There, is that clear enough of a call?

There, is that clear enough of a call?

FU people who don't pay, this is a private post for our Members and I've already put out an Alert to our Members (tweeted it too at 6:14) in which we analyzed Germany's ZEW, the Australian Central Bank Meeting, China's Bond Market and the continuing effect of the Doha Failure (see yesterday's post) that had us shorting /CLM6 contracts at $41.50 (now $41.58) in anticipation of a sharp correction into tomorrow's NYMEX rollover (2:35 pm, EST). As to the indexes, my comment this morning was (and is):

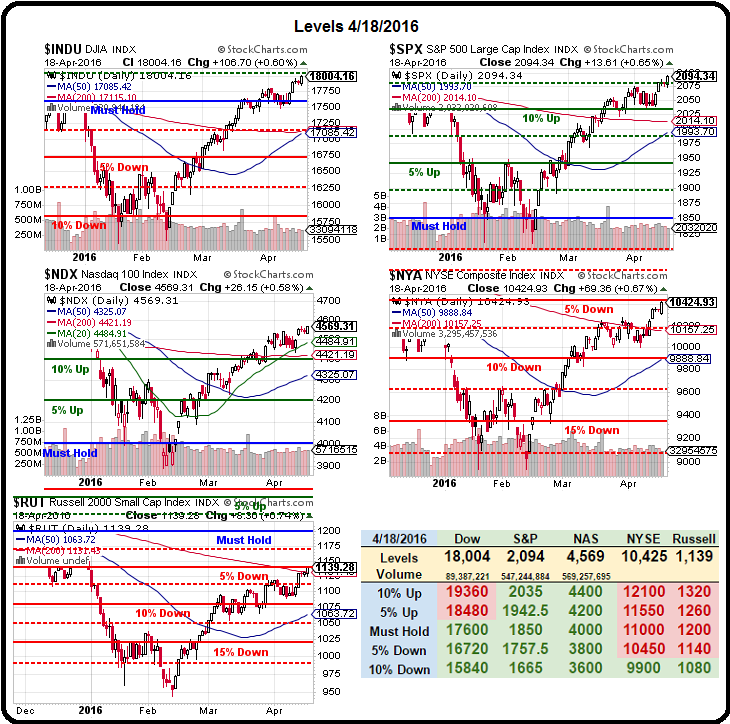

It is tempting, however, to play a Futures short here – in case we are rejected at 2,100 on /ES (now 2,097.50) and that's lined up with Dow (/YM) 18,000 (now 17,995), 4,585 on /NQ and 1,145 on /TF and 17,200 on /NKD. You know the rules – short the last 2 of the 3 to cross below, but they are all below now, so we short the closest to the top (/YM or /ES) and we stop out if ANY of them go over!

This is not rocket science folks. I made the call after IBM had a miss that cost them $6 (48 Dow points) and before GS missed too and they are down $2 (8 Dow points). Netflix (NFLX) is down 10% on their disappointing earnings as well and the only think holding up the oil market is the Kuwait strike, which is taking 2Mb/d off the market but could end at any moment. Oh, and the weak Dollar that's been supporting everything this week.

We don't need to talk about news and the Fed is done speaking for the week and no interesting data until Japanese Trade Wednesday and then Thursday gets busy again but between now and then is earnings and earnings kind of suck, on the whole, with -8.3% earnings vs. last year BUT, because expectations were SO LOW, that's an 8.2% "upside surprise". I know I sound like your older brother telling you that Uncle Market isn't really pulling coins out of your ear and it's just a trick – you kind of know it's true, but you don't really want to believe it…

Still, skepticism doesn't stop us from making money. The July /NGN6 contracts we played in yesterday's post gave us a great entry under $2.13 and popped over $2.20 this morning for a $700 per contract gain (which we're happy to take off the table (1/2 off under $2.20 with stops below $2.19 on the rest), of course).

Still, skepticism doesn't stop us from making money. The July /NGN6 contracts we played in yesterday's post gave us a great entry under $2.13 and popped over $2.20 this morning for a $700 per contract gain (which we're happy to take off the table (1/2 off under $2.20 with stops below $2.19 on the rest), of course).

