Unintended Consequences

Courtesy of Paul Price

Excerpt:

The investment implications that accompany the positive sounding "Fiduciary Rule" push advisors and retirement plan administrators in just one direction. Fear of being sued makes anything other than the "lowest cost provider" legally fraught situation.

The safest choices for financial professionals (not necessarily for clients) become:

- 1) Index Funds or ETFs with super-low expense ratios

- 2) Computer Directed Robotic-Investing Programs

There is one common denominator with both alternatives.

They eliminate all human thought from the investing process.

Send money to an index fund and it will instantly allocate it proportionally among the components of the underlying index. Hand your money to a robotic-investment program and it will be parked in a standard assortment of asset classes without regard to any research analysis.

Do you really want your life savings dependent on a computer-generated algorithm? That recent self-driving Tesla fatality resulted from a similar leap of faith.

Set aside concerns about computer control. Consider what else the trend towards unthinking investment means. As greater sums are funneled into similar categories, like S&P 500 index funds, demand for the shares included will be artificially ramped up.

In a supply/demand world, this implies ever growing valuations for those 500 largest stocks. We've already experienced major P/E expansions in most blue chip names.

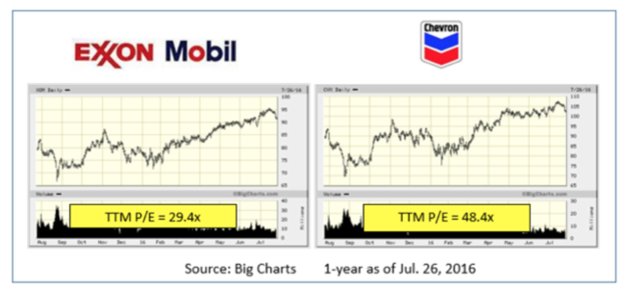

Integrated oils like Exxon Mobil (NYSE:XOM) and Chevron (NYSE:CVX) are trading near their 52-week highs even though profits are way down and crude is sinking again. Allocations to energy stocks require ETFs and index funds to own them, regardless of the lack of investment merit.

Human intervention suggests profit-taking is in order when shares get too expensive. However, computer programs and automatic indexing simply keeps buying as net money continues flowing through the doors.

Central bank QE programs in Europe and Japan are already buying corporate securities along with their sovereign debt purchases. That incremental demand also gets shuttled right into the same mix of big-name stocks.

On April 24, 2016, Bloomberg reported,

(Dr. Paul Price is a regular contributor to Real Money Pro, Seeking Alpha, Guru Focus and now to Lowenthal Capital Partners. Learn more about LCP's newsletter here.)