By David Trainer. Originally published at ValueWalk.

Dan O’Connor, TechCXO Partner – Guest Contributor

David Trainer, CEO New Constructs

This article originally published here on January 30, 2017.

Executive Summary

Working capital optimization initiatives have not been a high priority for senior executives once the Financial Crisis of 2008 ended. Historically low interest rates have allowed enterprises to borrow their way out of any potential cash bottlenecks. When credit is cheap and plentiful, why should companies care about generating cash from working capital?

For one thing, any money unnecessarily tied up in inventory, receivables, and payables is money that can be used to self-fund strategic initiatives such as R&D or acquisitions. Low interest rates will not last forever, and executives need to focus on funding sources other than debt. Working capital represents a significant portion of most companies invested capital base (working capital, PP&E, Goodwill and other intangibles). Organizations that focus on capital efficiency performance realize the following benefits:

- Reduce reliance on external debt/equity capital

- Increase cash flow

- Reduce operational and financial risks

- Reduce stock price volatility and cost of capital

- Higher enterprise valuations from the investment community

Leveraging data and analytics provided by New Constructs, we calculated working capital metrics for each company included in the Russell 3000 Index as of November 30, 2016. Previously, conducting such an analysis was infeasible due to technology limitations and scalability challenges. From this analysis, we show that working capital metrics fluctuate significantly within sectors, especially between the top quartile companies vs. the bottom quartile companies. Across sectors, differences in working capital metrics can be more than 50 days.

Based on our analysis, we estimate that Russell 3000 companies can free up between $600 billion to $1 trillion by focusing on working capital optimization initiatives.

We conclude with a “Call to Action” for senior executives to take a holistic view of their organization and concentrate on the following working capital initiatives to drive sustainable shareholder value creation:

- Assessment of Working Capital Processes

- Define Desired Outcomes

- Formulate Solutions

- Align Stakeholder Expectations

The Analysis

We conducted an analysis – as of November 30, 2016 – of companies included in the Russell 3000 to calculate working capital metrics and identify the top sectors for working capital efficiency. For purposes of this analysis, working capital metrics are calculated as follows:

- Days Sales Outstanding (DSO): 365 Days Divided by Accounts Receivable Turnover or

365 / (Revenue/Ending Accounts Receivable)

- Days Inventory Outstanding (DIO): 365 Days Divided by Inventory Turnover or

365 / (Revenue/Ending Inventory)

- Days Payable Outstanding (DPO): 365 Days Divided by Accounts Payable Turnover or

365 / (Revenue/Ending Accounts Payable)

- Cash Conversion Cycle (CCC): Days Sales Outstanding plus Days Inventory Outstanding less Days Payable Outstanding (DSO + DIO – DPO)

In summary, it is advantageous for a company to minimize their DSO, DIO, and CCC metrics as working capital is not free – there is a cost for carrying working capital. On the flipside, it is advantageous for a company to maximize their DPO metric as the company is conserving cash. However, working capital metrics should be optimized by taking into consideration special terms negotiated with key customers that impact DSO, avoiding stock outs that impact DIO, and creating cash flow challenges for vendors that impact DPO.

New Constructs Analytics

Leveraging data and analytics provided by New Constructs, we calculated working capital metrics for each company included in the Russell 3000 Index. Previously, conducting such an analysis was infeasible due to technology limitations and scalability challenges. New Constructs has solved the technology challenge by automating the data gathering from SEC filings (including accompanying footnotes) that are required for the proper analysis of each company’s working capital metrics. Accounting distortions are removed for each company, providing a standardized, “one version of the truth” to benchmark each company against peer groups and across industry sectors. New Constructs updates it data base daily, so working capital metrics are available in real time.

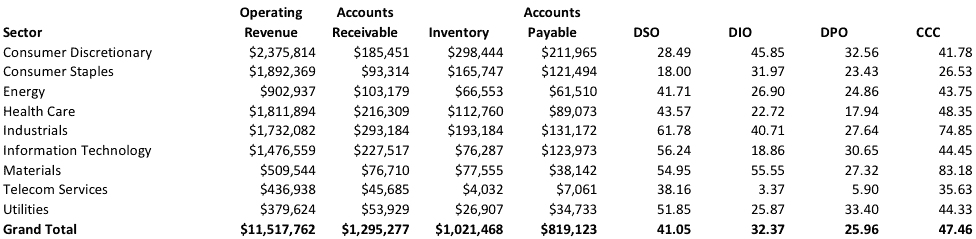

Summarized in the table below are the working capital metrics (as of November 30, 2016,) for non-financial companies included in the Russell 3000 by sector:

Table 1: Russell 3000 (Figures in Millions of USD)

Sources: TechCXO, New Constructs, LLC, and company filings

- Working Capital as a % of Total Revenues is Significant: Total working capital for the Russell 3000 ($1.5 Trillion) represents 13% of total revenues ($11.5 Trillion). Accounts receivable represents the largest component of working capital. For the non-financial companies in the Russell 3000, their working capital metrics were as follows: DSO (41 Days); DIO (32 Days); DPO (26 Days); and CCC (47 Days).

