Courtesy of Lee Adler (originally published at David Stockman's Contra Corner)

There’s so much great data in the Commerce Department’s monthly new home sales report. It’s always useful to parse it for all the tasty morsels that the mainstream media ignores. We’ll take a look at some of it here, with more to come in the days ahead.

First let’s look at the usual positive spin given the report in the mainstream media which is usually devoid of historical perspective whatsoever. It’s always about the short run. The Wall Street Journal’s headline said it all.

U.S. New-Home Sales Posted Solid Gain in First Half of 2016

Solid pace offers fresh evidence of healthy momentum in the U.S. housing market as home-buyers enjoy low interest rates

All of that is true, but it doesn’t tell the whole story. To his credit, the Journal’s Ben Leubsdorf noted in the body of the article that “the pace of home construction and purchases of new homes remain depressed compared with levels seen during past economic expansions” but he never addressed just how weak those sales are.

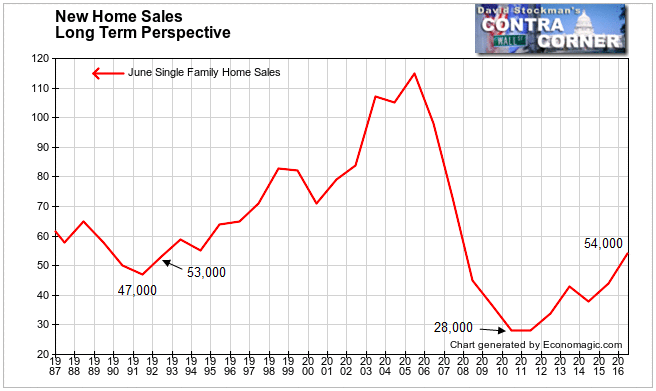

Here’s some perspective.

Sales have nearly doubled from the June 2010 and June 2011 lows of 28,000 to this June’s 54,000. But this is still down sharply from the June 2005 peak of 115,000 units. At the same time, it barely exceeds the low of 47,000 reached in June 1991 and 53,000 in June 1992 during that recession.

US population has grown significantly over this period so it’s useful to consider the data on a population adjusted basis. The sales rate this June was 166.7 per million people. That’s a nice gain from the rate at the bottom of the housing collapse in 2010 and 2011 when the June sales rate hit 90.5 and 89.8 per million. But it’s a long way from the June 2005 level of 388.6 per million, when the housing bubble was at peak momentum.

The 2005 level was clearly overheated and unhealthy. It’s not a good benchmark for judging just what is a healthy market. But the current recovery has not even reached the level of the 1991 recession bottom when the sales rate was 185.6 per million. At that time, mortgage rates were around 10%. That compares with mortgage rates just over 3% today, thanks to central bank market manipulation. Likewise the current sales rate barely exceeds the June 1981 rate of 165.4 per million, when mortgage rates were 16%.

Sales haven’t recovered more because low mortgage rates are stimulating tremendous housing inflation. That offsets the lower mortgage interest cost, making homes less affordable. The housing price inflation has been been far greater than the gains in nominal household income. Had the central banks refrained from forcing bond yields, and therefore mortgage rates, down, housing prices would not have risen so much and affordability would have improved. The Fed’s goal, and that of the BoJ and ECB however, was to stimulate inflation at the cost of lower production. In that, they succeeded.

The sweet spot in the new home sales market is the $200-400 thousand range. That’s the range where the most houses are sold. Under standard qualifying ratios, households at or above the median US household income can afford houses in that price range. Households below the median cannot. Builders have focused their efforts on those households above the median.

From the 2002 recession until this year, nominal median household income has risen by approximately 32%, using estimated 2% increases for 2015 and this year, which is consistent with the BLS data on nominal wage growth. However, the rate of sales per million people has declined by almost 22% over that period. This chart starkly illustrates the problem. It is why central bank money printing can’t boost the economy. It causes asset price inflation not just in securities, but in fixed assets like housing. As the pool of excess labor has grown, household earnings have failed to keep up with the housing inflation rate, causing housing production to languish.

The answer of the central banks to the problem of weak economic growth in recent years has been always the same: print more money and keep interest rates at zero, or even below zero. It’s a solution that can never work because it is the source of the problem, which is asset inflation.

We’ll have more on the new home sales patterns and their implications later.