The Deck Is Stacked

Courtesy of John Mauldin

“The individual investor should act consistently as an investor and not as a speculator.”

“The individual investor should act consistently as an investor and not as a speculator.”

– Ben Graham

Ben’s admonition is always true, but it’s more true at some times than others. It’s very true today, as investors go on riding the Balloon of No Hard Landings into the stratosphere, clinking their champagne glasses and avoiding looks down over the side of the basket as terra firma recedes ever further. My friend Michael Lebowitz of 720Global has already parachuted out of the balloon, and in today’s Outside the Box he tells us exactly why.

He begins with one of his favorite themes, the contrast between investment conditions in the early 1980s – when an unconventional president had just been elected to tackle a dicey economy and generally shake things up – and today. Conclusion? “The risk-return profile of 1981 is the polar opposite to that of today.”

When – not if – the balloon springs a leak and loses a lot of gas, how will those on board react? If they have waited too long to jump off, they may go kersplat before their chutes can deploy: permanent loss of capital. But it can be quite unnerving to be slung under a leaky bag of volatile gas, with your basket rocking wildly as it’s buffeted by heavy winds, knowing that the hard, stony ground of a market bottom is approaching at an ever-accelerating rate.

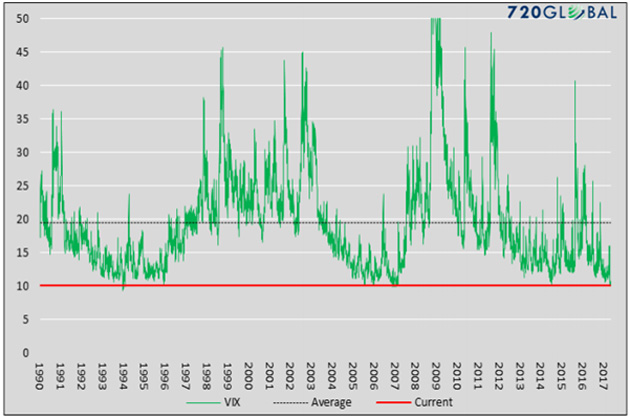

I went to add a few comments to Michael’s. Ed Easterling just shot me a note with the observation that we may about to have the third day in a row when the VIX closes below 10. There have been only 11 days out of some 6900, going back almost 28 years, when we’ve had a sub-10 VIX. When I look carefully at those dates, the word complacency leaps to mind.

| Date | Close |

| 12/22/1993 | 9.31 |

| 12/23/1993 | 9.48 |

| 12/27/1993 | 9.70 |

| 5/8/2017 | 9.77 |

| 12/28/1993 | 9.82 |

| 1/24/2007 | 9.89 |

| 11/21/2006 | 9.90 |

| 1/28/1994 | 9.94 |

| 5/9/2017 | 9.96 |

| 11/20/2006 | 9.97 |

| 12/14/2006 | 9.97 |

Current implied volatility is at a level that has been experienced only 0.22% of the time since 1990, and it has almost halfed from its long-term average.

I’m going to be writing about this in two weeks, but the current massive move into passive investing is distorting the markets. Noted value investor Seth Klarman described it this way in his recent letter to clients: “One of the perverse effects of increased indexing and ETF activity is that it tends to ‘lock in’ today’s relative valuations between securities. Thus today’s high-multiple companies are likely to also be tomorrow’s, regardless of merit, with less capital in the hands of active managers to potentially correct any mispricings.”

The movement into passive investing is resulting in active managers’ losing their edge because of their inability to discern between overvalued and undervalued companies. There has been a great deal of whining and teeth-gnashing over this by active managers, and I guess I understand their sentiments, except that blaming the market for your lack of alpha is pointless. The market is what the market is, and as a manager you have to deal with it.

Which is why I want to start talking to you about how to handle what I’m calling the Great Reset in our future. But for now, let’s pay close attention to what Michael has to share.

For those of you coming to my Strategic Investment Conference in two weeks, let me mention that there will be private breakfasts available Tuesday, Wednesday, and Thursday. Tuesday and Wednesday will be hosted by Altegris Investments and will be available only to qualified investors, which means a net worth of $5 million or more. Tuesday I will be interviewed on my actual portfolio as it exists today, which is something I've never talked about. Wednesday will feature a very famous hedge fund manager. On Thursday we’ll be joined by a local friend, a successful oil exploration entrepreneur who will talk about what is happening in the Permian Basin in West Texas. What they’re doing is truly amazing, and those of you who are interested in oil technology and exploration will find it fascinating. On top of an already fascinating conference.

Tonight David Shepherd, of the eponymous firm based in Boston, is bringing some of his cohorts down; and instead of making the traditional steakhouse run, he has asked me to cook chili. I think I will surprise them with a little prime and some of my mushrooms, and maybe Shane and I will whip up a few other delightful items, too. A few of my friends have encouraged me to have a cameraman come in and document my culinary skills and post it on YouTube so that you too can re-create what is universally acclaimed to be the best prime and mushrooms anywhere. In Texas, no one can claim to have the greatest chili. It’s an intensely and endlessly debated topic, and what constitutes “best” is a highly personal and subjective matter.

It will be a fine night for chili and prime and great conversation. David tells me he is bringing the wine. In that regard, David is kind of like Jeremiah the Bullfrog – he always has some mighty fine wine.

You have a great week and spend some of it with friends. Great conversation and good friends always make the food and wine taste even better.

Your already working up an appetite analyst,

John Mauldin

Get John Mauldin's Over My Shoulder: "Must See" Research Directly from John Mauldin to You.

The Deck Is Stacked

Putting Risk and Reward into Perspective

“The individual investor should act consistently as an investor and not as a speculator.” – Ben Graham.

We are frequently told that valuation analysis is irrelevant because fundamentals do not signal turning points in markets. Scoffers of valuation analysis are correct, as there is no fundamental statistic or for that matter, technical or sentiment indicator that can provide certainty as to when a market trend will change direction.

Despite being humbled by recent market gains and the difficulties associated with timing the market to call a precise top, we remain resolute about the merits of a conservative investment posture at this time. At some point, current equity market valuations will succumb to financial gravity and the upward trend of the last eight years will reverse. When that day arrives, it will not be because a valuation ratio hit a certain level or because the market formed a well-known technical pattern. It will simply be the day that selling pressure overcomes demand.

In prior articles, we compared the current economic landscape to the early 1980’s. Let’s revisit that contrast to further quantify the risk and reward associated with the U.S. stock market during both time periods.

As Graham so eloquently stated, speculating and investing are two vastly different endeavors, and we prefer the practice of investing.