Courtesy of Lee Adler of the Wall Street Examiner

I’m not here to argue whether the July report was lousy or not. The US economy may well be spawning big numbers of crappy low paying jobs. Withholding tax collections were huge in the last 4 weeks of July. We know that that didn’t come from big wage gains by existing workers. They’re running at about a 2.5% annual growth rate. So when tax collections increase by a significant margin over a similar period a year ago, it suggests that there were new jobs, maybe a lot of them.

I’m not here to argue whether the July report was lousy or not. The US economy may well be spawning big numbers of crappy low paying jobs. Withholding tax collections were huge in the last 4 weeks of July. We know that that didn’t come from big wage gains by existing workers. They’re running at about a 2.5% annual growth rate. So when tax collections increase by a significant margin over a similar period a year ago, it suggests that there were new jobs, maybe a lot of them.

I’m also not here to argue that the headline number bears any semblance of reality. The headline number is the seasonally adjusted month to month gain in the estimated number of jobs. The whole process of seasonal adjustment is a bogus attempt to smooth a jagged trend with peaks and valleys into a continuous modified moving average. The number is a fiction. Because it’s based on a moving average it has a built in lag, for which statisticians try to compensate with a bunch of statistical hocus pocus. That includes constantly revising the number based first on subsequent surveys, and then on benchmarking the data with actual tax collections in the 5 subsequent years. Not only is the number revised twice after the first month it’s issued, but it’s then fit to the curve of actuality for the next 5 years until the reading is finalized. July’s reading won’t be final until July 2021. The process is really “seasonal finagling.” It’s abstract impressionism. It’s a joke.

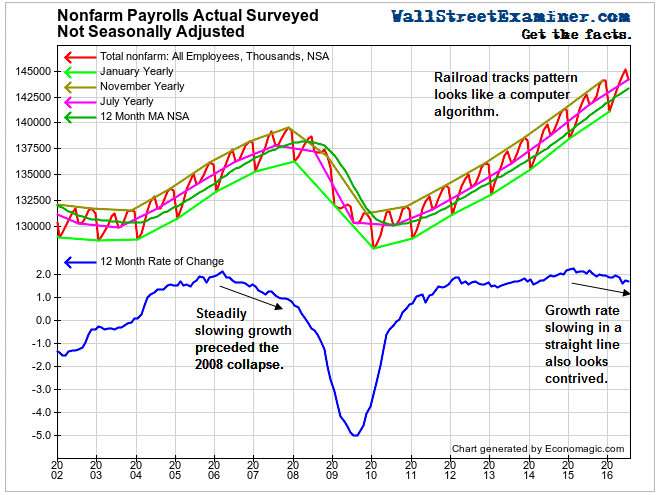

What I have come to argue here is that the not seasonally adjusted (NSA) numbers, which I have always relied upon in my analysis of the jobs trend, is probably also a joke. Look at this chart. Do those railroad tracks look like the real world to you, or are these some kind of computer generated auto-numbers that merely make a pretense of reality. Law of Large Numbers or not, I have never seen any other economic series behave with such regularity.

This is a farce, a sham. But it doesn’t matter because the economy doesn’t matter. The world’s central banks have attempted, and largely succeeded, in rigging the financial markets. One of the consequences, intended or unintended, is that the bulk of the benefit of that rigging flows to the US financial markets. That has been so been since 2009. The US market has been and remains today, the Last Ponzi Game Standing. All roads lead to the US.

Joe Granville once asked, and answered:

What does the stock market have to do with the economy?

Absolutely nothing!

I would only partly agree. Because the Fed follows and ultimately will react to strengthening economic data by beginning to tighten monetary policy in earnest. There are reasons to believe that the data could strengthen markedly between now and early November. This is not only because the Administration has the ability to, if not manufacture data then at least to influence it. It can do so both through its management of the data and through a means more direct and concrete than that.

The Federal Government is sitting on a record cash hoard for this time of year of $258 billion. It could easily spend an extra $70-80 billion per month in extra discretionary spending to goose economic activity leading up to the election. They already spent $42 billion of that cash pile over the past month. During the same period of 2015, the government spent just $8 billion of its cash reserves.

The fix is in. Look for a big boost in Government spending over the next 3 months to goose the economy. And be ready for the Fed to react. By then the economy and the markets could be in full blown blowoff mode.

Thence cometh the inferno.

Follow the macro liquidity trends flowing toward and through the US markets in the Wall Street Examiner Pro Macro Liquidity reports. The monthly updates for the end of July were posted this week. Try the service today, risk free for 90 days.

Copyright © 2014 The Wall Street Examiner. All Rights Reserved.