Courtesy of Joshua Brown, The Reformed Broker

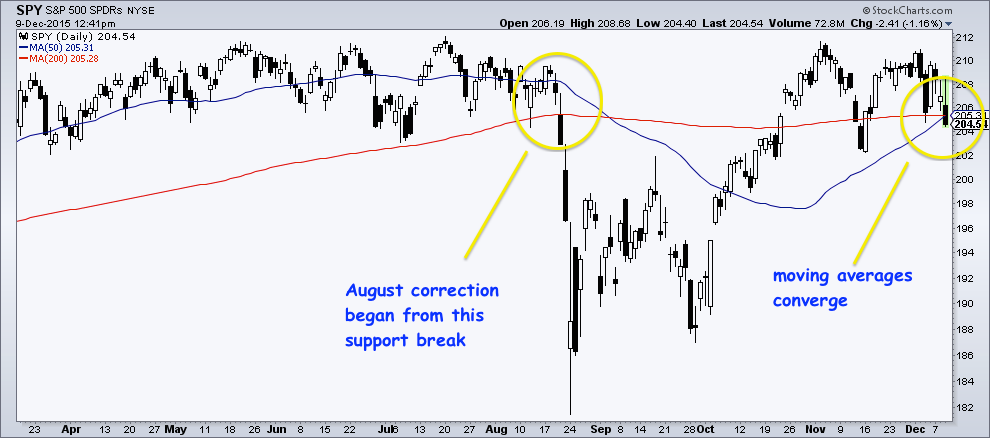

Flop around in a flat market long enough and your moving averages begin to lineup pretty perfectly.

And then one day you break below them both at once – and lose the same support level you lost to trigger the August correction.

I’m using SPY instead of the index here:

The people who need to have a reason for this will blame:

- Oil

- Tax loss selling

- Santa is running late

- The ECB

- Rate Hike next week

- whatever

To me, the reason is probably less important than just having the awareness that short-term traders act differently above and below these support levels. Trigger fingers get itchier, liquidity becomes more in-demand and story stocks lose their appeal.

Investors should orient their expectations and mindsets accordingly.