This is getting tedious, isn't it?

Now the MSM cheerleaders have taken to saying "if only this" and "if only that" to lament how close the Dow came to making that magical 20,000 mark – as if it means anything other than the markets are officially, ridiculously overbought.

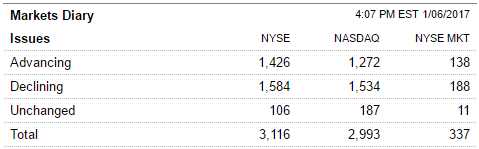

Once again on Friday, down volume exceeded up volume by a wide margin on the NYSE and the number of shares that declined outpaced the number of shares that advanced – which was pretty much the story for the weak as the Nasdaq and the S&P both made all-time highs against a backdrop of this very weak action.

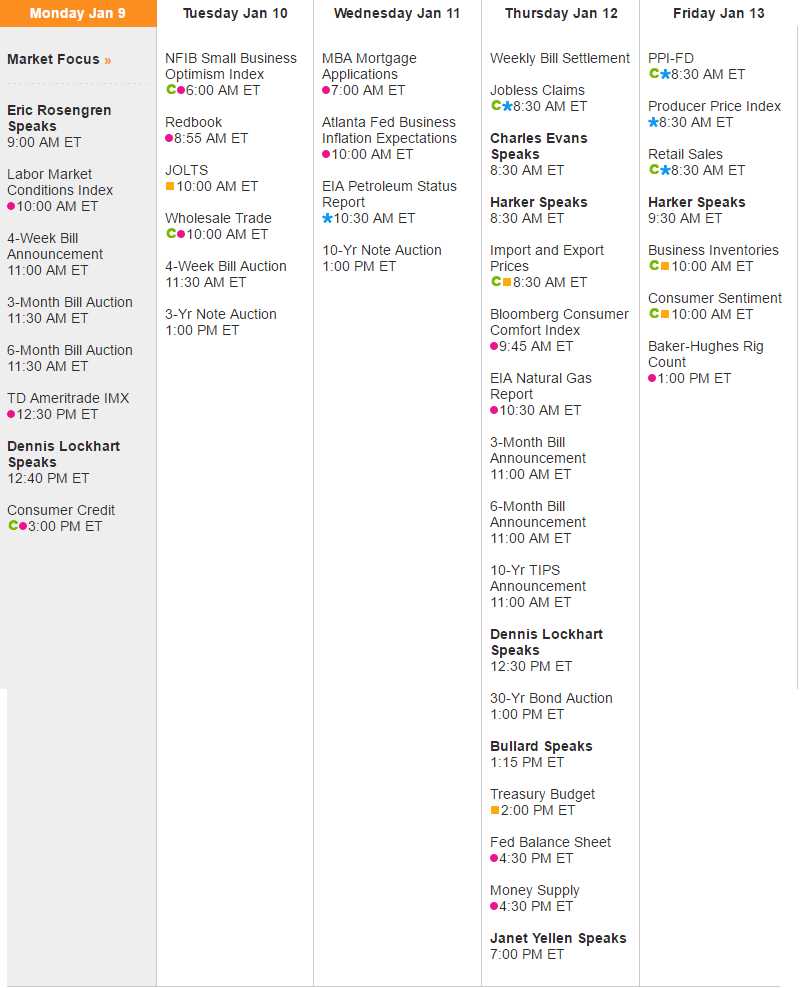

There's not likely to be much help today as 3 potential future Fed Chairmen speaking at this weekends American Economic Association meeting suggested that monetary policy would be tighter if they were in charge. Yellen, who still has a year left in her term, whill speak at 7pm on Thursday in a week with 6 other Fed speeches while the US looks to auction off another $100Bn worth of TBills in a fairly unfriendly environment.

More importantly, it's earnings season and earnings trump data – especially when expectations are for 15% earnings growth in 2017 to justify the insane valuations that are already being given to stocks.

Banking is the sector that is expected to carry most of the weight in earnings growth, followed by Energy and expectations for both seem overblown to me but we'll get a good clue as to the state of the Banking sector as Bank of America (BAC), JP Morgan (JPM), Wells Farg (WFC), PNC (PNC), First Republic (FRC), First Horizon (FHN) and Black Rock (BLK) all report on Friday morning (the morning after Yellen speaks with Harker speaking before the bell Thursday and Friday).

Sounds a bit like the Fed is anxious to put some spin on those earnings, doesn't it?

It's a fairly sure thing that WFC will be impacted by their recent scandal but it's doubful BAC will put up great numbers and JPM is expected to have a fantastic quarter and can easily disappoint while PNC, like BAC, is mainly an ordinary bank and it was a tough year for ordinary banks and rising rates won't make 2017 any easier for them. We already had a shorting idea on the Financials using SKF:

If you think the Financials have gotten ahead of themselves, I like the Ultra-Short Financial ETF (SKF) which has been slammed down 33% since the Summer but seems to be holding up at $30 as the Financial ETF (XLF) runs out of gas at $24. A pullback on XLF to $21 would be 10% down and that should give SKF a 20% pop to $36. If we assume that happens after January earnings, we can play like this:

- Buy 20 SKF Feb $30 calls for $1.80 ($3,600)

- Sell 20 SKF Feb $33 calls for 0.75 ($1,500)

- Sell 5 WFC 2019 $45 puts for $4.50 ($2,250)

This trade has a net credit of $150 and you get another $6,000 back in Feb if SKF is up 10% (if XLF is down 5%) for a $6,150 gain (4,100%) on cash. You carry an obligation to buy 500 shares of Well Fargo (WFC) for $45, but that's 20% below the current price and, of course, the idea is that it's unlikely WFC is doing poorly if the Financials are doing well – so hard to lose on both sides.

That trade is still playable at a better price as SKF fell below $30 last week. We'll check back and see how it's doing next week.

9:00 am update: Rosengren (Boston Fed) spoke and he's saying the Fed is leaning towards 3 hikes in 2017, which is what we (PSW, not economorons) were expecting and it's a bit too bearish for the bulls so, per our headline, it's another day without making that magical 20,000 line.

Also, Goldman Sachs (GS) just downgraded two Dow components, Coke (KO) and Procter & Gamble (PG), both lowered all the way to SELL with a strong dollar and a weak consumer hurting demand. Makes you want to keep BUYBUYBUYing at those all-time highs, right?

Have I mentioned how much I like CASH!!! lately?