Courtesy of Pam Martens.

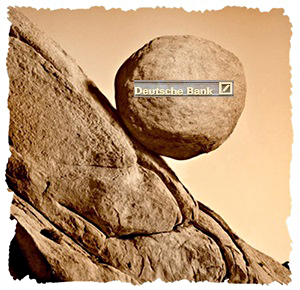

The old adage that when one is already in a hole, one should stop digging, has apparently not found its way to the corner offices of Deutsche Bank. After a non-stop two years of scandals, the Bank has decided to take its shareholders on another heart-thumping cop car chase by publicly feuding with the U.S. Justice Department. After the Wall Street Journal reported in the wee hours this morning that the Justice Department was proposing a fine of $14 billion for Deutsche Bank’s involvement in tricking investors with toxic mortgage backed securities, the Bank had the tenacity to tell Reuters that it was planning to “fight” the demand. This negotiating tactic sounds a little like something that might have been taught at the Trump Institute.

The old adage that when one is already in a hole, one should stop digging, has apparently not found its way to the corner offices of Deutsche Bank. After a non-stop two years of scandals, the Bank has decided to take its shareholders on another heart-thumping cop car chase by publicly feuding with the U.S. Justice Department. After the Wall Street Journal reported in the wee hours this morning that the Justice Department was proposing a fine of $14 billion for Deutsche Bank’s involvement in tricking investors with toxic mortgage backed securities, the Bank had the tenacity to tell Reuters that it was planning to “fight” the demand. This negotiating tactic sounds a little like something that might have been taught at the Trump Institute.

In just the past two years, Deutsche Bank, Germany’s largest bank with a large trading footprint in the U.S., has been terrifying widows and orphans – not to mention its shareholders. Two of its executives, William Broeksmit and Charles Gambino, hanged themselves. In June of this year the International Monetary Fund issued a report calling Deutsche Bank “the most important net contributor to systemic risks” on a global basis. In the same month, the U.S. Federal Reserve indicated that the U.S. unit of Deutsche Bank, Deutsche Bank Trust Corp., had failed its stress test. The Fed cited “material unresolved supervisory issues” as one of the reasons for the failed grade.

Last year Deutsche Bank settled charges with British and U.S. authorities for $2.5 billion for rigging the interest rate benchmark known as Libor. It pleaded guilty to the U.S. charges.

In 2014 Deutsche Bank, along with Barclays, was the target of an investigation by the U.S. Senate’s Permanent Subcommittee on Investigations. The duo had created an elaborate scheme to assist hedge funds in magically converting millions of short-term trades into long-term capital gains, a much lower tax rate, and thus ripping off the U.S. Treasury of tax revenue. Called “basket options” or MAPS at Deutsche Bank, the bank effectively loaned out its balance sheet to hedge funds to conduct billions of trades each year in trading accounts under the bank’s name, deploying massive leverage as high as 20:1 that is illegal in a regular Prime Brokerage account for a hedge fund client. The banks got paid through margin interest, fees for stock loans for short sales, and trade executions.

This was not the first time Deutsche Bank had engaged in tax dodge maneuvers. According to the final report of the Senate’s Permanent Subcommittee on Investigations, there had been a previous history of tax abuse. The report found the following:

“About ten years ago, Deutsche Bank became the subject of a series of investigations focused on its participation in abusive tax shelters from 1996 through 2002, which aided and abetted evasion of an estimated $5.9 billion in U.S. income taxes. On December 21, 2010, Deutsche Bank and the U.S. Attorney for the Southern District of New York executed a non-prosecution agreement (NPA) related to the bank’s involvement with the abusive tax shelters. Under the agreement, the bank paid more than $550 million to the United States, and the U.S. Attorney and the U.S. Department of Justice (DOJ) agreed not to prosecute Deutsche Bank criminally for participating in abusive tax shelters benefiting its clients from 1997 to 2005, provided the bank met certain requirements.

…