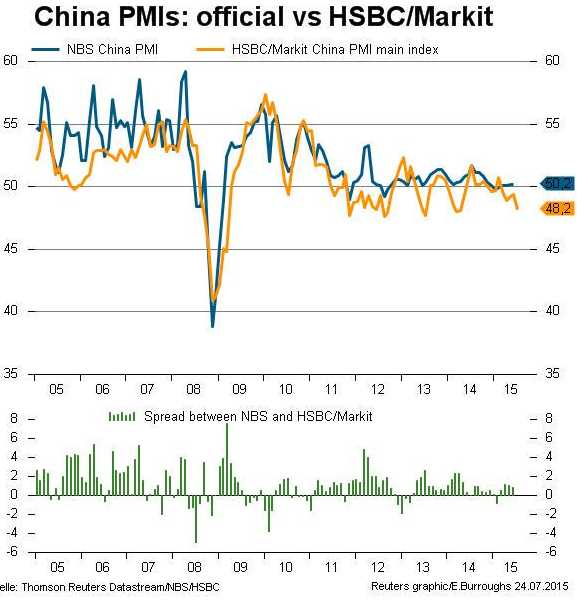

Who wants to keep talking about stuff like China's PMI just posted CONTRACTION for the 2nd month in a row DESPITE the MASSIVE stimulus? What we liked hearing were the ESTIMATES by ECONOMORONS, who said it would improve to 49.7. As it turned out, up 0.3 turned out to be down 1.2 so our leading economorons missed this one by 500% but hey – we rallied into it!

Don't worry, we're still one more dip away from breaking into the 2008/9 low range – at the moment, we're still holding on to the lows since 2011 but, unfortunately, China may have been too distracted propping up the markets to prop up the actual manufacturing sector. That's one of the reasons commodities are collapsing – nothing is being manufactured on the World's factory floor.

“The industrial sector has seen no sign of stabilization yet,” said Xu Gao, chief economist at Everbright Securities Co. in Beijing, adding that most of the growth stabilization last quarter came from the services sector. “The government should further step up the policy supports, including further boosting infrastructure investment and expediting the debt swap program.”

ROFL! This is how our Global economy "works" people. It's not up to the Capitalists to make things people actually want to buy – it's the Government's problem to make them profitable, no matter how much time and money is being wasted!

Ray Dialo, of Bridgewater (the World's biggest hedge fund) has taken my advice and is now warning people out of China (a bit late but he finally came around).

“Our views about China have changed,” Bridgewater’s billionaire founder, Raymond Dalio,wrote with colleagues in a note sent to clients earlier this week. “There are now no safe places to invest.”

Of course Ray, with "only" $169Bn under management, isn't really the World's largest hedge fund anymore. That honor now goes to Apple's (AAPL) super-secret Braeburn Capital, whose sole purpose is to manage their own $203Bn cash hoard.

Of course Ray, with "only" $169Bn under management, isn't really the World's largest hedge fund anymore. That honor now goes to Apple's (AAPL) super-secret Braeburn Capital, whose sole purpose is to manage their own $203Bn cash hoard.

Braeburn, by the way, for those of you without young daughters, is the name of the Earth pony in My Little Pony and he's the cousin of Applejack, Big McIntosh and Apple Bloom and the Grandson of Granny Smith. See – and you thought playing with your daughter wasn't going to help you in business!

.jpg) Speaking of useless information – Amazon (AMZN) beat expectations and turned a PROFIT last night! That's right, this COULD be the last time I get to use my favorite picture of Jeff Bezos. Well, not really…

Speaking of useless information – Amazon (AMZN) beat expectations and turned a PROFIT last night! That's right, this COULD be the last time I get to use my favorite picture of Jeff Bezos. Well, not really…

As you know, I don't like to comment in the morning post on things every other idiot in the media is commenting on unless I have something important to say and today I will simply point out to you (and to all the idiots who call themselves analysts) that, out of $464M in profits reported on $23.2Bn in revenues, $397M (85%) of them came from Web Services (mostly cloud), the same thing that gave MSFT a mild pop.

Web Services were $1.8Bn of the revenues so roughly 1/2 of AMZN's revenue growth came from Web Services and essentially ALL of the profits came from there as well. The stock is up over 20% pre-market, gaining over $45Bn in market cap, which is 96 times their TOTAL profits while AMZN's total market cap is now over $270Bn, blowing past Wal-Mart's $233Bn even though WMT does $500Bn in sales and drops $16Bn to the bottom line while this is AMZN's first profit ever and it's only 1/40th the size of WMT's AND AMZN says they may lose as much as $480M next quarter as things go back to normal.

