"Cause baby, now we've got bad loans

You know it used to be mad loans

So take a look what you've done

Cause baby, now we've got bad loans, hey!"

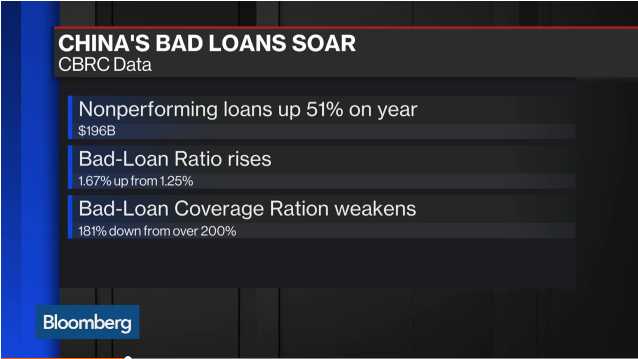

Bad loans at Chinese banks jumped 7% in the fourth quarter and are now topping 1.27Tn Yuan which is, fortunately, "only" $196Bn but still – that's a LOT of bad loans! And, of course, this being China, those are just the ones they are admitting to. If you include "special-mention" loans, where future repayment is at risk but yet to become nonperforming, the industry’s total troubled loans swelled to 4.2Tn Yuan ($648Bn), representing 5.46% percent of total advances made by banks.

"The slower quarterly increase in NPLs are likely to be results of stepped-up efforts by banks to recollect loans, more aggressive write-offs, and some relaxation in their bad-loan recognition standards," said Chen Shujin, a Hong Kong-based analyst at DBS Vickers Hong Kong Ltd. "We don’t expect to see any turnaround of asset quality until the end of this year."

This is why, here at Philstockworld, we turned bearish on 2016 back in the fall (our Institutional Report Service is available here) and now, finally, other Wall Street analysts are catching up, with BAC, JPM, CS et al now dropping their 2016 forecasts by 10% to roughly our 2,000 year-end target (if all goes well) on the S&P. Some of the others are still on drugs, with 2,200 targets but, in the case of Deutsche Bank (DB), I think it's just wishful thinking that maybe that will be enough for them to survive the year intact.

Like the Sinatra song, DB has been up up and down and over and out and, lately, flat on their faces and the problems facing the European Banks aren't so different from those facing the Chinese banks – as they are in any economic downturn as more and more of their business loans become troubled.

There are two major issues driving banks down this quarter, the governments seem to be running out of QE, which has been bailing them out of their mistakes for the last 7 years and, this time, the fact that the banks have refused to lend to consumers has deprived them of a base of mortgage and small loan revenue streams they can fall back on when commercial loans are in a rocky climate. The banks have lived by the commercial loan and now they risk dying by it.

Nonetheless, this is a KNOWN risk – one I got bored talking about over a year ago and we don't even bother talking about China's FAKE economy anymore – because it's kind of obvious now. Still, our 2,000 target for the S&P is based on the current economic climate which includes the fact that we think the Central Banksters have one more round of QE left in them before the wheels finally fall off the wagon – so we have that to look forward to!

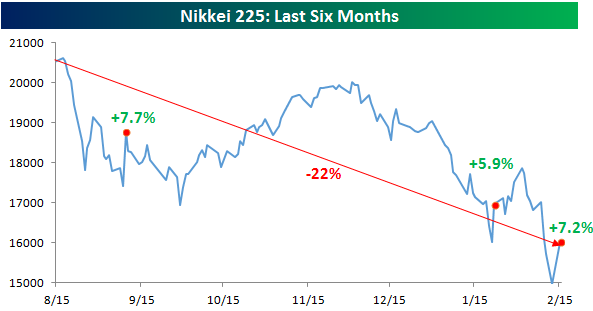

.jpg) In fact, we discussed the BOJ intervening in Last Wednesday's Live Trading Webinar (replay here) and our trade idea at the time was to go long on the Nikkei (/NKD) at 15,700 and, after a poor start, which we used to improve our position – we soared to over 16,000 this weekend, though we got out early at 15,880 as that was very good money on Sunday night (Futures). For the futures challenged, our options trade idea was:

In fact, we discussed the BOJ intervening in Last Wednesday's Live Trading Webinar (replay here) and our trade idea at the time was to go long on the Nikkei (/NKD) at 15,700 and, after a poor start, which we used to improve our position – we soared to over 16,000 this weekend, though we got out early at 15,880 as that was very good money on Sunday night (Futures). For the futures challenged, our options trade idea was:

We haven't done much gambling in the STP lately so let's see if we can turn $2,200 into $3,300 bucks real fast buy buying 40 EWJ March $10 calls for 0.55.

