Courtesy of The Nattering Naybob at Seeking Alpha

In Swap Spread Spike Signal?, I cover the Financial Time's salient points and also the main reason for the potential market dislocation that negative swap spreads can create. If the current global sell off of equities accelerates, any potential dislocation might become most pronounced resulting in a potential "flash crash" liquidity event much like Aug 24, 2015.

[Additional reading: On Nov 10, 2015, the Financial Times covered many facets of Why Are Swap Rates Below Bond Yields?]

Swap Spread Spike Signal?

Summary

- Examination of recent 5 and 10 year swap spread spike.

- Discussion of swap spread utilization and market liquidity conditions.

- Discussion of potential Treasury debt paydown effects on markets.

- Discussion of forward derivatives potential effects on the dollar, commodities, global equities and bond markets.

Excerpt:

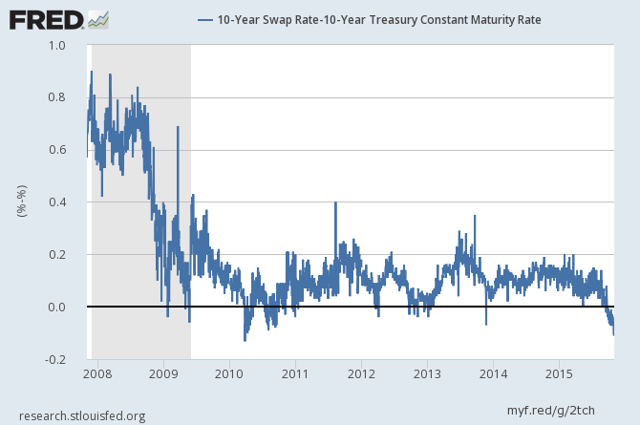

"Take a look at 5 and 10-year US swap spreads, NEGATIVE in the extreme, not a good sign."

I have Nattered about illiquidity, the dollar squeeze and the havoc it will wreak on commodities and equities markets many times.

Above note, 10-year swap rate minus 10-year constant treasury rate at -0.17%

ZeroHedge: "The exact reason for the sharp move is unclear but blame has been placed on high corporate issuance, balance sheet re-pricing into year-end given tighter regulatory pressure and also the poor liquidity."

[Digging deeper we find]: "Banks and investors say the moves exemplify constraints on dealers' balance sheets, unable to facilitate the reversal of the dislocation due to hefty capital charges for doing so. Another trader says it is indicative of a bank or hedge fund hitting a limit on a position and having to suddenly liquidate into the market." – FT

Constraints and hitting position limits are symptoms. One of the causes is in the form of Gozer the Destructor who is lurking about, aka King Dollar, which just hit 98-99 and is pausing before hitting new highs. Just hitting 99 caused a surge in credit spreads as position limits were hit and carry trades had to be liquidated into an illiquid market. And there IS ANOTHER cause…

"Volumes in the London afternoon had already reached $12.5bn, compared to recent full-day highs of $25bn, with much of that going through in 30-year swap spreads, according to Clarus Financial Technology, a data provider."

So last week, somebody was loading up on 30-year duration swap spreads? Who? Why?