- Metrics Vary Significantly Within and Across Sectors: Working capital metrics fluctuate significantly within sectors, especially between the top quartile companies vs. the bottom quartile companies. Across sectors, differences in working capital metrics can be more than 50 days:

- DSO: Consumer Staples Sector had the best DSO (18 Days) while the Industrial Sector had the worst DSO (62 Days).

- DIO: Telecom Sector had the best DIO (3 Days) while the Materials Sector had the worst DIO (56 Days).

- DPO: Utilities Sector had the best DPO (33 Days) while the Telecom Sector had the worst DPO (6 Days).

- CCC: Consumer Staples Sector had the best CCC (27 Days) while the Materials Sector had the worst CCC (83 Days).

Cheap Debt

When credit is cheap and plentiful, why should companies care about generating cash from working capital? For one thing, any money unnecessarily tied up in inventory, receivables, and payables is money that could be invested in strategic initiatives or returned to shareholders. Low interest rates will not last forever, and executives need to focus on funding sources other than debt.

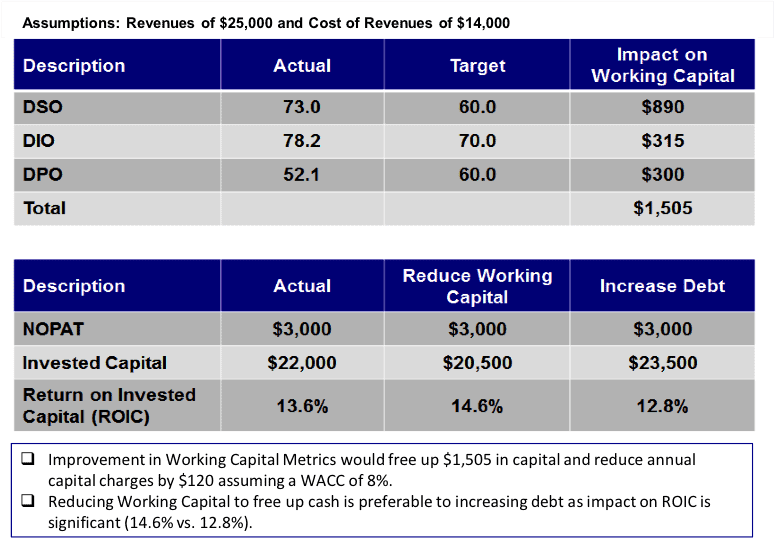

Also, reducing working capital to free up cash is preferable to borrowing funds from a shareholder value / enterprise value perspective. In the example below (Table 2), we demonstrate how freeing up cash tied up in working capital improves a company’s Return on Invested Capital (ROIC) – while holding Net Operating Profit After Tax (NOPAT) constant – and shareholder value due to improved capital efficiency

Table 2: Freeing Up Working Capital vs. Increasing Debt

Sources: TechCXO, New Constructs, LLC, and company filings

Capital allocation is a senior management team’s most fundamental responsibility. The objective of capital allocation is to build long-term value. This principle is fundamental to value creation and the integrity of the capital markets. It applies to publicly-traded and privately-held companies at all stages of the life cycle. Capital efficiency is measured by the metric Return on Invested Capital. ROIC more impact on Enterprise Value than any other metric. For additional insights on the importance of ROIC as driver of enterprise value, see ROIC: The Paradigm For Linking Corporate Performance To Valuation.

Increasing ROIC by just 1% can lead to significant increases in a company’s operating profits & enterprise value. For example, if a company’s ROIC is 8%, and its WACC is 8%, a 1% increase in ROIC leads to a 12.5% increase in Net Operating Profits and a 12.5% increase in enterprise value / shareholder value.

Recent surveys of finance executives show that only 20% say that all of their company’s liquidity needs are met through working capital. CFOs realize that their ability to finance their company’s growth initiatives depends on their finance function’s skill at improving working capital

The post The $1 Trillion Plus Opportunity in Working Capital Optimization in the Russell 3000 appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.