EWJ should open this morning at about $10.75 so we're well on track to a 50% profit in just one trading session – not bad! One of Abe's advisers called for Yentervention over the weekend and that is all it took to spark a short-covering rally on the Nikkei – exactly as we expected. Most of these things are obvious in retrospect, the trick is to get on the right side of the trade BEFORE the news is announced…

EWJ should open this morning at about $10.75 so we're well on track to a 50% profit in just one trading session – not bad! One of Abe's advisers called for Yentervention over the weekend and that is all it took to spark a short-covering rally on the Nikkei – exactly as we expected. Most of these things are obvious in retrospect, the trick is to get on the right side of the trade BEFORE the news is announced…

Now we can move onto oil, the other thing that is driving the markets crazy. Oil prices went on a tear last week, from $25 back to $30 on rumors that there would be an OPEC meeting regarding EMERGENCY PRODUCTION CUTS to stem the rising tide of surplus oil. Remember that term – EMERGENCY PRODUCTION CUTS – because it matters. Now, what actually happened is that, over the weekend, Saudi Arabia, Russia, Qatar and Venezuela agreed that they wouldn't INCREASE PRODUCTION LEVLES above the record-high January output AS LONG AS OTHER MAJOR OIL PRODUCERS FOLLOW SUIT VOLUNTARILY.

I know, WOW, powerful stuff, right? Obviously news like that sent oil prices skyrocketing, hitting a high on the NYMEX of $31.50 (which we caught this morning on /CL Futures) before falling back below the $30 mark again as people who understand words began reading the actual statements.

We're still long on oil. We made a very aggressive play in our Options Opportunity Portfolio (sign up here), when oil hit $27.50 – as that's a bottom we're willing to bet holds up into our July time-frame ($35+ is our target). We certainly didn't expect to hit it this week but we'll take it if it comes. Meanwhile, as I said on Money Talk last week, we don't expect oil to come back in any meaningful way and, to prove my point – despite very low oil prices in 2015, a record $329Bn was spent on Global Clean Energy Projects.

$126Bn was spent on Clean Energy in 55 Emerging Markets in 2015, up 39% from the year before despite all the economic woes. China spent $110Bn, double that of the US and Europe. “These figures are a stunning riposte to all those who expected clean energy investment to stall on falling oil and gas prices,” said Michael Liebreich, founder of the London-based research arm of Bloomberg LP. “They highlight the improving cost-competitiveness of solar and wind power.”

New wind and solar power accounted for about half of all new generation last year. Around 64 gigawatts of new wind power and 57 gigawatts of new photovoltaics was added, representing an increase of 30 percent from to 2014. As a result, the U.K. was by far Europe’s strongest market, despite Prime Minister David Cameron’s effort to roll back incentives for the industry. Renewables investment in the U.K. rose 24 percent to a record $23.4 billion from 2014.

This is a macro that is not going away folks. As wind, wave and solar conversions get more efficient, more and more of our energy use will switch to renewables and, though our grid does not run on oil (but it does run on gas, coal and nuclear), Chevy, for example, is rolling out the all electric Bolt this year, which gets the same 200 miles on a charge as a Tesla, but for about $35,000 and that's just $27,500 with electric incentives.

This is a macro that is not going away folks. As wind, wave and solar conversions get more efficient, more and more of our energy use will switch to renewables and, though our grid does not run on oil (but it does run on gas, coal and nuclear), Chevy, for example, is rolling out the all electric Bolt this year, which gets the same 200 miles on a charge as a Tesla, but for about $35,000 and that's just $27,500 with electric incentives.

Let's say that only 2M electric cars are sold in 2016. The average driver drives 15,000 miles a year and our current fleet averages 22Mpg but worse for older cars. That's 682 gallons of gasoline and that would be 16 barrels of oil (though it doesn't all convert to gas, of course). 2M electric cars means you don't need 32M barrels of oil which adds an extra 615,000 barrels a week to our inventory and next year, if we sell 4M electrics, as projected, now we need 2Mb/week less than we do now.

That's bad enough but then OPEC has to worry about trucks going hybrid or, eventually, all electric or natural gas – which we don't need from them. So oil is in a long-term decline all the way to irrelevancy but it will take decades to wind down (as did steam engines when internal combustion came along) but, eventually, it will die and poor OPEC has a 40-year supply sitting in the ground and their worry is the World may only want oil for 20 more years and then they'll be stuck with the stuff.

So of course they will sell as much of it for whatever they can get for now and you won't get a real cutback.