![]() Wow, what a market!

Wow, what a market!

The Futures are up 10 points on the S&P, bringing us back to 2,142 at 7:30 (2,136 on the /ES futures) driven by nothing in particular other then Europe's relief that we rallied into the close so now they are rallying and our futures are rallying because Europe is rallying and if that sounds idiotic to you – welcome to trading! It kind of sucks if you are one of those stock-holding traders waiting for your equities to appreciate but it's unbelievably fun when you play inside the channels.

We started out the day short (and our Live Webinar's short on the Dow ended up making $1,000 per contract) but by 11:30 we were done with that trade as I said to our Members in the Live Chat Room:

Truth or dare time with the EU closing in 10 mins. They've recovered a bit into the close (down 1.25%) so no reason we should go lower now, especially with the Dollar at 97.63 but watch for the bounce off 97.50 as that could add more downward pressure.

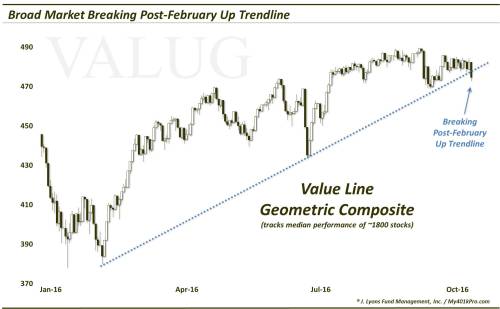

As you can see from the chart, we nailed the turn perfectly and, of course, we did a little bottom-fishing but not much as we really don't trust this low-volume rally (and pre-market is very low volume too) and we already took a stab at shorting the Nasdaq this morning that failed (-$50 per contract) and we also are, of course, back in to short oil at $51, which is the gift that keeps on giving this week. Yesterday we hit $49.50 (up $1,000 per contract) before it turned back up!

We're anxiously waiting for Fed Governor Rosengren to speak at 8:30 and the title of the conference is "The Elusive 'Great' Recovery: Causes and Implications for Future Business Cycle Dynamics" and, as if that isn't enough insure an empty room – I hear the bagels are also terrible. Rosengren's boss is speaking at the same conference at 1:30 so it's unlikely he will make too strong a hawkish case ahead of Yellen's comments. It all hinges on Janet this afternoon – she's definitely the deciding vote at the next meeting, even if she wasn't the Chair.

Meanwhile, the pre-market rally is silly and you can see all these fantastic shorting lines shaping up in the Futures at Dow (/YM) 18,100, S&P (/ES) 2,135, Nasdaq (/NQ) 4,820, Russell (/TF) 1,220 and Nikkei (/NKD) 17,000. The system for shorting is very simple, wait for 3 of the indexes to cross under, then short one of the laggards and then, if any of the indexes cross back over the line – get out! This limits your losses but not your gains so you only have to be right some of the time to make money.

Remember we predicted these bounce lines in Wednesday morning's post using our fabulous 5% Rule™ – there's nothing surprising going on here – these are just the levels we expected to be at on the way to a bigger correction:

Bounce lines to watch for our other indexes (Futures, we don't care about the headline index) are:

- Dow (/YM) 18,075 (weak) and 18,150 (strong)

- S&P (/ES) 2,134 (weak) and 2,140 (strong)

- Nasdaq (/NQ) 4,820 (weak) and 4,840 (strong)

- Russell (/TF) 1,226 (weak) and 1,232 (strong)

- Nikkei (/NKD) 16,900 (weak) and 16,950 (strong)

And no, this is not TA, this is just math. TA is just another form of voodoo… That doesn't mean we ignore it. Frankly, if enough people believe the S&P would go up every time it rains – we'd pay attention to the weather. You have to follow what moves the herd and the beautiful sheeple love their TA because it's easy and requires very little thinking – just some nice pictures to look at and something to blame when your trade doesn't go right.

