Courtesy of Declan.

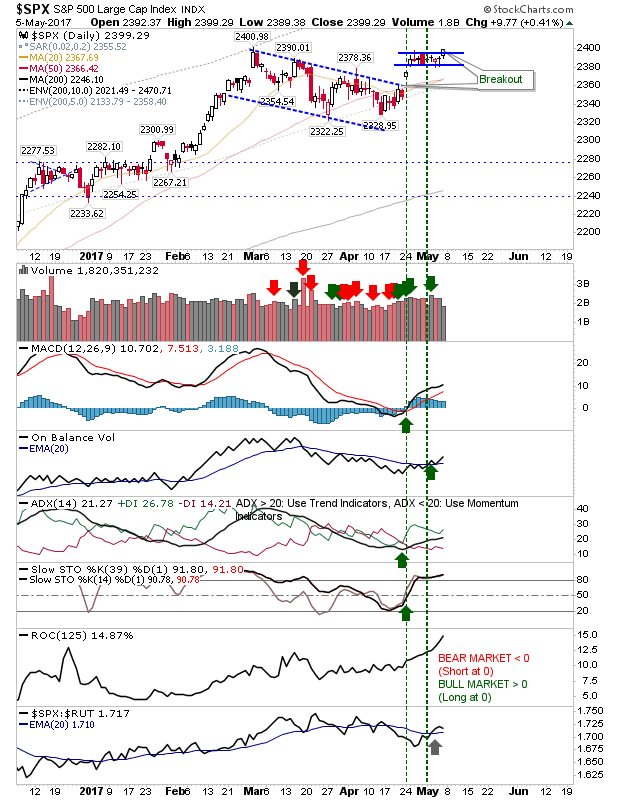

After a relatively quiet week markets finished strong on Friday. This helped push markets out of their trading ranges for the last few days. Volume was subdued but this won’t matter if there is some follow through on Monday.

The S&P has broken from its narrow consolidation which had bumped along just below the previous high of 2,400. Current action looks very healthy with technicals supporting price action; a loss of 2,380 would push things back into a consolidation, but not enough to send long-term holders running.

The Nasdaq hasn’t quite followed the lead of the S&P but given the strong relative performance it likely won’t be long before it’s following the lead of Large Cap stocks.

The Russell 2000 made a solid recovery after a series of down days. Buyers were willing to step in at 1,390. The question is now whether they want to take it beyond 1,425. Small Caps have been underperforming for a number of months, but market leadership comes from growth orientated Small Caps. If this relationship changes then it could be a good year for the Russell 2000. The last couple of days looks to be a good buying opportunity with a stop on a loss of 1,380.

The other index to watch is the Semiconductor Index. It has returned to former channel support on a small bullish hammer with technicals a little mixed (bearish CCI, slugging ADX and drifting stochastics). However, psychological support of 1,000 will be important to hold, making the risk:reward attractive for longs.

For tomorrow, look to Semiconductors and Small Caps for summer long trades. Buy-and-Holds remain holds. Shorts have little to play with. Maybe a stalled rally in the Russell 2000 will offer something, but that’s not tomorrow’s story.

You’ve now read my opinion, next read Douglas’ blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for “fallond”.

If you are new to spread betting, here is a guide on position size based on eToro’s system.