Re: Expected Stock Returns – from the RWM Client Conference Call

Courtesy of Joshua Brown, The Reformed Broker

This week Barry and Michael put on our Q4 conference call for clients of Ritholtz Wealth Management.

One of the most popular topics people are talking about right now is the fact that we shouldn’t be expecting much in the way of stock market returns going forward.

People are saying this is because:

- Rates are headed higher, which should constrict further multiple expansion

- Profit margins are peaking (something we’ve been hearing for years – any day now!)

- The dollar will hamper earnings and revenue for US exporters (most large caps sell globally)

- Valuations

- (name your own boogeyman – geopolitics, terror, Trump, global warming, whatever)

These are all legitimate concerns. But the number one reason investors believe returns will be muted is the fact that we’ve rallied 200% over the last 5 years.

This reasoning is dead wrong and is symptomatic of the Gambler’s Fallacy, as in “the roulette wheel landed on black five times, so the next one just has to be red!”

(My in-depth thoughts on the Gambler’s Fallacy here, btw.)

Arguments for future returns based on where an asset’s price came from are easy to shoot down. But they are persistent among the investor class because we all anchor to something. In this case, investors anchor to the low point of the bear market and view everything that’s happened subsequently through that lens.

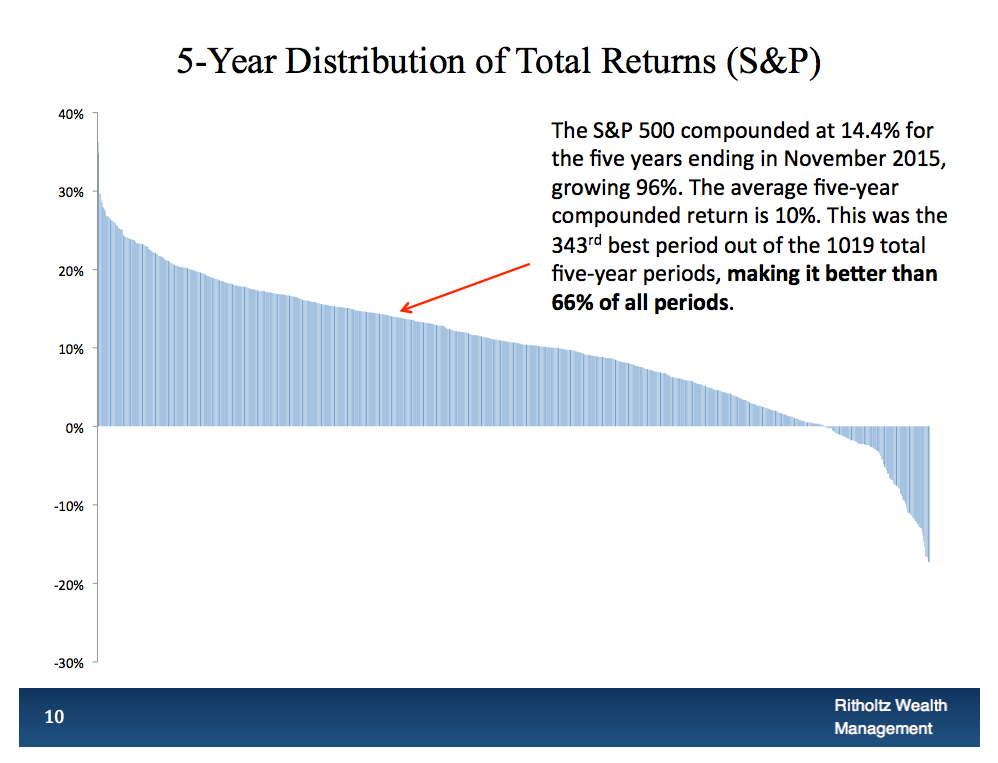

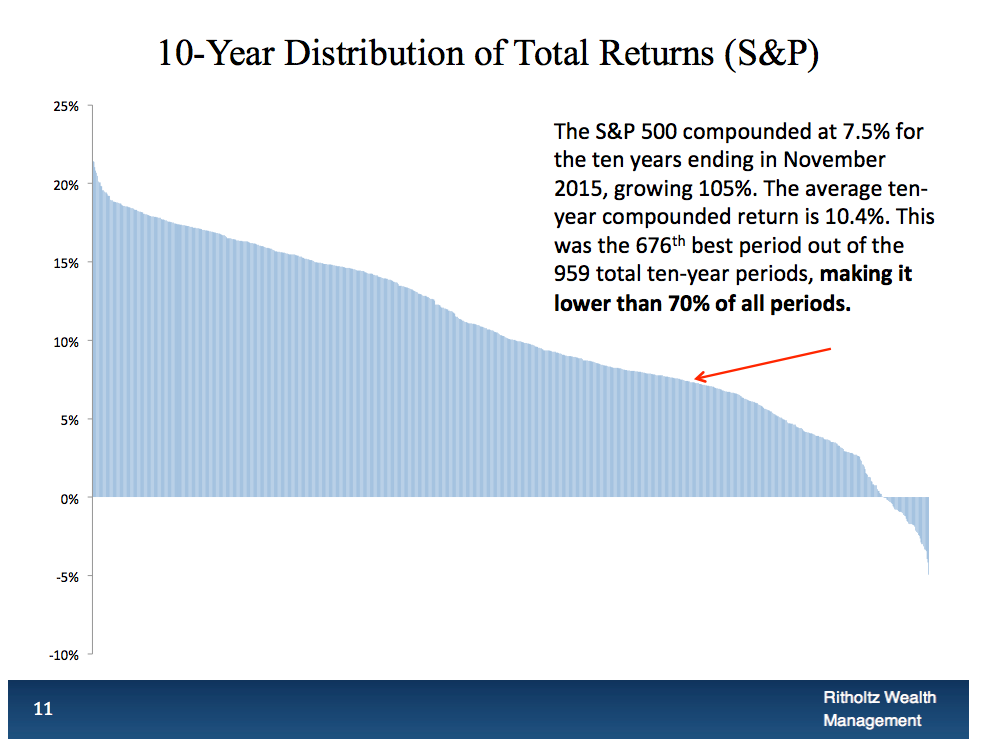

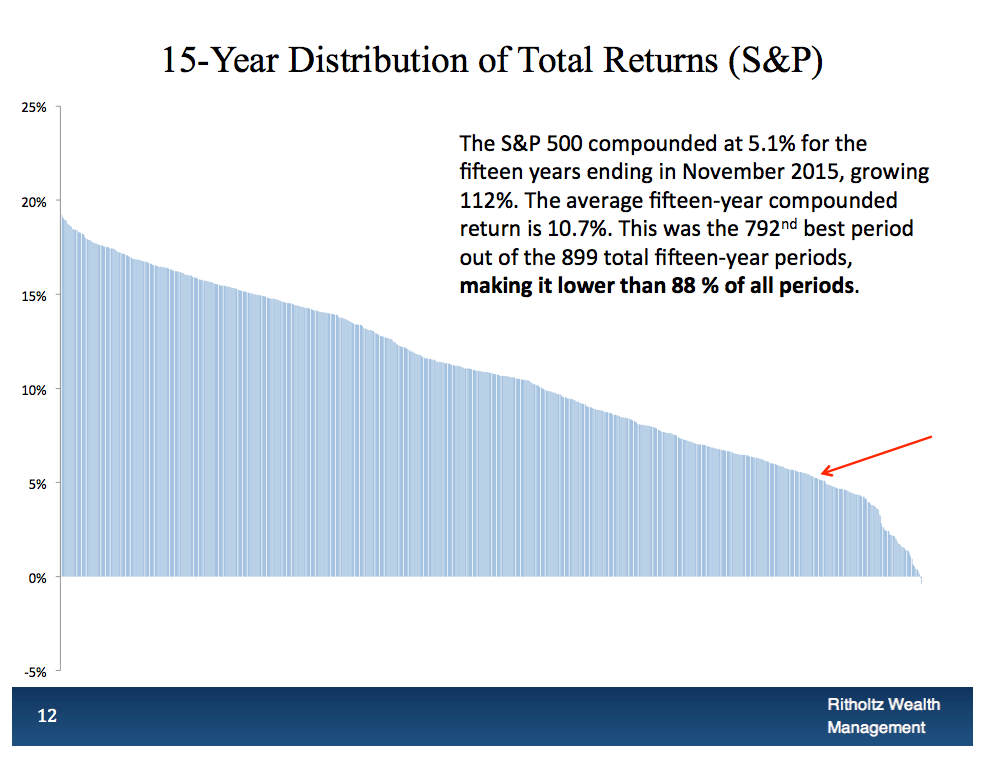

But something interesting happens when you broaden out the time horizon and focus on rolling returns as opposed to calendar-year returns, which are pedestrian and meaningless in real life. We know that stock market returns are mean-reverting in the long run, even if we don’t know how far they’ll be stretched in one direction or another over the short run. And when we look at returns over the last ten year period and the last fifteen year period – way more meaningful stretches of time for retirement investing – we see that returns have actually been quite underwhelmingrelative to all historic ten and fifteen year periods.

Three slides from Barry’s discussion below make this point in very clear and concise way:

If we can help you with your investment portfolio or financial plan in any way, give us a shout: Ritholtz Wealth Management.