Should You Be 100% Long Stocks?

Courtesy of Joshua Brown

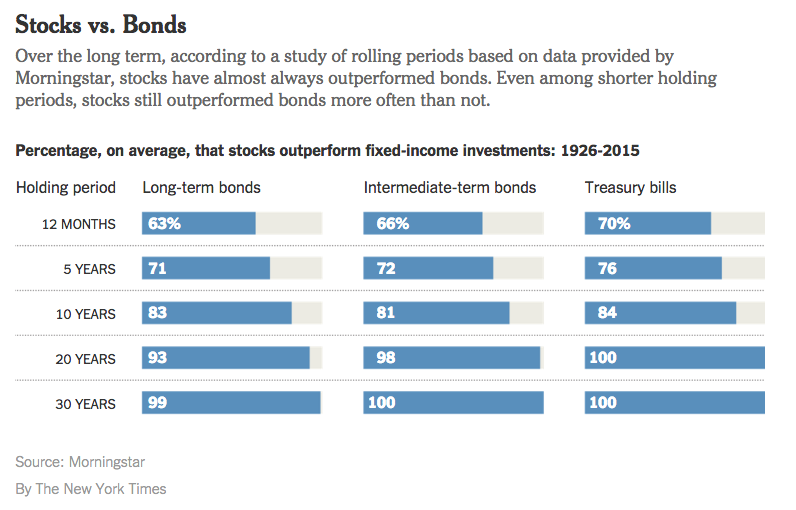

The New York Times is out with an investing column that posits the following: You should be 100% stocks in your portfolio because, given enough time, they should outperform everything else you can possibly own in an investment account.

And here is the data that “proves” it – as long as you’re willing to bet that the future will look precisely like the past:

I’m troubled by this idea, although I do agree that there are select cases where this could make sense. The author is David A. Levine, a former chief economist at Sanford C. Bernstein & Company. And, to his credit, he does pay lip service to the idea that very few human beings can actually live with the volatility that a 100% equity portfolio will induce.

As we say at our shop, long-term returns are the only returns that matter, but the long-term is not where investors live their lives.

There are some cases where a 100% stock allocation makes sense. Here are five of them:

* The investor is under 35 years old, starting from a small base, and is automatically dollar-cost averaging every month.

* The investor is in a coma of an indeterminate length

* The investor has been diagnosed with a terminal disease and is going to be passing on the assets to the next generation soon.

* The investor’s portfolio is very small in comparison with their other assets, assets that are not fully correlated with stocks.

* The investor is going to be living on a desert island for two decades without access to TVs, radios, the internet or Barron’s.

.jpg) ?Under any of the above circumstances, the idea of a 100% allocation to stocks is doable. The portfolio will probably perform miracles for the investor’s net worth so long as they don’t (or can’t) touch it for 20 years.

?Under any of the above circumstances, the idea of a 100% allocation to stocks is doable. The portfolio will probably perform miracles for the investor’s net worth so long as they don’t (or can’t) touch it for 20 years.

But I would postulate that it is unnecessary, for one thing, and may even be suboptimal given the ease and low cost with which real estate and bonds can be held and a periodic rebalance can be executed.

We’ve seen eleven bear markets during which stocks declined by over 35% in the eleven decades since Charlie Dow created his index in 1896. That works out to roughly one every ten years, although they don’t occur on a regular schedule. The majority of investors cannot live through two or three of those and have their money be fully exposed without making a major mistake or two.

Having worked directly and indirectly with investors from all walks of life and every region of the country over the last 18 years, I can promise you that almost no one can endure – emotionally speaking – the volatility and drawdowns that an all-equity portfolio brings to the table.

The good news is, investors don’t have to. The power of compounding is every bit as potent in a well-managed, diversified portfolio as it is in a kamikaze portfolio.

Source:

How Much of Your Nest Egg to Put Into Stocks? All of It (New York Times)