By Aswath Damodaran. Originally published at ValueWalk.

Storied Asset Sales: Valuing and Pricing Trophy Asset

Pearson PLC, the British publishing/education company, has been busy this summer, shedding itself of its ownership in two iconic media investments, the Financial Times and the Economist. On July 23, 2015, it sold its stake in the Financial Times for $1.3 billion to Nikkei, the Japanese media company, after flirting with Bloomberg, Reuters and Axel Springer. It followed up by selling its 50% stake in the Economist for $738 million, with 38% going to Exor, the investment vehicle for the Agnelli family, and the remaining 12% being purchased by the Economist Group itself. The motive for the divestitures seems to be a desire on the part of Pearson to stay focused on the education business but what caught my eye was the description of both the Financial Times and the Economist as “trophy” assets, a characterization that almost invariably accompanies an inability on the part of analysts to explain the prices paid by the acquirer, with conventional business metrics (earnings, cash flows, revenues etc.).

What is a trophy asset?

-

My first task in this analysis was to find other cases where the term was used and I found that its use spreads across asset classes. For instance, it seems to be commonplace in real estate transactions like this one, where high-profile properties are being acquired. As in the stories about the Economist and the Financial times, it seems to also be used in the context of media properties that have a long and storied tradition, like the Washington Post and the Boston Globe. In the last few years, sports franchises have increasingly made the list as well, as billionaires bid up their prices for these franchises. I have seen it used in the context of natural resources, with some mines and reserves being categorized as trophy assets for mining companies. While this is a diverse list, here are some of what they share in common:

- They are unique or rare: The rarity can be the result of natural scarcity (mining resources or an island in Hawaii), history (a newspaper that has survived a hundred years) or regulation/restriction (professional sports leagues restrict the creation of new franchises).

- They have name recognition: For the most part, trophy assets have name recognition that they acquire either because they have been around for a long time, are in the news or have wide following.

- They are cash flow generating businesses or investments: In contrast with collectibles and fine art, trophy assets are generally cash flow generating and can be valued as conventional assets/businesses.

There is undoubtedly both a subjective and a negative component to the “trophy asset” label. The subjective component lies in how “rare” is defined, since some seem to define it more stringently than others. The negative aspect of labeling an asset as a trophy asset is that the buyer is perceived as paying a premium for the asset. Thus, an asset is more likely to be labeled as a trophy asset, when the buyer is a wealthy individual, driven more by ego and less by business reasons in making that investment.Valuing a trophy asset

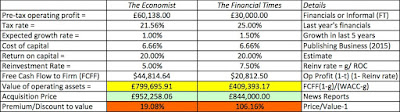

Rather than take it as a given that buyers overpay for trophy assets, let us look at the possibility that these assets are being acquired for their value rather than their glamor. We have the full financial statements for the Economist but only partial estimates for the Financial Times, and I have used this information to estimate base values for the two assets:Spreadsheet with valuation Thus, based on the earnings power in the two assets and low growth rates, reflecting their recent static history, the estimated value for the Economist is about £800 million and the Financial Times is worth £410 million. I will label these values in this table as the status quo estimates, since they reflect the ways in these media names are managed currently. While you could take issue with some of my assumptions about both properties, it seems to me that Nikkei’s acquisition price (£844 million) for the Financial Times represents a much larger premium over value than Exor’s acquisition of the Economist Group for £952 million. Does that imply that Nikkei is paying a trophy asset premium for the Financial Times? Perhaps, but there are three other value possibilities that have to be considered.- Inefficiently utilized: If a trophy asset is under utilized or inefficiently run, a buyer who can use the asset to its full potential will pay a premium over the value estimated using status quo numbers. That is difficult to see in the acquisition of the Economist stake, at least to the Agnellis, since the interest is a non-controlling one (with voting rights restricted to 20%), suggesting that the acquirer of the stake cannot change the way the Economist is run. With the Financial Times, the possibilities are greater, since there are some who believe that the Pearson Group has not invested as much as it could have to increase the paper’s US presence.

- Synergy benefits to another business: If the buyer of the trophy asset is another business, it is possible that the trophy asset can be utilized to increase cash flows and value at the acquiring business. The value of those incremental cash flows, which can be labeled synergy, can be the basis for a premium over the status quo value. With the Nikkei acquisition of the Financial Times, this is a possibility, especially if growth in Asia is being targeted. With the Agnelli acquisition of the Economist, it is difficult to see this as a rationale since Exor is an investment holding company, not an operating business.

- Optionality: There is a third possibility and it relates to other aspects of the business that currently may not be generating earnings but could, if technology or markets change. With both the Economist and the Financial Times, the digital versions of the publications in conjunction with large, rich and loyal reader bases offer tantalizing possibilities for future revenues. That option value may justify paying a premium over intrinsic value. In fact, at the risk of playing the pricing game, note that you are acquiring the Economist at roughly the same price that investors paid for Buzzfeed, a purely digital property with a fraction of its history and content.

With the Financial Times, adding these factors into the equation reinforces the point that the price paid by Nikkei can be justified with conventional value measures. With the Economist, and especially with the Exor acquisition, it does look like the

About the author

Sign up for ValueWalk’s free newsletter here.