And no, this is not TA, this is just math. TA is just another form of voodoo… That doesn't mean we ignore it. Frankly, if enough people believe the S&P would go up every time it rains – we'd pay attention to the weather. You have to follow what moves the herd and the beautiful sheeple love their TA because it's easy and requires very little thinking – just some nice pictures to look at and something to blame when your trade doesn't go right.

Nonetheless, that doesn't mean there aren't any TA people we like, you can find them in our Chart School and also you can read Pharmboy's Primer on Technical Analysis, which will make you an expert in no time – or whatever time it takes you to read 82 pages. If you have more time, Fundamental Analysis for Dummies is 384 pages, so you can see why most people stick to TA and 384 pages only scratches the surface on FA but it's really worth learning if you want to really learn what's happening in the markets.

Of course, just learning FA isn't enough from my point of view. I'm a news hog and a data junkie and I simply love this stuff, so this is all nerdy fun for me but most people find it tedious and I realize that. That's why we don't write a lot of long, drawn-out analyst reports at PSW – generally I explain why I like something in a paragraph or two, focusing on the key drivers that make something a good trade. That way, when one of those drivers go off the rails – we know it's time to reconsider our position.

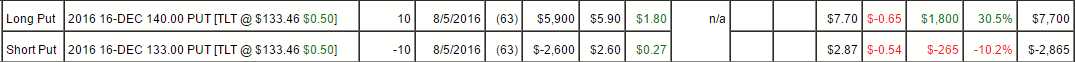

For instance, we have a short on 20-Year Treasuries (TLT) in our Options Opportunity Portfolio (which you can follow over at Seeking Alpha) which was is the Dec $140/133 bear put spread that we bought 10 contracts of in August for net $2,300 and it will pay $7,000 (up $4,700 or 204%) if TLT is below $133 at December expiration (16th) and yesterday we hit our goal at $133 but, as is the nature with spreads, the net of the spread is "only" $4,835 (up 110% in 2 months) but we're sticking with it because our premise hasn't changed and we still have another $2,165 left to gain so, on the whole, this trade is merely "on track" for our full 204% expected gain over 4 months.

If Yellen says something that makes us think there will not be a rate hike at the December meeting (14th), THEN we might take the money and run but, for now, everything we see points to a hike and that means TLT should be quite a bit lower by then – but we only need it to be at $133 anyway! We started shorting TLT way back on July 6th, pretty much nailing the top of that chart – this is just our trade of the moment.

8:30 Update: Our PPI came in hot at 0.3% vs 0.2% expected by the usual Economorons who apparently didn't notice oil went up 15% in the past month. Even ex-food and energy and with a strong Dollar, the Core PPI popped 2% beating expectations by 100% because, well because Economorons! We also got a strong Retail Sales Report, up 0.6% after being down 0.3% in August but the acutal number was $445Bn vs $471Bn in August and the +0.7% is entirely due to "seasonal adjustments". Still, we have to respect the 0.6% headline – that's what traders will key off. In the very least we'll test our bounce lines again.

Surprisingly, "seasonal adjustments" don't show up on the balance sheets of companies who make $26Bn less sales than they did the month before. So, stagnant economy + inflation = Stagflation and that is not a good thing. The Fed is very concerned with the PPI and our man Rosengren is still hawkish, saying "My views haven't changed, but economic conditions have." As we noted in our live Webinar and as we just noted in the PPI – all the Fed's excuses for not raising rates are rapidly melting away. As for overheating right now, he's seeing signs of it in commercial real estate – "running hot" thanks to low rates.

Our oil shorts just stopped out at $50.75 for a disappointing $250 gain for the morning but it's enough to pay for the Egg McMuffins and hopefully we'll get another chance to short at $51 on the knee-jerk reaction to strong Retail Sales but this is the kind of good news that may be bad news – especially if Janet reiterates her call to hike rates by the end of the year – because the year ends in 78 days!

Have a great weekend,

– Phil