Courtesy of Declan.

Microsoft and Google are doing their bit to kill the momentum of this respectable rally. While the short term picture gives bears an angle to work with it’s going to take more to suggest this rally is done.

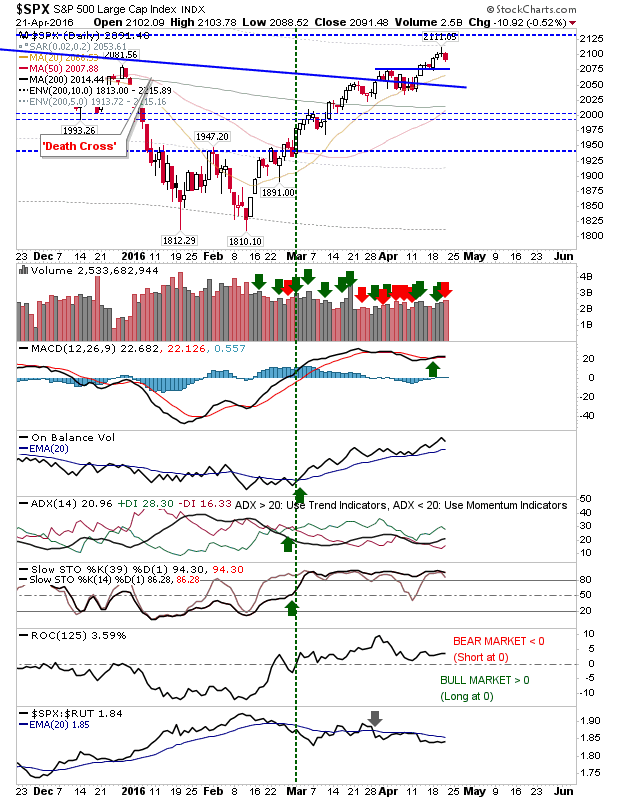

The S&P had experienced profit taking with higher volume distribution on a bearish evening star. Technicals haven’t turned yet, so it’s a pure price reversal at the moment, and it’s early days.

The Nasdaq hasn’t yet felt the full force of tech selling, but today’s action continued yesterday’s indecisiveness. Today finished with a MACD trigger ‘sell’ but also a relative strength gain to the S&P. Rate-of-Change has remained above the bullish zero line through April, which is another tick in the bull column. Google will likely change all that tomorrow, so watch for reaction should the 20-day MA be tested.

The Russell 2000 is sticking to channel resistance. Unlike the Nasdaq, Rate-of-Change has remained below zero – a bearish marker. Other technicals remain bullish and relative strength is easing back after the recent surge against the Nasdaq.

The Dow pulled back bang on resistance in a possible move to the 20-day MA. There is a ‘Golden Cross’ between 50-day and 200-day MA which improves the long term picture and offers a follow through target down of the 50-day MA should selling expand.

Earnings will likely continue to dictate whether markets continue to sell off into a second day. Shorts have been driving the rally in recent days, but they may sniff an opportunity if they can take indices down another notch tomorrow. Certainly, long term buyers will be reluctant to drive things until all-time highs are breached.

You’ve now read my opinion, next read Douglas’ and Jani’s.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for “fallond”.

If you are new to spread betting, here is a guide on position size based on eToro’s system.