By David Trainer. Originally published at ValueWalk.

Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life and Marketwatch.com

No matter how flashy the service, when the provider cannot turn a profit, one must question the viability of the business. With losses piling up, a weak competitive position, and expectations of tremendous profitability already embedded in the stock price, PROS Holdings (PRO: $21/share) is in the Danger Zone this week.

Losses Are Only Getting Worse

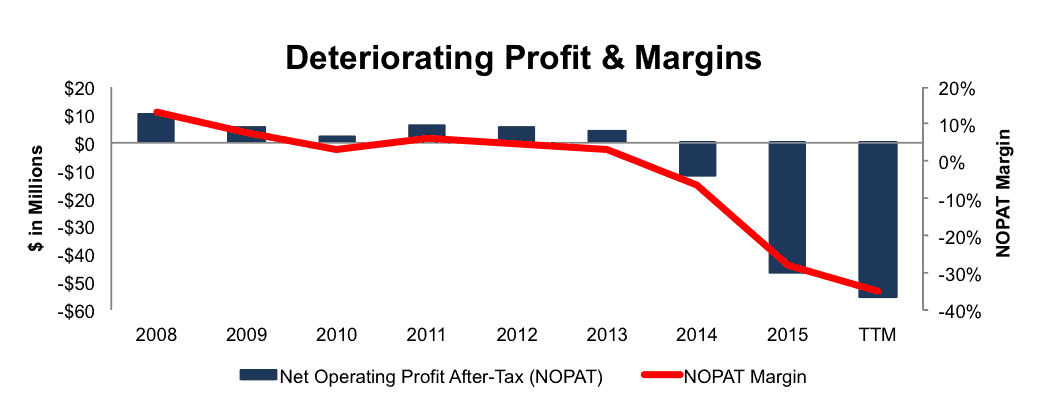

PROS’ after-tax profit (NOPAT) has declined from $10 million in 2008 to -$47 million in 2015, and even further, to -$55 million over the last twelve months (TTM). The company’s NOPAT margin has fallen from 13% in 2008 to -35% TTM, per Figure 1. Such drastic deterioration in PROS’ profitability comes despite revenue growing 12% compounded annually from 2008-2015.

Figure 1: PRO’s Accelerating Losses

Sources: New Constructs, LLC and company filings

PROS Holdings’ return on invested capital (ROIC) has fallen from a once impressive 47% in 2010 to a bottom-quintile -68% TTM. Compounding the above issues, PROS Holdings has burned through $104 million in free cash flow over the past five years.

Compensation Plan Misaligns Executive Interests

Annual cash bonuses are paid out based upon the achievement of numerous non-GAAP goals, including bookings, annual recurring revenue, annual contract value, free cash flow and other discretionary goals. By using multiple non-GAAP metrics, management has significant leeway in determining “business success,” while ignoring the underlying economics of the business. Equity awards are earned based on the company’s total shareholder return in relation to the Russell 2000. In both cases, executives are incentivized by metrics that do little to create shareholder value, and it should come as no surprise that economic earnings, the true cash flows of the business, have declined from $10 million in 2008 to -$62 million TTM. Until executive interests are aligned with those of shareholders, expect further shareholder value destruction. The best way to create shareholder value, and align executives with the best interest of shareholders, is to tie performance bonuses to ROIC, as there is a clear correlation between ROIC and shareholder value.

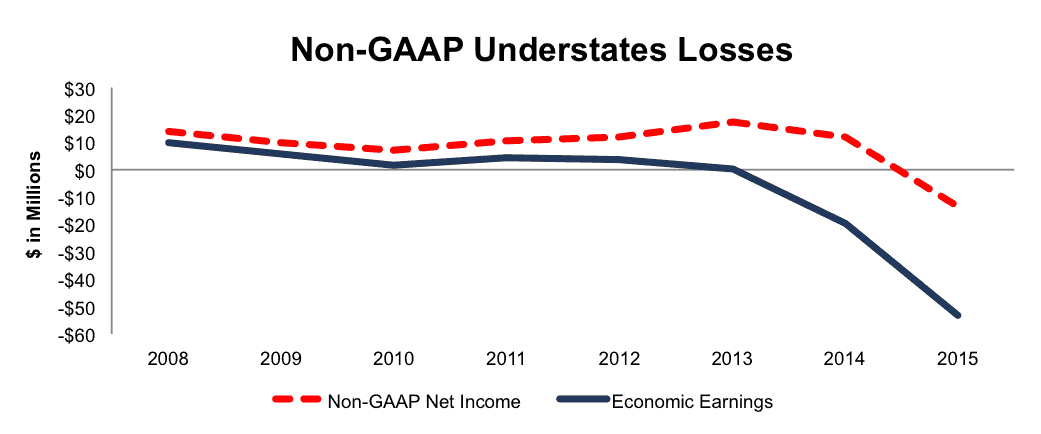

Non-GAAP Metrics Understate Losses

Discretion over which items are removed to calculate non-GAAP metrics gives executives the ability to understate losses and mislead investors into believing a company is profitable. See the dangers of non-GAAP metrics for more. Regarding PROS Holdings, here are some of the expenses PRO has removed in the past or still currently removes to calculate its non-GAAP metrics such as non-GAAP operating income, non-GAAP net income, and adjusted EBITDA:

- Share-based compensation expense

- Acquisition related expense

- Amortization of intangible assets

The removal of these items has a significant impact on the disparity between economic earnings and PRO’s non-GAAP metrics. In 2014 PROS removed just over $22 million in share-based compensation expense (12% of 2014 revenue). Through the removal of this equity-based compensation and other expenses, PRO reported a non-GAAP net income of $12 million compared to GAAP net income of -$37 million. In 2015, the company removed nearly $28 million in share-based compensation expense (17% of 2015 revenue) and reported a non-GAAP net income of -$13 million compared to a GAAP net income of -$66 million. Long-term, PROS’ non-GAAP metrics present the business in a much better light than economic reality. From 2008-2015, non-GAAP net income declined from $14 million to -$13 million. Meanwhile, economic earnings declined from $10 million to -$53 million over the same time frame, per Figure 2.

Figure 2: Discrepancy Between Non-GAAP & Economic Earnings

Sources: New Constructs, LLC and company filings

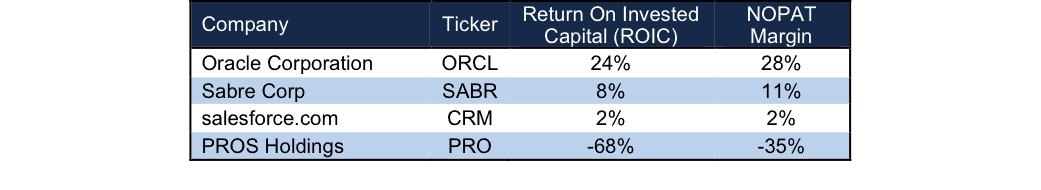

Weak Competitive Position: Negative Profitability In A Highly Competitive Market

PROS Holdings’ solutions for providing pricing and revenue management pit it against some of the largest tech firms in the world, including Oracle (ORCL), Salesforce.com (CRM), and SAP. At the same time, PROS faces competition from smaller firms such as Sabre Corp (SABR), Vendavo, Zilliant, and Apptus. The data analytics market provides plenty of opportunity for a firm to carve out a niche segment. However, with highly negative margins, amidst much more profitable competition, PROS Holdings faces an uphill battle. Per Figure 3, PROS earns an ROIC and NOPAT margin well below three of its main competitors. PROS is at a competitive disadvantage when it comes to pricing power and the ability to reinvest in its operations. With such low margins, it will also have a hard time reaching the lofty expectations baked into its stock price, as we’ll detail later.

Figure 3: PROS Holdings’ Profitability Ranks Well Below Competitors

Sources: New Constructs, LLC and company filings

Bull Hopes Imply Cloud Can Cure All

The market loves a good growth story, particularly a software and/or cloud growth story. Look no further than prior Danger Zone reports on companies such as Box (BOX), Splunk (SPLK), of FireEye (FEYE) for examples of how irrational the market can get when valuing tech firms. PROS Holdings, despite operating since 1985, only recently joined the ranks of cloud companies when it switched its business to a primarily software-as-a-service model rather than a licensing model in mid 2015.

With this switch came a shift in market sentiment, and the stock began trading on non-GAAP metrics such as annual recurring revenue or contract value, while the fundamentals of the firm got pushed to the side. At the same time, bulls will argue this shift to a SaaS model has resulted in the negative profitability. However, this argument ignores the fact that the profitability issues began long before the shift to SaaS and don’t appear to be coming to an end anytime soon.

To make the argument that a shift to SaaS business model is causing near term profitability issues, one must show that profits had been growing prior to 2015. However, per Figure 1 above, PROS Holdings’ NOPAT and NOPAT margin has declined each year since 2011, and only gotten worse over the last twelve months. Furthermore, the costs of running the business are consistently growing faster than revenues. Since 2012, revenue has grown 13% compounded annually. Cost of revenue, selling & marketing, general & administrative, and research & development costs have grown by 22%, 35%, 28%, and 19% compounded annually over the same time. Worst yet, in 2015, when revenue declined 9%, each of these costs continued to grow grew year-over-year. The fact remains that PROS Holdings is unprofitable, whether it operates a licensing model or a SaaS model.

Market expectations for PROS Holdings are to not only grow revenue at impressive rates (as with many SaaS firms) but also immediately achieve profitability. Anything less would fail to meet the lofty expectations implied by the current stock price.

The largest risk to the bear case is what we call “stupid money risk”, which is higher in today’s low (organic) growth environment. Another firm could step in and acquire PRO at a value that is much higher than the current market price. However, we see an acquisition as possible only if a firm is willing to destroy shareholder value.

Is PRO Worth Acquiring?

The biggest risk to any bear thesis is that an outside firm

The post Danger Zone: No PROfit, Big PROblem appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.