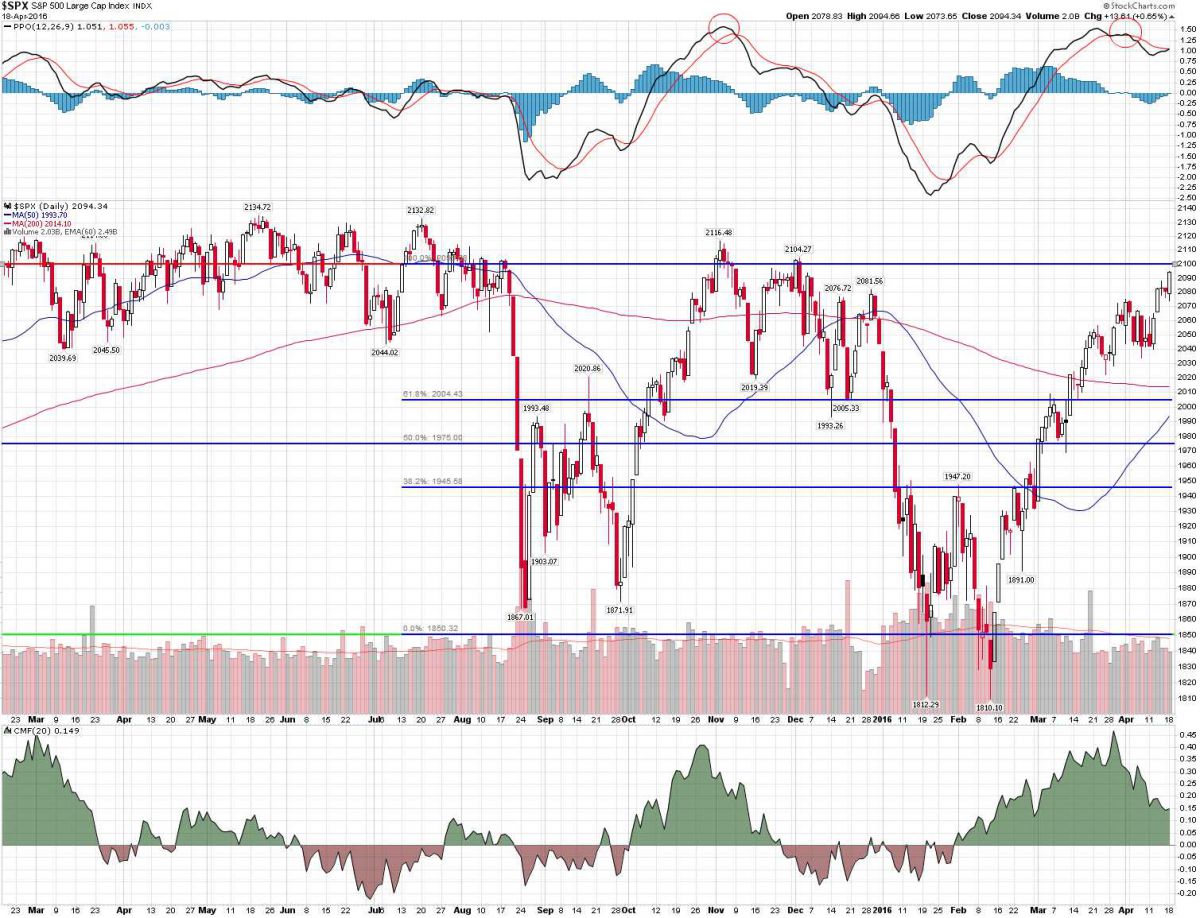

Getting back to the indexes, though, we don't want to be fighting the Fed(s) on this one so we're not going to have a lot of conviction shorting BUT we can play for a nice, technical rejection off 2,100 and 18,000 – especially when we know that, Fundamentally, these are ridiculous levels anyway. Taking a look at the S&P, we're right back where we finished off last year and we know that was a complete load of nonsense because it collapsed in a puff of smoke over the next 3 weeks.

That market sell-off was presaged by the cross of the 200 and 50-day moving averages which, at the time, we thought was being manipulated to show fake strenght comming off the September lows. This is the chart from December 7th, when I warned that:

That market sell-off was presaged by the cross of the 200 and 50-day moving averages which, at the time, we thought was being manipulated to show fake strenght comming off the September lows. This is the chart from December 7th, when I warned that:

Money is flowing into equities because, like Richard Gere, it simply has nowhere else to go. With negative interest rates, if you put your money in the bank, it's GUARANTEED to get smaller. The Housing and Commercial Real Estate markets are still fairly dead and usually perform poorly in rising rate environments, Precious Metals aren't precious anymore, Energy Investing is suicide and the last time the Fed had a tightening cycle in the 90s, the value of 10-year notes slipped 75% – no one wants to be caught in that trap again.

Still, I don't believe in a rally that has no Fundamental basis. Just because money is being forced into the market – that doesn't mean I should follow it when I'm not being forced. That's just lemming-like behavior and we, as humans, strive to be better than that, don't we? I know it's hard when ALL of your friends are jumping over a cliff not to do so yourself – especially when you can hear them shouting "wheeeee!" on the way down so you're sure they are having fun and things can only get better at the bottom, right?

OPEC failed to curtail production at Friday's meeting and oil is diving below the $40 mark and the biggest economic issue we are ignoring in the US is the impact these prices will have on the US energy sector, whose costs are significantly higher than OPEC's overall. Probably about half the oil in the US is not profitable under $40 and, when recalculating the value of reserves and asset to loan ratios next year – using the 2015 average vs the 2014 average is going to probably put a lot of companies into a technical default by Q116.

Investors and analysts are now keenly awaiting the US earnings season and a round of lending redeterminations, in which banks are expected to cut credit facilities available to oil and gas companies. “The one hope is that earnings bounce back and company cash flows improve,” UBS's Steve Caprio added, “if that doesn’t happen, companies will have debt to pay off and it is unclear how they’ll pay it.”

To that end we're adding a speculative long on SJB for our Options Opportunity Portfolio (OOP), thanks to a very good observation by Hanjongin, who's a brand new Member – so now the pressure is on him as we'll be expecting trade ideas every day! 8)

As to the S&P itself, like all of our indexes it's primarily Bot-traded – as evidenced by how perfectly the Fibonacci Lines (numbers in the middle) line up with our 5% Rule™ Lines and you can see how well-behaved the index has been within the range. While we can certainly hang out at these overbought levels for a month or two – it only takes one more straw to break the market's back – and you never quite know which straw it will be.

We can't force the markets to go lower – even if it's right for them to do so. All we can do is take advantage of the opportunity to lighten up on our longs as they get back to their highs and press our hedges and, if we're wrong and there ends up being a well-confirmed breakout towards new highs – then the hedges give us plenty of room to put capital back to work as we pick up the stragglers who haven't punched back up to record levels yet.

The nice thing is – there's tons of those stragglers because it's been a very narrow, low-volume rally – leaving thousands of stocks closer to their 52-week lows than their highs. So yes, you may have missed a chance to get JNJ for under $100 or MCD under $125 but CAT is still under $80 and we just picked PFE in yesterday's chat and AAPL still has a lot of room to run at $107.50 – like I said, THOUSANDS of stocks are still cheap – let's not rush things and make SURE we get the good ones!