Courtesy of Declan.

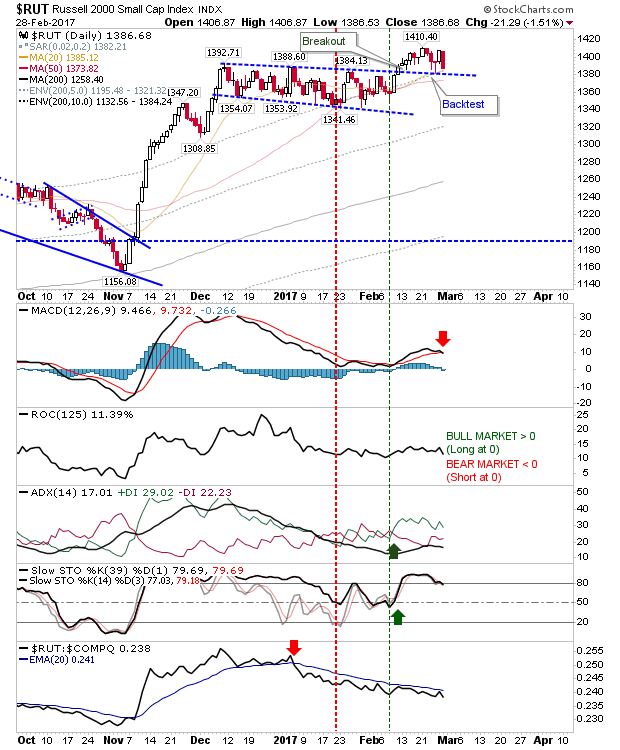

After successfully defending former resistance turned breakout support, the Russell 2000 experienced a relatively heavy reversal. It hasn’t yet given up breakout support, but the index now finds itself back at the 20-day MA. It did so with a ‘sell’ trigger in the MACD and another relative loss in performance against the Nasdaq

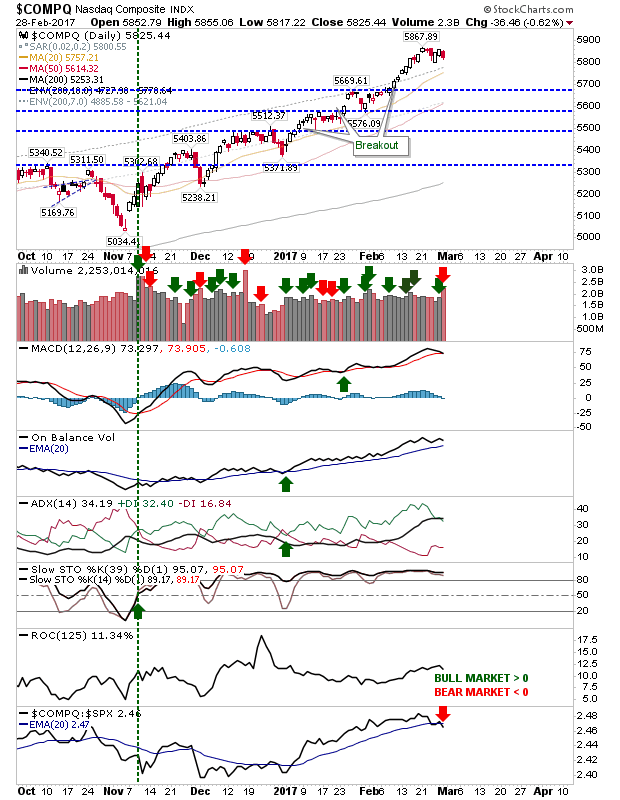

The Nasdaq also lost ground on heavier volume distribution. If there are further losses look to the 20-day MA at 5,727 for support. Otherwise, hard to be buyer before there is a support test, and shorts would be taking a risk assuming 5,867 holds as a swing high.

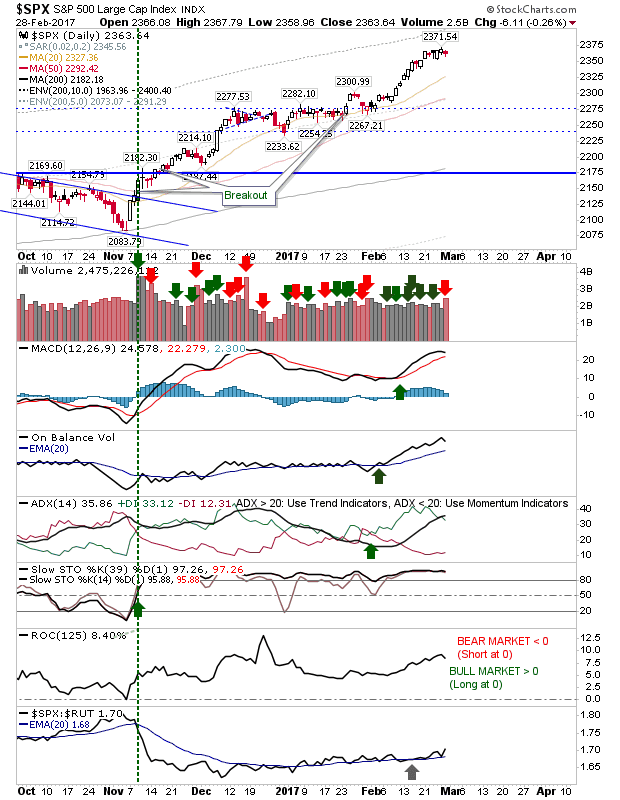

The S&P has been the index of defensive choice. And while it just experienced a 0.26% loss it did come with higher volume distribution. The smaller loss meant there was another uptick in relative performance.

Also to watch is the Semiconductor Index. It drifted below the rising channel which had been threatened last Friday (but it came back strong by the close). The lower rising trendline is looking a better test into the summer months. Technicals are negative, but not net negative.

For tomorrow, watch to see how the Russell 2000 tests breakout support, and if the Semiconductor Index accelerates its negativity.

You’ve now read my opinion, next read Douglas’ blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for “fallond”.

If you are new to spread betting, here is a guide on position size based on eToro’s system.