Web Services were $1.8Bn of the revenues so roughly 1/2 of AMZN's revenue growth came from Web Services and essentially ALL of the profits came from there as well. The stock is up over 20% pre-market, gaining over $45Bn in market cap, which is 96 times their TOTAL profits while AMZN's total market cap is now over $270Bn, blowing past Wal-Mart's $233Bn even though WMT does $500Bn in sales and drops $16Bn to the bottom line while this is AMZN's first profit ever and it's only 1/40th the size of WMT's AND AMZN says they may lose as much as $480M next quarter as things go back to normal.

So, Amazon's market cap is now officially stupid. Essentially, investors are paying almost 10 times as much for Amazon as they are for Microsoft, who have the same Web Services with the same 80% growth BUT DROP $22 BILLLION TO THE BOTTOM LINE. Are you people freakin' crazy???

This opportunity is too good to pass up and we'll be taking our first put on a MoMo stock this morning as AMZN tests $600 – expect a Top Trade Alert once the market opens. We will also be pressing our gold bets as gold tests our $1,050 target floor. Back on the 21st, we took a stab at playing the Gold ETF (GLD) long with the Aug $103.50 calls at $3.60, selling the $105.50 calls for $2.35 for net $1.25 on the $103.50/105.50 bull call spread.

Since then, gold and GLD have gone straight off a cliff but we planned for this when we were taking the spread. The Aug $103.50s are still $2.50, which is more than we paid for the spread and we can roll them (sell the ones we have and buy a new target) to the Sept $102 calls at $4.10 for just $1.60 and we gain $1.50 in strike and another month of time. We leave the short $105.50s and they either expire worthless or we get $3.50 back on our net $2.75 investment (+27%) – not bad for a "wrong" entry!

Also, this is a huge benefit of scaling in as we started with $1.25 and making 0.75 off that bet would have been fantastic (60%) but now we're making 27% of a larger amount and it works out the same (assuming it works out). If not (and we do think GLD can dip as low as $95 before recovering), we will roll again and have an even larger position as gold goes lower – as planned! In fact, we haven't even added it to our Short-Term Portfolio yet, but now we will.

While we're on the topic of adjustments, in our STP we already have 40 EWJ Sept $14 puts that we bought for 0.95 ($3,800) back on 6/23 and they are "only" up 0.20 ($800, 21%) at $1.15 and you can still play those as it's about to hit the fan in Japan as the IMF called them out on their unsustainable debt in a report the MSM is completely ignoring this morning.

While we're on the topic of adjustments, in our STP we already have 40 EWJ Sept $14 puts that we bought for 0.95 ($3,800) back on 6/23 and they are "only" up 0.20 ($800, 21%) at $1.15 and you can still play those as it's about to hit the fan in Japan as the IMF called them out on their unsustainable debt in a report the MSM is completely ignoring this morning.

Japan's debt is already at about 245% of its annual gross domestic product — or more than 1 quadrillion yen ($11 trillion).

"Japan's public debt is unsustainable under current policies," the IMF said in a report issued Thursday. "A credible medium-term fiscal consolidation plan is needed … [it] should aim to put debt on a downward path."

Australia is in free-fall thanks to falling commodity prices and South Korea has already seen a lot of contraction in manufacturing (and Samsung getting killed) and now Singapore is reporting weak economic growth that has led to the first decline in office leasing since 2012 after the economy dropped 4.6% in Q2 – something else completely ignored by the MSM as they sing "Everything is Awesome" for the 10,000th time.

Australia is in free-fall thanks to falling commodity prices and South Korea has already seen a lot of contraction in manufacturing (and Samsung getting killed) and now Singapore is reporting weak economic growth that has led to the first decline in office leasing since 2012 after the economy dropped 4.6% in Q2 – something else completely ignored by the MSM as they sing "Everything is Awesome" for the 10,000th time.

In a blatant attempt to keep things Awesome in the press, the Nikkei just bought the Financial Times, which is effectively yet another group of Top 1%'ers taking control of your information to make absolutely sure people aren't having any stray thoughts.

Have an AWESOME weekend,

– Phil